In March 2019, the Atlanta Fed made it an explicit priority to promote economic mobility and resilience in the Southeast. That includes addressing how institutionalized racism contributes to racial wealth and income gaps through a long history of discriminatory policies and practices. Today, that legacy leaves many Black and Hispanic people less resilient in face of the economic shock caused by the ongoing coronavirus pandemic, and therefore more likely to encounter hardships.

In this article, the authors look at discrimination's connections to financial resilience, which is one essential piece of what makes us resilient overall. We define it as a household's capacity to weather unexpected expenses or shocks to income.

The Federal Reserve Board's Survey of Household Economics and Decisionmaking (SHED) collects data on factors that contribute to financial resilience, including personal savings that provide a cushion for households that experience a sudden economic strain.1 The SHED indicates that when the COVID crisis hit, only half of American households had a rainy day fund, defined as three months of saved income. The data also reveal that even smaller shares of Black and Hispanic households, along with renter and low-income households, had these savings available. Supplemental SHED data from July 2020 help show the pandemic's impact on these households' finances. We use the SHED and other sources to demonstrate how low personal savings tie into racial and economic disparities, and we challenge institutions to devise appropriate responses.2

Data indicate differences by race and ethnicity that must be understood in the context of structural racism. Legal discrimination, especially against Black people, has excluded racial and ethnic minorities from critical wealth-building opportunities over generations, with a compounding impact. It is present today in homeownership gaps, barriers to educational attainment, and occupational segregation patterns where Black people are disproportionately employed in lower-wage jobs. Although discriminatory practices like redlining have been abolished, systemic barriers in both housing and labor markets continue to disadvantage Black and Hispanic people. Research shows that Black people with qualifications comparable to their white peers are considered for jobs less and paid less for the same jobs. Research also shows that racial discrimination in both access to and cost of mortgage credit maintain the white-Black homeownership gap today.

Who had savings before the pandemic?

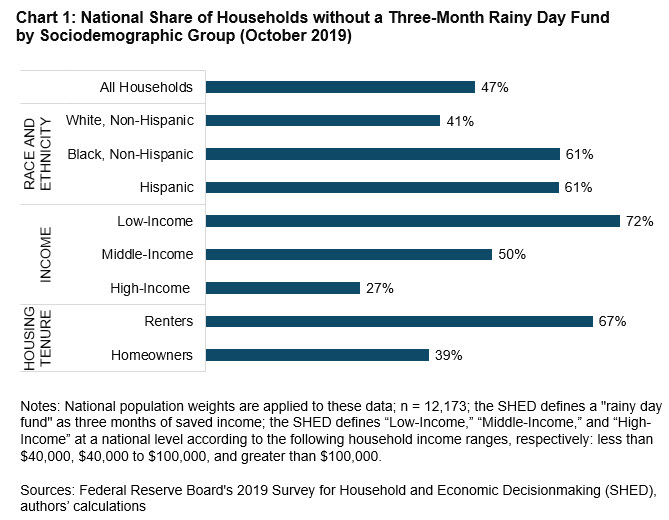

According to the SHED, 47 percent of U.S. households did not have a rainy day fund in October 2019. Upon closer examination, stark disparities emerge across income level, housing tenure, and race and ethnicity (see chart 1). Nearly three-quarters (72 percent) of households with less than $40,000 in annual income had no rainy day fund. Two-thirds (67 percent) of renters lacked these savings, as did over 6 in 10 Black and Hispanic households (both 61 percent).3 Intersectional disadvantage also exists within these groups. Black and Hispanic households are more likely to be extremely low-income renters than white households, a pattern that can be traced to the ongoing reality of racial discrimination in labor and housing markets.

