Many small cities are growing at faster rates than has been seen in decades, according to the report City versus Suburban Growth in Small Metro Areas. Not all small cities are growing, but many are. The Atlanta Fed's Community and Economic Development (CED) team is engaged in a project to explore economic dynamism in small cities. For the purpose of this work, our team defines small cities as those with populations of at least 50,000 within metropolitan statistical areas (MSAs) with populations less than 500,000.

From existing research, we know that historical industrial structure explains a significant amount in terms of per capita income growth in small cities; see, for instance, the paper "Small Cities Blues." Put another way, the industry sectors that employed our parents and grandparents in a particular market have been shown, to a substantial degree, to influence the income growth of the current generation of workers. We also know that small cities with universities, state capitals, or large firms remain economically dynamic relative to those without such institutional assets.

Other studies have shown that many small cities are economic hubs for surrounding rural communities with strong anchor institutions such as hospitals, higher education institutions, faith-based organizations, and municipal or other local government enterprises. The Boston Fed has written extensively on the subject, including the papers "Economic Distress and Resurgence in U.S. Central Cities" and "What Makes Working Cities Work? Key Factors in Urban Economic Growth." Many growing small cities are employment centers for lower-income residents living outside the city proper who commute to work in retail, health care, education, and social services jobs.

I provide an overview of data on where small cities are concentrated in the United States, how many people live in them, and where they are growing. I conclude with some key takeaways from this research.

Overview on small cities

Using data from the U.S. Census Bureau, I extracted 255 MSAs meeting the criteria described above from a total of 366 MSAs (see the map in chart 1 and access this PDF for the key to cities). In total, these small cities have a population of more than 53 million. The South has a greater number of small city MSAs than any other census region, with more than 100 (see chart 2).

Further disaggregation to the census division level shows that the southern states have the greatest number of small cities (see chart 3).

The population in small city MSAs varies by region as well. In the South, approximately 20 percent of the population—or 24 million residents—lives in small cities (see chart 4).

At the census division level, almost 12 million people or 20 percent of those living in the South Atlantic states are in small cities (see chart 5).

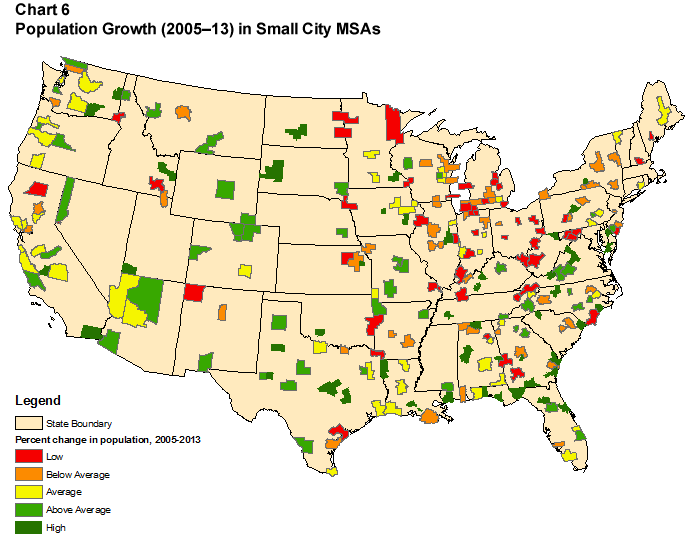

Small cities' population growth 2005–13

Between 2005 and 2013, 87 percent or 218 small city MSAs gained population (see the map in chart 6). Thirteen percent (33 small cities) lost population over the same time period. As indicated on the map, the small cities with the highest growth rates were concentrated in the South. The top 10 fastest-growing small city MSAs were:

- Lafayette, LA

- Salisbury, MD

- Gulfport-Biloxi, MS

- Bowling Green, KY

- Warner Robins, GA

- Winston-Salem, NC

- Jacksonville, NC

- Elizabethtown, KY

- Crestview-Ft Walton Beach-Destin, FL

- Ames, IA

What we are learning and what to expect

The purpose of this research is to better understand and describe the relationship between economic dynamism and capital attraction in small cities. Based on discussions with local, state, regional, and national community development partners, the Atlanta Fed's CED program is testing whether, where, and the relative degree to which some small cities are becoming "stickier," pulling in residents and businesses from surrounding rural areas and newcomers from more urban areas. A second level of inquiry will explore the impact of regional variation in terms of the ability of small cities to attract subsidized capital for economic revitalization.

Obviously, there is tremendous variation across small cities. This work is adding nuance to the discussion of where and how to invest in economic and community development in small cities. Our team is identifying promising markets of opportunity for community development investment as well as barriers and challenges facing both investors and projects seeking investment. Over the coming weeks, we will share what we learn in Partners Update.

The next article in this series will explore additional elements of economic dynamism in small cities, including population density, employment and jobs, education levels, migration patterns, building permits, small business lending, and commuting patterns.