Notes from the Vault

Gerald P. Dwyer

September 2009

- Stock prices fell roughly 50 percent from peak to trough from October 2007 to March 2009.

- These drops in stock prices are large relative to those associated with earlier recessions since World War II.

- This extraordinary plunge in stock prices may reflect effects of the financial crisis rather than lower earnings from an especially severe recession.

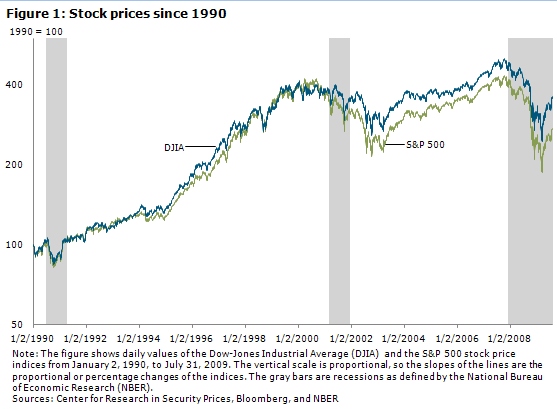

The financial crisis in September and October 2008 was accompanied by stunning decreases in stock prices. Figure 1 shows the widely quoted Dow-Jones Industrial Average (DJIA) index and the S&P 500 index from January 1990 to July 2009.

These declines were the most evident manifestation of the crisis to many people as they watched their retirement accounts shrink. These decreases, though, are best interpreted as a reflection of the crisis in other financial markets and the effects of the crisis itself (Dwyer and Tkac 2009).

Faster and further

Compared to anything seen since 1990, the size and rapidity of the decline is extraordinary. The widely quoted DJIA fell over half—51.1 percent—from a peak of 14,165 on October 9, 2007, to a low of 6,926 on March 5, 2009. While widely quoted, the Dow-Jones is an index of only thirty firms.

The S&P 500 is broader, reflecting the prices of the largest 500 firms on U.S. stock exchanges. This index fell even more—56.8 percent from its peak on October 9, 2007, to a low point on March 9, 2009.

Calculations of the decreases from peak to trough mask the rapidity of the descent. Much of the decline in the United States occurred in the brief period around the climax of the crisis in the fall of 2008. From its local peak of 1,300.68 on August 28, 2008, the S&P 500 fell 48 percent in a little over six months to its low on March 9, 2009. This drop is similar to the decrease in much of the rest of the world (Bartram and Bodnar 2009).

These dramatic falls returned stock prices in March 2009 to levels not seen in more than a decade. The indices had not been as low since April 1997 for the Dow-Jones and September 1996 for the S&P 500.

The story for stockholders

Did stockholders fare that badly from 1996 or 1997 to 2007, receiving no return on their investment for twelve or thirteen years? These indices do not reflect the total return received by an investor. Both indices represent the level of stock prices and do not include the dividends investors receive. But according to the Center for Research in Security Prices, even indices including dividends show a total return of zero to holding stock for more than a decade.

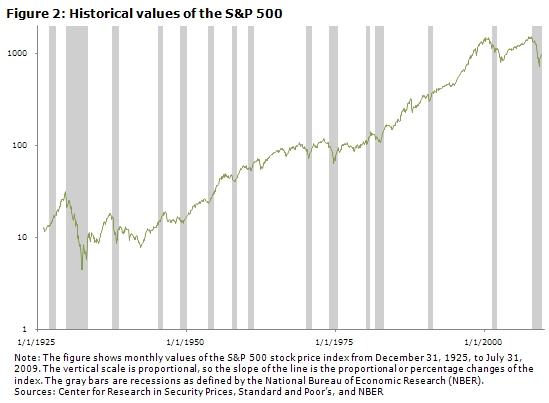

The recent decreases are large from a longer perspective as well. Figure 2 shows the S&P 500 over a longer period, 1926 to July 2009. The recent drop is the largest since the 1930s.

Looking for signs

In general, recessions are associated with decreases in stock prices. In Figure 2, recessions as defined by the National Bureau of Economic Research are shown as gray bars. While a drop in stock prices is not a perfect indicator of a recession, all of the recessions are associated with stock price declines.

Recessions are associated with lower corporate earnings, which is much of the reason why stock prices fall before or during recessions. Given the relationship between corporate earnings, stock price declines, and recessions, this recession’s precipitous fall in stock prices could be a signal that the recession is very severe, perhaps similar to the Great Depression in the 1930s.

On the other hand, the current recession to date has not been noticeably more severe than the recession of 1973 and the double-dip recessions of 1980 and 1981. The severity of the recent stock price decrease compared to the recession suggests that the recent drop in stock prices is partly due to the financial crisis rather than a forecast of an especially severe recession.

Gerald Dwyer is the director of the Center for Financial Innovation and Stability at the Atlanta Fed. He thanks Paula Tkac for helpful comments. The views expressed here are the author's and not necessarily those of the Federal Reserve Bank of Atlanta or the Federal Reserve System.

References

Bartram, Söhnke M., and Gordon M. Bodnar. 2009. No place to hide: The global crisis in equity markets in 2008/09. Journal of International Money and Finance (forthcoming).

Dwyer, Gerald P., and Paula Tkac. 2009. The financial crisis of 2008 in fixed-income markets. Journal of International Money and Finance (forthcoming).