In southeastern states served by the Atlanta Fed, an even smaller portion of respondents reported having three months of income saved. Similar disparities by race, ethnicity, income, and housing tenure show up here, too. Some southeastern subgroups appear even more prone to lacking a rainy day fund, with 63 percent of Black respondents and 69 percent of renters in the Southeast reporting that they did not have three months of income saved in 2019.4

Savings and hardship

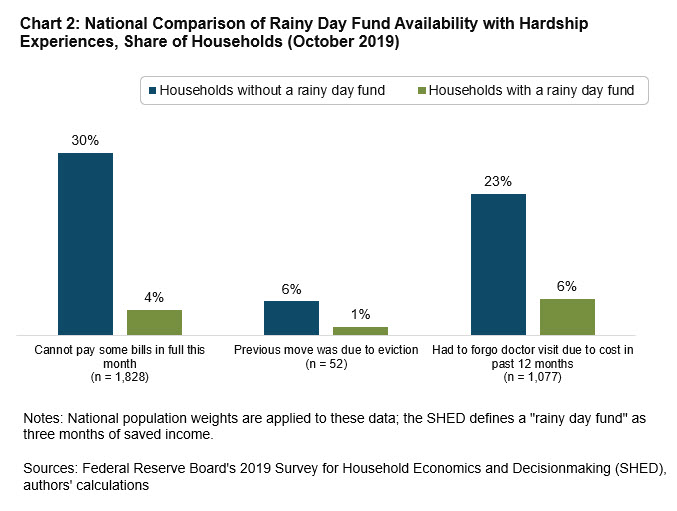

Without the safety net offered by personal savings, households are more vulnerable to hardship.5 SHED data show that in 2019, households without a rainy day fund more frequently experienced certain financial hardships that are now being observed as economic consequences of the COVID-19 pandemic (see chart 2).

- When they were surveyed, 30 percent of households without three months of income saved said that they struggled to pay all bills on time that month versus only 4 percent of those who did have a rainy day fund.

- Missing rent payments puts tenants at risk of being evicted. While only a small percentage of households attributed a recent move to an eviction, those without rainy day funds reported experiencing an eviction at a higher rate. Among households that moved recently, 6 percent of those without savings said that an eviction caused their move, compared with only 1 percent of those with savings.

- Households with no rainy day fund also reported more limited health care uptake. Twenty-three percent missed a doctor's visit due to the cost versus 6 percent among households that had a fund available.

Who has lost income during the pandemic?

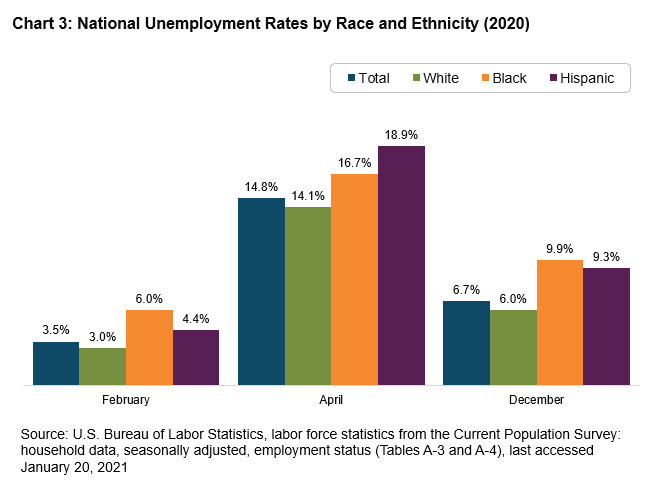

Black and Hispanic households, which were less likely to have rainy day funds before the pandemic, face a disproportionately high risk of needing one during the crisis. Data from the U.S. Bureau of Labor Statistics show that unemployment rates for these groups, which historically trend higher than the general population, have grown steeply during the pandemic (see chart 3). While unemployment rates improved from April to December 2020, they remain higher than they were before the pandemic began.

