Despite record-setting job losses during the COVID-19 pandemic, median growth in the hourly rate of pay for those who stayed employed has held up remarkably well, which we can see in the Atlanta Fed's Wage Growth Tracker (see chart 1).

![]()

The Wage Growth Tracker compares individual hourly wages in the current month with what the same individual's hourly wage was 12 months earlier and calculates the change. The fact that the median wage growth has not slowed, despite the increase in unemployment, suggests that the pandemic's impact on the labor market has been quite unusual.

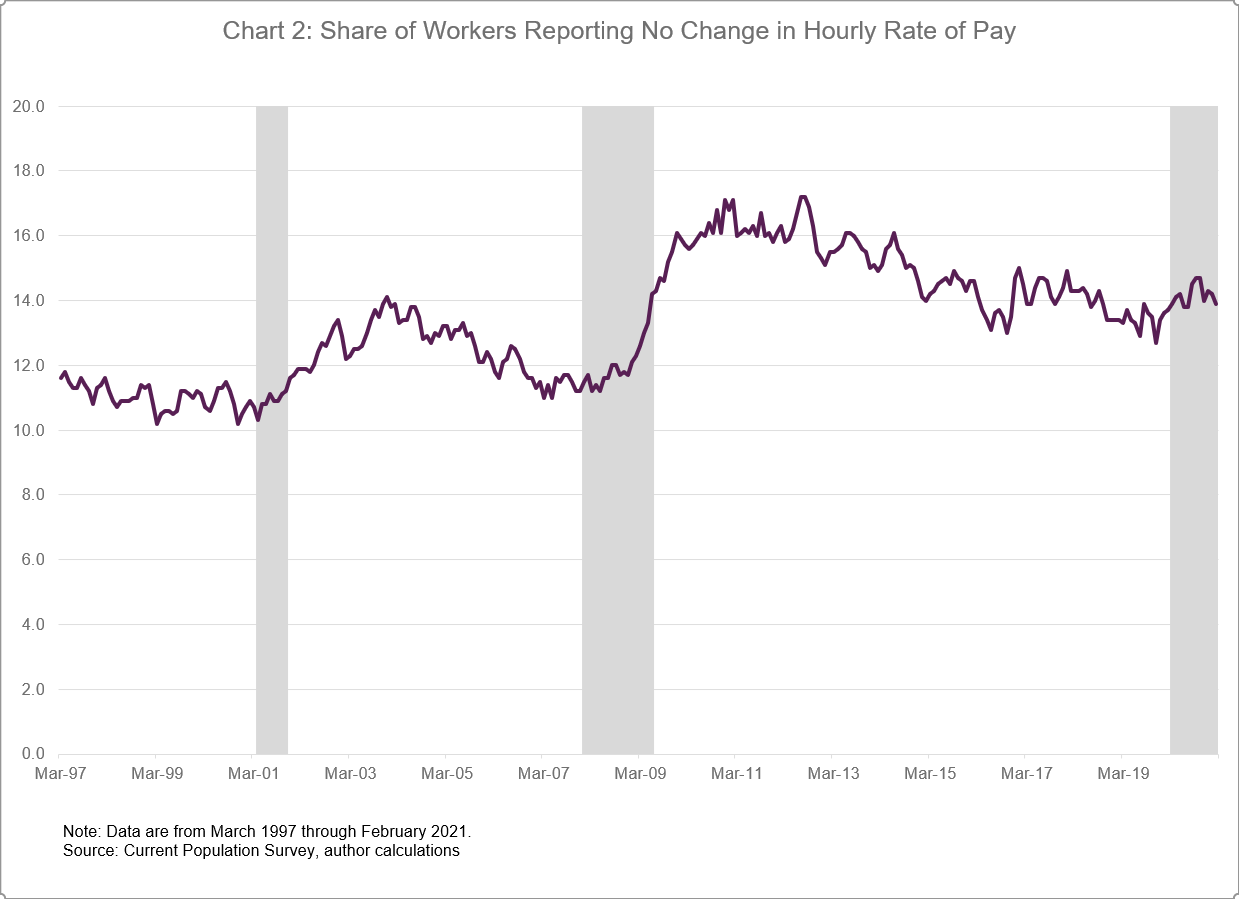

During the Great Recession, the slowing in median hourly wage growth coincided with a large increase in the share of workers reporting that their hourly rate of pay was unchanged from a year earlier. As chart 2 shows, the share of workers reporting zero change in their hourly rate of pay has ticked up a bit during the COVID-19 pandemic, but so far, what we see differs from observations we made during the Great Recession.

