As we pointed out in our most recent post, the principal policy response to the COVID-19 pandemic in the U.S. mortgage market has been forbearance. Support for renters, on the other hand, has been much less widespread. Now that states and cities have received CARES Act funds, allocation strategies are starting to surface (for example, here![]() and here

and here![]() ). A common element among these strategies is the formation of emergency assistance funds for renters.

). A common element among these strategies is the formation of emergency assistance funds for renters.

While household income most certainly will be considered in qualifying renter households for aid, other factors—like household cost burden and property type—may serve not only to channel funds to those feeling the economic effect of COVID-19, but also to help municipalities preserve their limited stock of affordable housing units. In this post, we attempt to provide greater insight on the types of affected households with the goal of helping policymakers design a relief program that reaches households most in need.

Vulnerable households

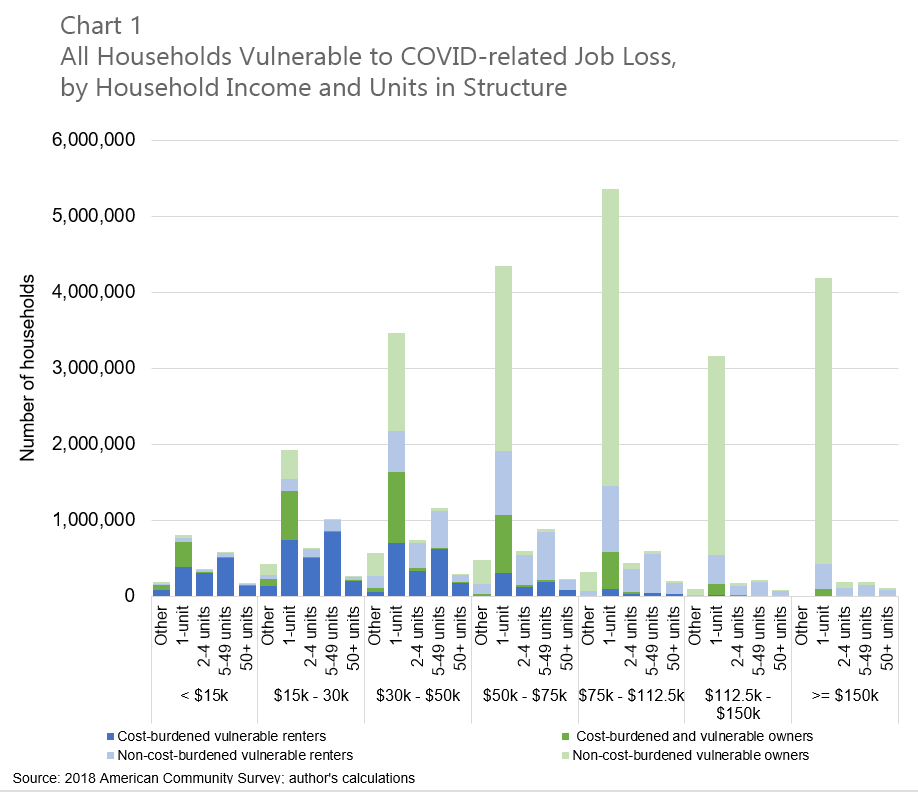

New York University's Furman Center looked at New York City households![]() and identified those that were likely to have members in occupations vulnerable to job layoffs. We applied the Furman Center methodology to national 2018 American Community Survey data and found that 37.8 percent of all U.S. households may be vulnerable to COVID-19-related income loss (we'll refer to these as vulnerable households). As chart 1 shows, the 34.3 million households vulnerable to COVID-related job loss span the income spectrum.

and identified those that were likely to have members in occupations vulnerable to job layoffs. We applied the Furman Center methodology to national 2018 American Community Survey data and found that 37.8 percent of all U.S. households may be vulnerable to COVID-19-related income loss (we'll refer to these as vulnerable households). As chart 1 shows, the 34.3 million households vulnerable to COVID-related job loss span the income spectrum.

