Inflation expectations in our April Business Inflation Expectations (BIE) survey fell to an all-time low (going back to October 2011) of 1.4 percent, plunging far below its next lowest level of 1.7 percent (most recently observed in February 2020). Perhaps unsurprisingly, firms have bigger worries on their minds. And our boss, President Raphael Bostic, agreed, noting on Wednesday![]() that "inflation at this point is not something I'm particularly worried about."

that "inflation at this point is not something I'm particularly worried about."

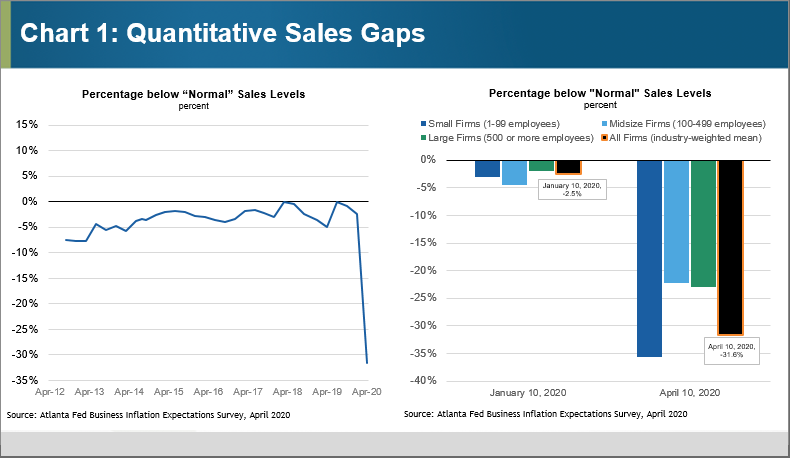

The drop in inflation expectations was not the only historical low that our survey results uncovered. Firms' assessments of current sales levels relative to what they consider "normal" levels fell precipitously. Recovering from the 2007–09 financial crisis and recession, this quantitative sales gap measure had slowly been moving toward zero (or "normal" sales levels) alongside solid gains in gross domestic product growth and previously strong job gains. However, that all changed in April. Our survey, which was in the field from April 6 to 10, showed an extraordinarily large decline in sales levels relative to normal—from 2.5 percent below normal in the first quarter to 32 percent below normal in April (see the charts). The decline in sales had an impact on firms of all sizes, but smaller firms reported a much larger hit to sales than did firms with more than 100 employees.

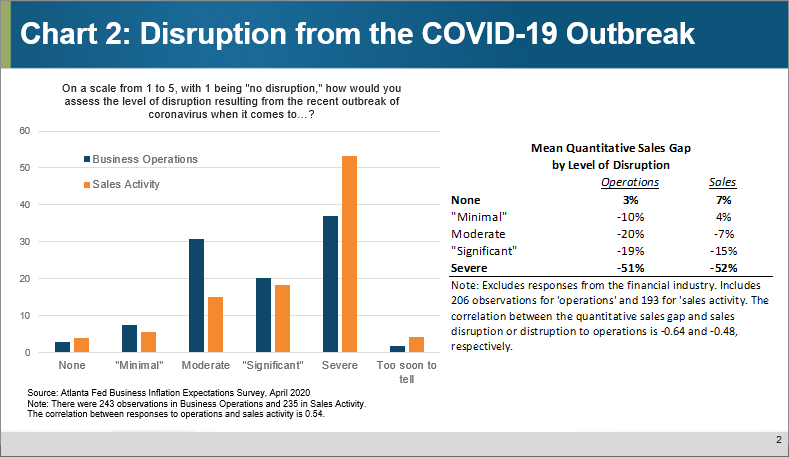

Our survey's special questions this month focused on the level of disruption the coronavirus outbreak was causing for southeastern firms. We asked participating firms to assess disruption to their business operations and sales activity, on a scale of "no disruption" to "severe disruption," and it's obvious that a majority of firms in our panel have experienced severe disruption to their sales activity (see chart 2). The table indicates how disrupted firms' operations and sales were. Among those firms experiencing severe disruption, current sales levels have been roughly halved relative to normal conditions. The results suggest that the disruption associated with the outbreak has not hit all firms equally. There is also some evidence of dispersion (reallocation) across firms, as a small share of firms that indicated they are experiencing low levels of disruption are seeing stronger-than-usual sales levels.