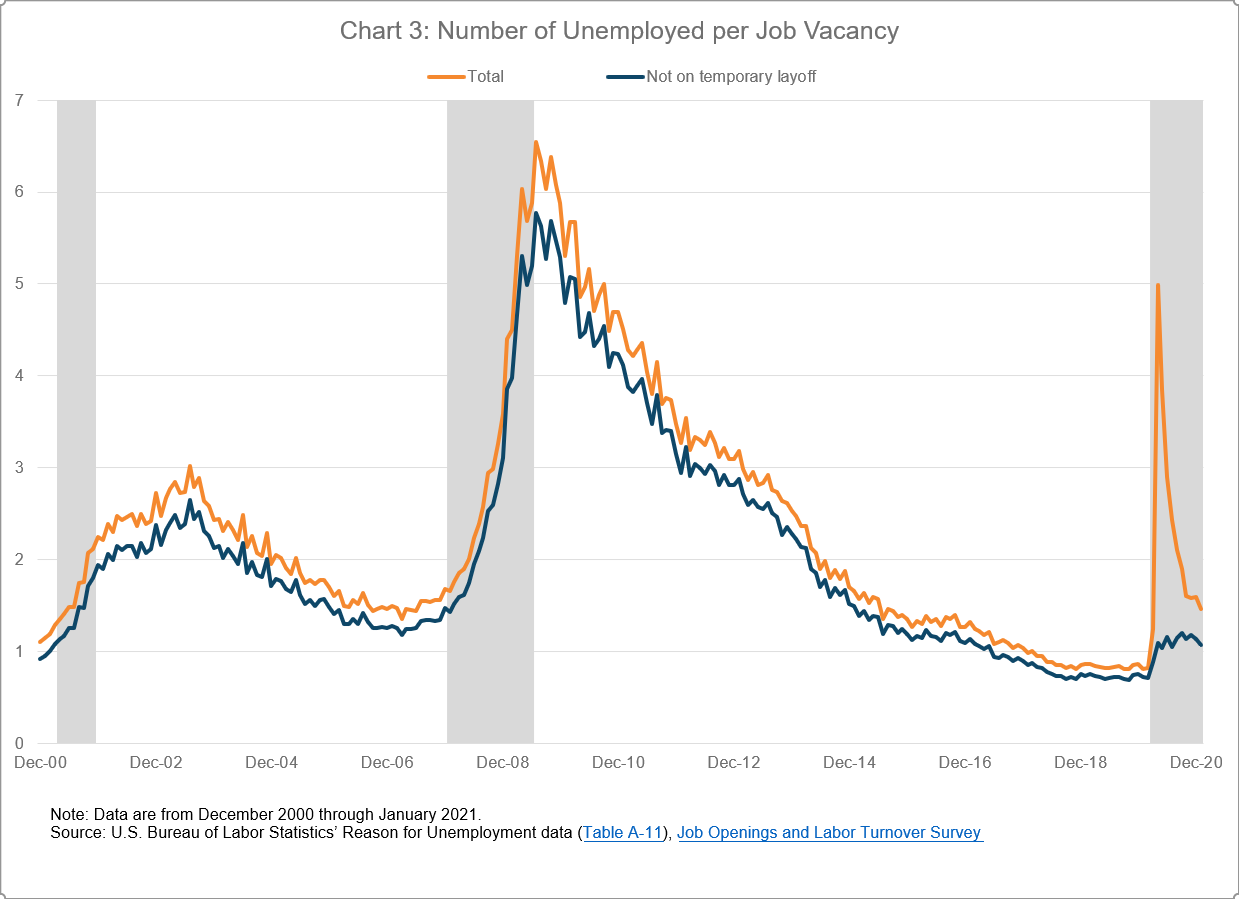

Why did the COVID-19 pandemic have a relatively smaller impact on median hourly wage growth compared to the Great Recession? One explanation is that the supply of unemployed job seekers far exceeded job vacancies in the earlier recession. That is, employers typically received many more applicants for each available position. As chart 3 shows, at the Great Recession's peak, there were 6.5 unemployed workers for each job posting and 5.7 unemployed not on temporary layoff for each job posting. I think unemployed workers not on temporary layoff is a more useful measure of unemployed job seekers because those on temporary layoff expect to be recalled by their employer and hence are not necessarily looking for another job. Contrast that with January 2021, when there were 1.5 unemployed workers for each opening and 1.1 unemployed workers not on temporary layoff for each job vacancy. In this sense, the labor demand and supply during the COVID-19 pandemic has been more in balance than during the Great Recession. Compared with the Great Recession, apart from the period during the initial lockdown, total vacancies by firms has scaled back relatively modestly during the pandemic while the number of workers looking for a job has increased by less.

Nonetheless, during both the Great Recession and the COVID-19 pandemic, many workers who remained employed have experienced an involuntary reduction in their work hours, which has dragged down workers' weekly paychecks even when their hourly rate of pay hasn't fallen. In February 2021, about 6.5 million workers were classified by the U.S. Bureau of Labor Statistics (BLS) as working part-time for economic reasons—almost 2 million more than in February 2020, just before the pandemic hit the U.S. economy. For this reason, I've constructed an alternate version of the Wage Growth Tracker, which shows the median growth of individual weekly earnings. This new measure uses the same data (from the Current Population Survey![]() , jointly administered by the BLS and the U.S. Census Bureau) as the hourly earnings measure, and I show both series in chart 4 for comparison.

, jointly administered by the BLS and the U.S. Census Bureau) as the hourly earnings measure, and I show both series in chart 4 for comparison.

![]()

Generally, the two series move in tandem, with the weekly series slightly outpacing the hourly series during economic expansions as hours worked tend to rise. However, as we see here, during both the Great Recession and the COVID-19 pandemic, reduced hours worked each week lowered many workers' median growth in weekly earnings relative to hourly earnings.

As the economy recovers from the COVID-19 pandemic, watching both the hourly and weekly versions of the Wage Growth Tracker will be useful. As fewer worker face reduced hours, I expect to see median weekly wage growth recover and at least match the pace of hourly wage growth. A tighter labor market should result in higher wage growth on both an hourly and weekly basis. I'll write about the developments using new Wage Growth Tracker data we'll post soon, so check back.

Note: If you are interested in tracking the hourly and weekly versions of the Wage Growth Tracker you can do that here, or via the EconomyNow app, which also features several other Atlanta Fed data tools.