The Atlanta Fed's Unemployment Claims Monitor offers additional evidence of the lopsided representation of Black and Hispanic workers among unemployment claims filed since March 2020, and it indicates the disparity is even more pronounced across southeastern states.6

Many factors rooted in the legacy of labor market discrimination contribute to disproportionately high unemployment rates today. For example, occupational segregation leaves Black and Hispanic workers concentrated in some industries hardest hit by the pandemic, including transportation and accommodation and food services.7

Data from the SHED confirm how the pandemic's economic fallout reinforces the link between low incomes, smaller rainy day funds, and hardship. In July 2020, the Federal Reserve Board recontacted about one-third of respondents from the October 2019 sample. Those July responses reveal higher rates of job loss among households that had previously reported lower incomes and less savings. Although 15 percent of recontacted respondents had lost a job since February, job loss hit 17 percent of households earning less than $40,000, 18 percent of households who had reported not having a three-month rainy day fund, and 19 percent of those who had lacked $400 in savings eight months earlier.8

The supplemental survey provides important evidence that unemployment benefits can intervene in minimizing hardship due to job loss. The Board's report on the July SHED supplement finds that 24 percent of households receiving unemployment insurance reported struggling to pay bills during that month, compared with 46 percent of out-of-work households that had not received unemployment. By helping households avoid hardship in this way, unemployment insurance and other safety net support can provide a buffer for those without personal savings.

What's needed: targeted support for widespread financial resilience

High unemployment rates and urgent health care needs resulting from the pandemic present a greater risk of financial hardship to households without emergency savings. We have highlighted the disparate distribution of risks by race, ethnicity, income level, housing tenure, and region. We've also begun to connect these patterns to long-standing labor and housing market discrimination that keeps incomes lower than average for Black and Hispanic workers and excludes many of them from the relative stability and potential financial benefits of homeownership. Indeed, the shock is poised to exacerbate disparities in the long run, much like the Great Recession and other shocks and stresses have done.9

Provisions in the $2 trillion CARES Act passed in March 2020 and the $900 billion relief package passed in December 2020 may help to mitigate the ongoing hardship. However, policymakers could build on these protections and direct payments and loans to households and businesses. In the short run, the severity of current hardships demands support that targets people in the most affected groups and serves as a bridge for the duration of the crisis. That might include larger and repeated installments of cash assistance and eviction moratoria and unemployment benefits extended through the pandemic. The December 2020 package's $25 billion in rental assistance funds may help stabilize renters who are struggling. More support to landlords and tenants is needed to facilitate rent forgiveness or fair repayment plans for those who remain in arrears.10

In the long run, efforts to build financial resilience for all should address the root causes of savings and hardship disparities. For example, higher minimum wages and strong safety nets help combat the impact of discriminatory labor markets. Down payment assistance programs and small-dollar mortgages promote homeownership among those who have been historically excluded, particularly Black people. Other financial products can help all households accumulate rainy day funds over time, including matched savings and prize-linked savings accounts. For households without savings, affordable, small dollar consumer loans assist with managing unexpected expenses.

Mission driven financial institutions play a role. Community development financial institutions (CDFIs) and minority depository institutions (MDIs) exist to serve low-income and minority individuals and communities. CDFIs and MDIs are uniquely positioned to provide immediate relief to those in need as well as longer-term support through lending and services. Accordingly, the December 2020 bill allocated $12 billion to increase CDFIs' and MDIs' capacity in helping to mitigate the pandemic's economic shock to these disadvantaged groups. Funders and future relief programs must continue to prioritize these institutions.

In this article, we demonstrate the link between low wages, a lack of savings, and hardship as well as the root causes that create barriers to financial resilience for many Black and Hispanic families. Without committed action, the disparities that were in place as the country entered the COVID-19 recession will limit widespread financial resilience and an inclusive recovery.

By Julie Siwicki, CED adviser, and Nisha Sutaria, CED research analyst II. The views expressed here are the authors' and not necessarily those of the Federal Reserve Bank of Atlanta or the Federal Reserve System. Any remaining errors are the authors' responsibility.