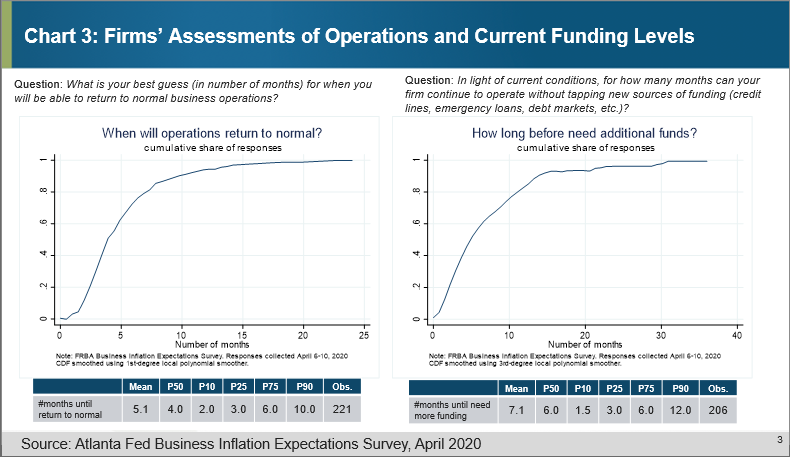

As firms continue to grapple with the unprecedented impact and uncertainty that the coronavirus outbreak has inflicted, we wanted to get a rough sense of how long they expect these unusual conditions to persist and how long they can weather the economic shutdown without seeking new sources of funding. The left-hand graph in chart 3 shows the cumulative distribution function (CDF) for how many months before business operations return to normal. The CDF on the right-hand side plots how long firms can continue to operate in the current environment without seeking additional funding to backstop operations.

The typical (median) response was an expectation that it will be about four more months for business operations to return to normal (though the tail is long, and about 10 percent thought a year or longer is in order). Perhaps the silver lining here is that the typical response was an expectation to be able to operate for another six months before needing to tap additional sources of funding. Assuming that much of the economic activity that has been shuttered begins to resume by the beginning of the fourth quarter and conditions do not deteriorate further, the "typical" firm in our panel should be able to continue to operate.

However, digging into the individual responses reveals some nuance in this relationship. The cross-sectional relationship between a business decision-maker's assessments of the length of time he or she can continue to operate without securing additional funding and the length of time before resuming normal activity carries a correlation coefficient of just 0.2. (This finding essentially means that survey respondents often had different notions of when they would be able to resume normal business operations and need to tap additional funding.) The typical firm expects to be able to resume normal operations about a week or so before they need to tap additional funding. And, perhaps more importantly, nearly 40 percent of firms in our sample expect they'll need to secure additional funding before their operations return to normal.

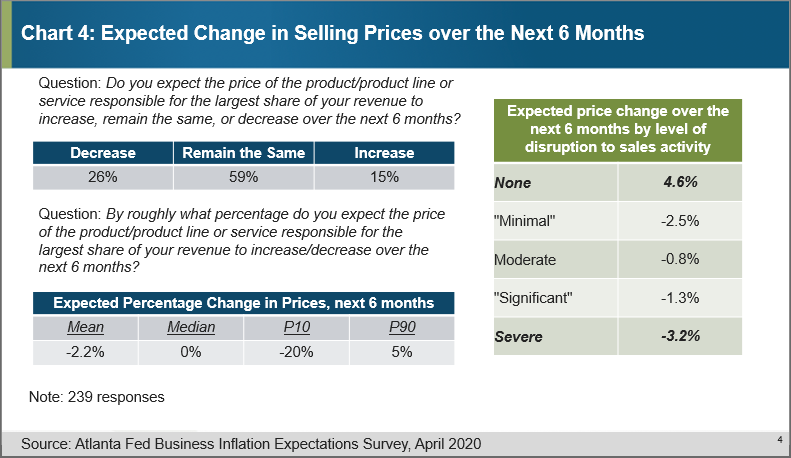

Finally, although inflation isn't the first thing on everyone's mind at the moment, we did ask firms about their price expectations (see chart 4). While roughly 60 percent expect to hold steady on prices over the next six months, roughly a quarter of the panel expect to lower prices, and just 15 percent expect to increase them. On average, firms expect to lower prices by 2.2 percent, and there appears to be a relationship between COVID-related disruption to sales activity and expected price declines.

Across many dimensions, the disruption caused by the current pandemic is without precedent. Many firms headquartered in the Southeast have indicated severely disrupted business operations and sales activity, disruptions that appear to have caused incredibly sharp declines in sales levels. The typical firm in the panel expects this disruption to persist at least through the summer months (which may foreshadow the likely shape of the recovery![]() ). And—though not a primary concern at the moment—inflation expectations are the lowest we've recorded in more than 100 consecutive months of conducting this survey. In many ways, we appear to be in uncharted waters.

). And—though not a primary concern at the moment—inflation expectations are the lowest we've recorded in more than 100 consecutive months of conducting this survey. In many ways, we appear to be in uncharted waters.

Nick Parker, the Atlanta Fed's director of surveys

Nick Parker, the Atlanta Fed's director of surveys