The majority of vulnerable households are owner occupied (58.4 percent, or 20 million). Moreover, these vulnerable owner-occupied households tend to have incomes greater than $50,000 per year, live in single-family homes, and are less likely to have been cost-burdened1 going into the COVID-19 downturn. As we noted above, the vast majority of these owner-occupied vulnerable households have access to relief via widespread mortgage forbearance.

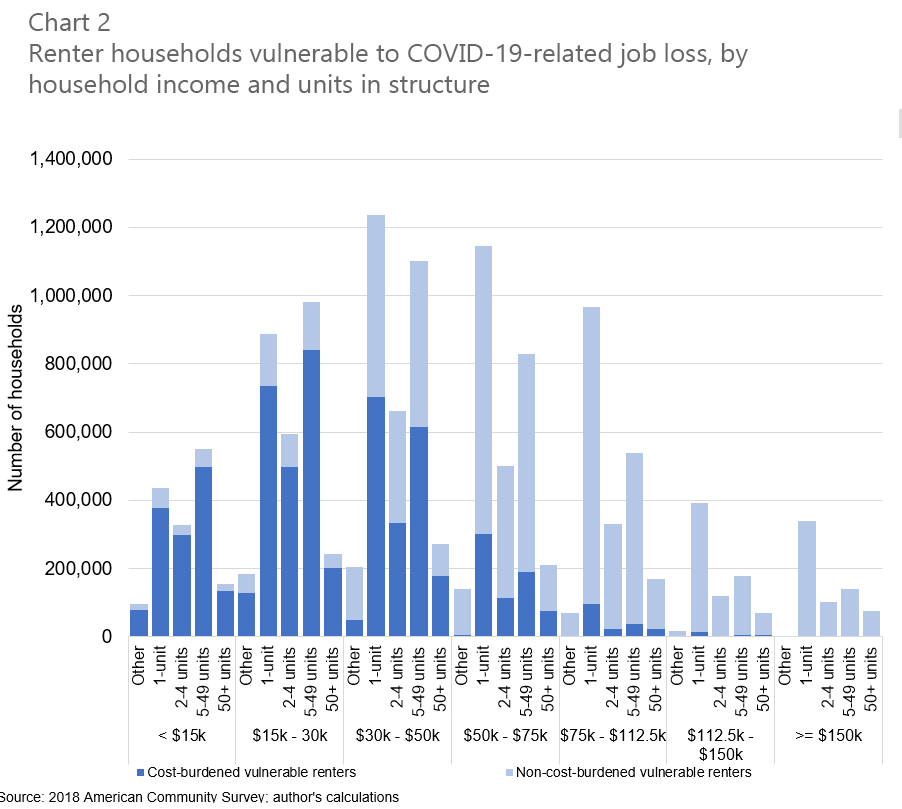

Honing in on the estimated 14.3 million vulnerable renter-occupied households, we see a more concerning picture emerge (see chart 2). Renter-occupied households vulnerable to COVID-related job loss also span the income distribution. Strikingly, though not surprisingly, the share of renter-occupied households that cost-burdened and vulnerable is disproportionately concentrated at the bottom of the income distribution. Put differently, 86 percent of the cost-burdened and vulnerable renter-occupied households (that is, the dark blue shaded portion of chart 2) earn less than $50,000. In other words, going into the COVID-19 downturn, the lower-income renter-occupied households who were employed in occupations most likely to suffer wage disruptions were already stretched thin and spending more than 30 percent of their income on housing costs.

In contrast to the picture for all vulnerable households, cost-burdened and vulnerable renter households are more likely to reside in properties with fewer than 50 units.

Small and medium multifamily housing units and affordability

Rent shortfalls in single-family rental properties and rental properties with 2–49 units are particularly worrisome because these properties are more likely to be owned by "mom-and-pop" investors and not institutional investors, according to a May 26 Joint Center for Housing Studies post![]() . Mom-and-pop investors may not have the financial cushion necessary to weather the shortfall and cover ongoing costs, in turn making these properties more likely to become distressed and be sold.

