The COVID-19 pandemic is affecting many aspects of our lives: interactions with friends and family, jobs, shopping habits—grocery shopping in particular. Lots of us have been speculating about those groceries, making predictions about ecommerce growth in the long run and also about how the composition of ecommerce sales could change.

Data from the Federal Reserve Payments Study give us a benchmark for thinking about remote card payments during and after the pandemic. For example, the average dollar value of remote card payments can suggest ways that consumer behavior has changed in recent years. And going forward, future data collection could give insights into behavior during the health crisis.

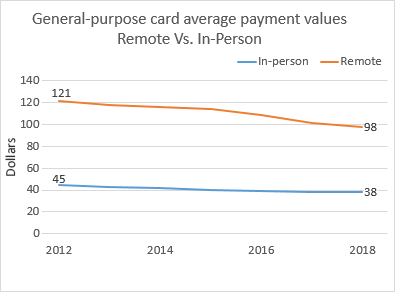

The average value of general-purpose card payments conducted remotely fell faster than the average value of in-person general-purpose card payments in the most recent three-year period for which data is available, 2015 to 2108. Remote payments by general-purpose credit, debit, or prepaid cards averaged $98 in 2018, compared to $121 in 2015. The chart shows the drop in average values.

What's going on here? Various factors likely play into this change in average dollar value. Here are three.

First, more and more people are shopping and paying bills remotely, which includes online. This measurement—"How many people make card payments remotely?"—is broad. It could be that people on the margin, those who have recently started making online payments, are different from others. Maybe they are older. Less card-centric. Less wealthy. Maybe they still are most comfortable writing paper checks for their biggest bills. These individual characteristics could reduce the average dollar value of their online payments compared to others.

Second, people who shop and pay bills remotely are doing it more frequently. This measurement—"How much are remote payers paying?"—is deep. For example, compared to the number of payments you made online during a typical month in 2015, think about the number you made in 2018. Are you making more? Are you paying online more intensively?

Third, people already making remote payments could be more willing to make what my colleague Jessica Washington calls "micropayments" with cards. When shopping online, do you buy a toothbrush one day, a pack of gum the next, and a candy bar on day three? Do you buy digital goods: a music download, the in-app purchase of virtual goods, access behind a news paywall? These tiny payments could be pushing down the average dollar value.

All three of these factors could be in flux right now. They could be changing due to the mix of things we are buying, our income and employment status, changes in household members, payees' willingness to accept different payment methods, etc. etc. etc. This bigger picture is important for payments choice.

Going forward, our short-term reactions to the pandemic—buying groceries online, for example—may or may not equal long-term change in remote purchasing behavior. The Federal Reserve Payments Study continues to collect data related to these behaviors. More data about payments trends is available in the 2019 report of the Federal Reserve Payments Study![]() .

.

By Claire Greene, a payments risk expert in the

By Claire Greene, a payments risk expert in the