The long-term fixed rate mortgage (FRM) is a central part of the mortgage landscape in America. According to recent data, the FRM accounts for 81 percent of all outstanding mortgages and 85 percent of new originations.1 Why is it so common? The conventional wisdom is that the FRM is a great product created during the Great Depression to bring some stability to the housing market. Homeowners were defaulting in record numbers, the story goes, because their adjustable rate mortgages (ARMs) adjusted upward and caused payment shocks they could not absorb.

In a Senate Committee on Banking, Housing, and Urban Affairs hearing on October 20, some experts presented testimony that followed this conventional wisdom. As John Fenton, president and CEO, Affinity Federal Credit Union, who testified on behalf of the National Association of Federal Credit Unions, laid out in his written testimony:

Prior to the introduction of the 30-year FRM, U.S. homeowners were at the mercy of adjustable interest rates. After making payments on a loan at a fluctuating rate for a certain period, the borrower would be liable for the repayment of the remainder of the loan (balloon payment). Before the innovation of the 30-year FRM, borrowers could also be subject to the "call in" of the loan, meaning the lender could demand an immediate payment of the full remainder. The 30-year FRM was an innovative measure for the banking industry, with lasting significance that enabled mass home ownership through its predictability.

Of course, this picture of the 30-year FRM as bringing stability to the housing market has profound implications for recent history. Many critics attribute the problems in the mortgage market that started in 2007 to the proliferation of ARMs. According to the narrative, lenders, after 70 years of stability and success with FRMs, started experimenting with ARMs again in the 2000s, exposing borrowers to payment shocks that inevitably led to defaults and the housing crisis. Indeed, one of the other panelists at the hearing, Janis Bowdler, senior policy analyst for the National Council of La Raza, argued in her written testimony that "when the toxic mortgages began to reset and brokers and lenders could no longer maintain their refinance schemes, a recession ushered in record-high foreclosure rates."

I argue, on the other hand—both in my testimony at the hearing and in this post—that the narrative of the fixed rate mortgage as an inherently safe product invented during the Depression that would have mitigated the subprime crisis because it

eliminated payment shocks does not fit the facts.

Parsing the myths around the fixed rate mortgage

First, the FRM has been around far longer than most people realize. Most people attribute the FRM's introduction to the Federal Housing Administration (FHA) in the 1930s.2 But it was the building and loan societies (B&Ls), later known as savings and loans, that created them, and they created them a full hundred years earlier. Starting with the very first B&L—the Oxford Provident Building Society in Frankfort, Pennsylvania, in 1831—the FRM accounted for almost every mortgage B&Ls originated. By the time of the Depression, B&Ls were not a niche player in the U.S. housing market. They were, rather, the largest single source of funding for residential mortgages, and the FRM was central to their business model.

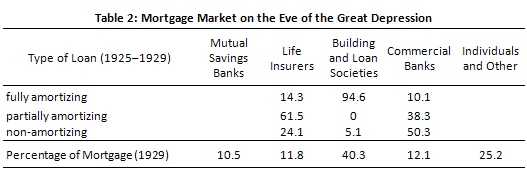

As Table 2 of my testimony shows, B&Ls made about 40 percent of new residential mortgage originations in 1929 and 95 percent of those loans were long-term, fixed-rate, fully amortized mortgages. Importantly, B&Ls suffered mightily during the Depression, so the facts simply do not support the idea that the widespread use of FRMs would have prevented the housing crisis of the 1930s.

Source: Grebler, Blank and Winnick (1956)

Note: Market percentage is dollar-weighted. Building and loan societies were the main source of funds for residential mortgages and almost exclusively used long-term, fixed-rate, fully amortizing instruments.

To be sure, at 15–20 years, the terms on the FRMs the FHA insured were somewhat longer than those of pre-Depression FRMs, which typically had 10–15 year maturities.3 The 30-year FRM did not emerge into widespread use until later. It must be stressed that none of the arguments that Fenton made hinge on the length of the contract. Furthermore, the argument that Bowdler made in her testimony—that by delaying amortization, a 30-year maturity lowers the monthly payment as compared to a loan with shorter maturity—applies as much to ARMs as it does to FRMs.

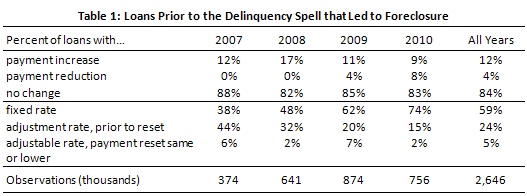

But even though the ARMs may not have caused the Depression, FRM supporters might ask, didn't the payment shocks from the exotic ARMs cause the most recent crisis? Again, the data say no. Table 1 of my Senate testimony shows that payment shocks actually played little role in the crisis.

Source: Lender Processing Services and author's calculations.

Note: Sample is all first-lien mortgages originated after 2005 on which lenders initiated foreclosure proceedings from 2007 to 2010.

Of the large sample of borrowers who lost their homes, only 12 percent had a payment amount at the time they defaulted that exceeded the amount of the first scheduled monthly payment on the loan. The reason there were so few is that almost 60 percent of the borrowers who lost their homes had, in fact, FRMs. But even the defaulters who did have ARMs typically had either the same or a lower payment amount due to policy-related cuts in short-term interest rates.

To be absolutely clear here, my discussion so far focuses entirely on the question of whether the design of the FRM is inherently safe and eliminates a major cause of foreclosures. The data say it does not, but that does not necessarily mean that the FRM does not have benefits. As I discussed in my testimony, all else being equal, ARMs do default more than FRMs, but since defaults occur even when the payments stay the same or fall, the higher rate is most likely connected to the type of borrower who chooses an ARM, not to the design of the mortgage itself.

The difficulty of measuring the systemic value of fixed rate mortgages

One common response to my claim that the payment shocks from ARMs did not cause the crisis is that ARMs caused the bubble and thus indirectly caused the foreclosure crisis. However, it is important to understand that this argument, which suggests that the FRM has some systemic benefit, is fundamentally different from the argument that the FRM is inherently safe. This difference is as significant as that between arguing that airbags reduce fatalities by preventing traumatic injuries and arguing that they somehow prevent car accidents.

Measuring the systemic contribution of the FRM is exceedingly difficult because the use of different mortgage products is endogenous. Theory predicts that home buyers in places where house price appreciation is high would try to get the biggest mortgage possible, conditional on their income, something that an ARM typically facilitates. When the yield-curve has a positive slope (in most cases) and short-term interest rates are lower than long-term interest rates, ARMs loans offer lower initial payments compared to FRMs. Thus, it is very difficult to disentangle the causal effect of the housing boom on mortgage choice from the effect of mortgage choice on the housing boom.

In addition, there is evidence from overseas that suggests that the FRM is not essential for price stability. As Anthony B. Sanders, professor of finance at the George Mason School of Management, points out in his written testimony, FRMs are rare outside the United States. A theory of the stabilizing properties of FRMs would have to explain why Canadian borrowers emerged more or less unscathed from the global property bubble of the 2000s, despite almost exclusively using ARMs.

By Paul Willen, senior economist and policy adviser at the Boston Fed (with Boston Fed economist Christopher Foote and Atlanta Fed economist Kristopher Gerardi)

1 First liens in LPS data for May 2011.

3 See the discussion in chapter XV of Leo Grebler, David M. Blank, and Louis Winnick (Princeton, NJ: Princeton University Press, 1956), 218–235; available on the website of the National Bureau of Economic Research.