The year 2000 feels like a long time ago. The dot-com boom was peaking. Some millennials were teens; the youngest were in pre-K. Grammy winner Billie Eilish was not born yet. I was using a flip phone—does anybody remember tapping the "5" three times to key in an "L"?

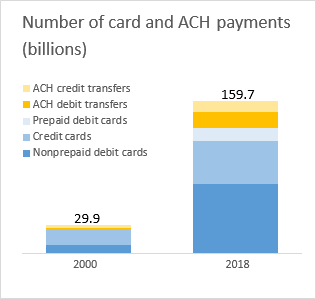

In payments, too, Y2K feels a long way away. Just look at the growth in the everyday ways to pay electronically: prepaid and nonprepaid debit cards, credit cards, and ACH transfers. From 2000 to 2018, these electronic payments in aggregate grew at a compound annual growth rate of 9.8 percent, from 29.9 billion payments to 159.7 billion, according to new data from the Federal Reserve Payments Study released in December 2019.

Nonprepaid debit cards, which represented 45 percent of these electronic payments in 2018, had the fastest growth since 2000 (12.8 percent a year). Standing at a mere 8.3 billion payments in 2000, nonprepaid debit card payments ballooned nearly nine times, reaching 72.7 billion payments in 2018. This total number of nonprepaid debit card payments in 2018 is approximately equal to the total number of noncash payments of all payment types (cards, ACH, and paper checks) reported for 2000 in the first triennial study: 72 billion.

This one fact encapsulates much that has happened in payments over the last two decades in the United States. Underlying this growth, we can see the effects of widespread acceptance of debit at the point of sale as well as consumers' willingness to use debit cards as the go-to payment choice for small-dollar-value payments. More recently, debit card growth can be linked to the growth of e-commerce, the decline of checks, the rise of electronic ways to pay bills, and the introduction of the smartphone and mobile commerce.

These facts and many more are available in the 2019 report of the Federal Reserve Payments Study![]() . A link labeled "Accessible Version" sits under each figure—click that to see a table of the data underlying each chart. So, depending upon your particular area of interest in the way payments methods are used, the report should provide you with an in-depth look.

. A link labeled "Accessible Version" sits under each figure—click that to see a table of the data underlying each chart. So, depending upon your particular area of interest in the way payments methods are used, the report should provide you with an in-depth look.

By Claire Greene, a payments risk expert in the

By Claire Greene, a payments risk expert in the