. Mom-and-pop investors may not have the financial cushion necessary to weather the shortfall and cover ongoing costs, in turn making these properties more likely to become distressed and be sold.

Importantly, a paper by An et al.![]() has established that, controlling for important differences, properties with 2–49 units often sell at a discount compared to single-family properties and properties with 50 or more units, thus making them a source of unsubsidized affordable housing.2 For this reason, it seems clear that directing rental assistance to these vulnerable households below the $50,000 income threshold living in properties with 2–49 units would target those most in need of assistance. Moreover, such targeting could preserve the already-insufficient supply of affordable units and prevent a greater deficit. It seems clear that directing rental assistance to these vulnerable households below the $50,000 income threshold living in properties with 2–49 units would target those most in need of assistance. Moreover, such targeting could preserve the already-insufficient supply of affordable units and prevent a greater deficit.

has established that, controlling for important differences, properties with 2–49 units often sell at a discount compared to single-family properties and properties with 50 or more units, thus making them a source of unsubsidized affordable housing.2 For this reason, it seems clear that directing rental assistance to these vulnerable households below the $50,000 income threshold living in properties with 2–49 units would target those most in need of assistance. Moreover, such targeting could preserve the already-insufficient supply of affordable units and prevent a greater deficit. It seems clear that directing rental assistance to these vulnerable households below the $50,000 income threshold living in properties with 2–49 units would target those most in need of assistance. Moreover, such targeting could preserve the already-insufficient supply of affordable units and prevent a greater deficit.

Conclusion

States and municipalities across the U.S. are still in the process of trying to understand (1) how many households are suffering from lost wages due to COVID-19, (2) how much financial support is needed to help these households weather the storm, and (3) what is an equitable way to design the relief program so that it reaches households most in need? Much of the research we've cited in this post can provide insight into the number of households and the required degree of financial support.

While evidence suggests that the one-time stimulus checks and expanded unemployment insurance benefits under the CARES Act have helped households meet their obligations (see this June 17 report![]() from the Urban Institute and this May 27 macroblog for more in-depth discussion), there are concerns about the balance sheets of households and impending housing market distress when these benefits expire. Of particular concern are renter households with members who are in occupations vulnerable to job layoffs—especially given that many areas are slowing or reversing the pace of reopening. The emergency rental assistance funds that cities are designing will likely serve as an important backstop for many rental households. Because the number of renter households in need of support will undoubtedly exceed the amount of funds that have been earmarked to support them, a strategic response may very well be one that directs the funds to households demonstrating the greatest need, and doing so would also work to preserve a limited stock of affordable units.

from the Urban Institute and this May 27 macroblog for more in-depth discussion), there are concerns about the balance sheets of households and impending housing market distress when these benefits expire. Of particular concern are renter households with members who are in occupations vulnerable to job layoffs—especially given that many areas are slowing or reversing the pace of reopening. The emergency rental assistance funds that cities are designing will likely serve as an important backstop for many rental households. Because the number of renter households in need of support will undoubtedly exceed the amount of funds that have been earmarked to support them, a strategic response may very well be one that directs the funds to households demonstrating the greatest need, and doing so would also work to preserve a limited stock of affordable units.

Though we provide a national-level snapshot in this post, this analysis can easily be tailored to finer levels of geography. In future posts, we will take a closer look at several of the largest cities in the Atlanta Fed's Sixth District to provide estimates for the number of vulnerable households while spotlighting similarities and differences in the distributions of the affected population.

1 [back] A household is considered cost-burdened if it spends more than 30 percent of its monthly income on housing costs (including utilities).

2 [back] B. Y. An, R. W. Bostic, A. Jakabovics, A. Orlando, and S. Rodnyansky, "Why Are Small and Medium Multifamily Properties So Inexpensive?![]() " Journal of Real Estate Finance and Economics (2019).

" Journal of Real Estate Finance and Economics (2019).