_______________________________________

1 For more on this model of household finance, see the following works: Morduch, Jonathan and Rachel Schneider. (2017). The Financial Diaries: How American Families Cope in a World of Uncertainty. Princeton, NJ: Princeton University Press; Aspen Institute Financial Security Program. (2020, November 9). The State of Financial Security 2020: A Framework for Recovery and Resilience.

2 The Federal Reserve Board established the SHED in 2013. The annual survey is nationally representative of U.S. households and covers topics related to financial security such as credit, housing, education, and retirement. The SHED is not a longitudinal survey, yet it does resurvey some respondents in each installment.

3 The SHED provides data on a limited number of racial and ethnic groups. In addition to the groups we focus on here—Black, Hispanic, and white—the survey also includes categories for people identifying as an "other" race or ethnicity and as two or more races or ethnicities. We do not expand this analysis to these additional categories because of small sample size limitations and the complexities of disaggregating a wide range of identities and experiences held within them. We use the terms Black and Hispanic throughout in keeping with the SHED's decision to use these terms.

4 The six southeastern states in the Federal Reserve Bank of Atlanta's Sixth District are Alabama, Georgia, Florida, and parts of Louisiana, Mississippi, and Tennessee. The weights provided by SHED were designed for a national purpose and were therefore not applied to this regional subset analysis. With weights applied, southeastern disparities by race, ethnicity, income, and housing tenure appear even more exaggerated when compared with national numbers. We opted not to disaggregate survey data by state due to the disproportionate sample sizes across states as well as the size of certain samples, which range from N=804 in Florida to N=68 in Mississippi.

5 See McKernan, Signe-Mary, Caroline Ratcliffe, Breno Braga, and Emma Cancian Kalish. (2016). Thriving Residents, Thriving Cities: Family Financial Security Matters for Cities. Urban Institute. The work shows that having even $250 in savings makes evictions and missed bill payments significantly less likely.

6 The Atlanta Fed's Unemployment Claims Monitor displays disaggregated unemployment insurance claims employees over time. The tool is based on U.S. Department of Labor Employment and Training Administration data.

7 The U.S. Bureau of Labor Statistics indicates that in 2019 Black or African American workers made up 12.3 percent and Hispanic or Latino workers made up 17.6 percent of employment across all industries for workers 16 years and older. However, Black or African American workers made up 21.4 percent and Hispanic or Latino workers 19.8 percent of those employed in the transportation industry, and 13.9 percent and 27.0 percent, respectively, of those working in the accommodation and food services sector. (Data accessed December 15, 2020.) Both industries are among those defined as "hardest-hit" by the pandemic in a study by the Federal Reserve Bank of Philadelphia.

8 Population weights are applied to these figures from the SHED supplement, which come from the authors' calculations. Eight percent of respondents from the 2019 annual survey completed a supplemental April 2020 survey, and 34 percent completed a supplemental July 2020 survey. An analysis of April's data reveals similar patterns to what we report for July, though less extreme.

9 For more on the uneven reach of previous recoveries, see the following works: McKernan, Signe-Mary, Caroline Ratcliffe, Eugene Steuerle, and Sisi Zhang. (2014, April). "Impact of the Great Recession and Beyond." Urban Institute working paper; Hoynes, Hilary W., Douglas L. Miller, and Jessamyn Schaller. (2012, March). "Who Suffers during Recessions?" National Bureau of Economic Research working paper 17951; Holder, Michelle. (2015, November). "The Impact of the Great Recession on the Occupational Segregation of Black Men"; and Carr, James H. (2020, March 25). "Why Recovery from the Great Recession Favored the Wealthy: The Role of Public Policy." Nonprofit Quarterly.

10 The Federal Reserve Bank of Philadelphia estimates that 1.3 million renters will accrue $7.2 billion in unpaid rent through 2020 alone, and that Hispanic households, Black households, and family households headed by single women are disproportionately likely to experience rental debt.