Back in April, during the height of the current pandemic, we asked panelists in our national Survey of Business Uncertainty a couple of key questions: what impact they anticipated the pandemic to have on their sales revenue in 2020, and when they expected COVID-related uncertainty to have largely abated. We repeated this line of inquiry in August, and the results are quite interesting. For the most part, firms' views about the size of the coronavirus impact on 2020 sales revenue haven't changed since April. However, they do anticipate that disruption from the virus will remain a part of the economic landscape for quite a bit longer than they did four months ago. Amid these views, firms' year-ahead expectations for sales and employment growth remain highly uncertain.

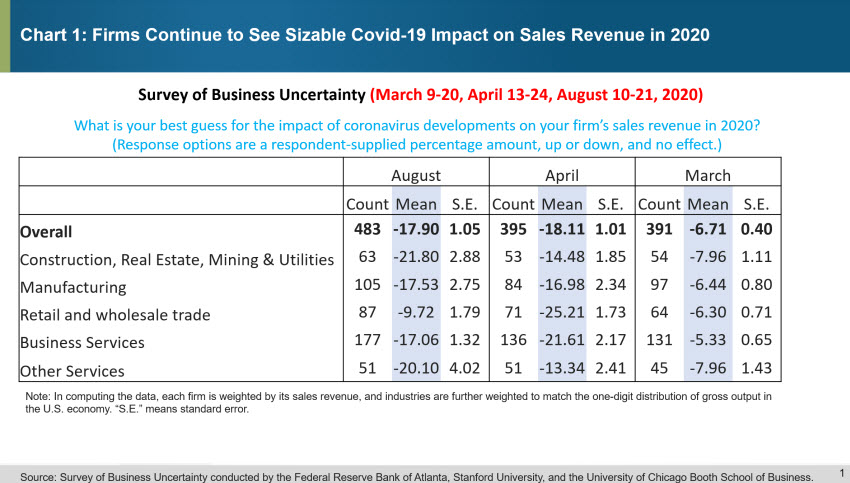

Chart 1 shows firms' best guesses about the impact of coronavirus developments on 2020 sales revenue in August, and it compares these results to the last two times we asked this question (in April and March). As we've documented before, expectations from March to April declined dramatically, likely as the breadth and severity of the COVID-19 pandemic became apparent. Since then, however, firms' sense of the COVID-19 impact on 2020 sales revenues has mostly remained unchanged, an expectation that would hold true even if we were to restrict the sample only to respondents who answered all three iterations of this question.

Digging into the industry cross-section, retail and wholesale trade is the only sector where 2020 sales expectations have materially changed since spring. Firms in retail and wholesale trade have significantly revised downward the expected impact of COVID-19 on sales revenue. In April, they anticipated a 25 percent hit to sales, and in August they foresaw about a 10 percent impact. This improvement seems consistent with the relatively strong rebound we've seen to date in the retail trade reports from the U.S. Census Bureau and in data about high-frequency debit and credit card spending.

As chart 2 shows, despite the severity of the anticipated 2020 (calendar year) COVID-related impact on sales revenue, firms' year-ahead (a rolling four quarters) sales growth expectations, which turned negative in April and May, have rebounded. However, this rebound is only a partial one relative to the precoronavirus sales-growth trend. At roughly 1 percent, firms' nominal sales growth expectations over the next four quarters (through the third quarter of 2021) are tepid and suggest a muted and prolonged recovery from the pandemic-induced recession on the part of firms (and thus the economy).

Firms' year-ahead employment growth expectations have improved moderately, rising from an expectation of near zero growth back in April (over a time period covering April 2020 to April 2021) to roughly 2.5 percent (from August 2020 to August 2021). Although employment growth expectations have risen to the highs we saw during the strong labor market period of 2018 and 2019, it's important to note that these expectations are forward-looking growth rates and do not show the dramatic, swift decline in employment that the economy experienced earlier this year. The current employment growth estimates still suggest that, on average, firms will not have regained their pre-COVID employment levels by August of next year.

Unlike measures of market-based volatility (like the Chicago Board of Exchange's VIX) that have swiftly returned to more normal levels, uncertainty over firms' sales and employment growth over the year ahead remains elevated (see chart 3). Sales growth uncertainty, in particular, shot up by roughly 200 percent April and is still 167 percent above normal. So, though expectations have improved, firms continue to view their own year-ahead outlooks with great uncertainty.

Perhaps these persistently high levels of uncertainty shouldn't come as much of a surprise. Firms' sentiment about how long it will take pandemic-related uncertainty to dissipate has become more pessimistic and more dispersed (see chart 4) than it was early in the crisis. In April, roughly three-fourths of the firms in our panel expected COVID-related uncertainty to be behind us by the end of the year. Now, the majority of firms anticipate a return to a more "business-as-usual" stance at some point in 2021, and less than 20 percent are optimistic that the end of the year will see normal conditions. Moreover, the tail of this distribution has grown quite long, and roughly 10 percent of firms anticipate that uncertainty will linger into 2022—or beyond.

Overall, our results indicate that firms continue to see COVID-19’s impact on 2020 sales revenue as significant. Although firms’ expectations for sales and employment growth have risen from their depths earlier in the crisis, our results reflect the belief that the economy is in for a tepid, protracted return to its pre-COVID state. And, perhaps those sluggish and highly uncertain expectations make sense given how long COVID-related uncertainty might last.

By

By  Jose Maria Barrero, assistant professor of finance at Instituto Tecnológico Autónomo de México Business School,

Jose Maria Barrero, assistant professor of finance at Instituto Tecnológico Autónomo de México Business School, Nick Bloom, the William D. Eberle Professor of Economics at Stanford University,

Nick Bloom, the William D. Eberle Professor of Economics at Stanford University, Steven J. Davis, the William H. Abbott Professor of International Business and Economics at the Chicago Booth School of Business and a senior fellow at the Hoover Institution,

Steven J. Davis, the William H. Abbott Professor of International Business and Economics at the Chicago Booth School of Business and a senior fellow at the Hoover Institution,

Nick Parker, the Atlanta Fed's director of surveys

Nick Parker, the Atlanta Fed's director of surveys