Mels de Zeeuw

April 24, 2018

2018-04

https://doi.org/10.29338/wc2018-04

In the current tight labor market with low levels of unemployment, it is not surprising that a large share of firms experience difficulty hiring candidates for open positions. However, much is unclear about the extent of these difficulties, their underlying reasons, and how firms respond. Using data from the Federal Reserve Banks' national 2017 Small Business Credit Survey, a recent paper examines the nature of firms' hiring difficulties and how they vary by industry and geographic location. The paper also explores how the reasons behind hiring difficulties relate to firms' responses. The findings give workforce and economic developers a better understanding of where hiring problems persist, the causes of such problems, and more specifically, to what extent skill mismatches are the culprit.

Hiring difficulties

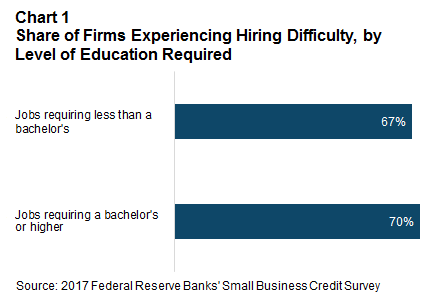

About two-thirds of firms report they find it somewhat or very difficult to hire for positions that do not require a college degree, and a slightly larger share of firms (70 percent) report the same when attempting to hire for positions that require a bachelor's degree or higher (see chart 1). There is a great deal of variation in the underlying reasons for this difficulty, and in the responses firms use to address it.

Skill mismatches and applicant pools

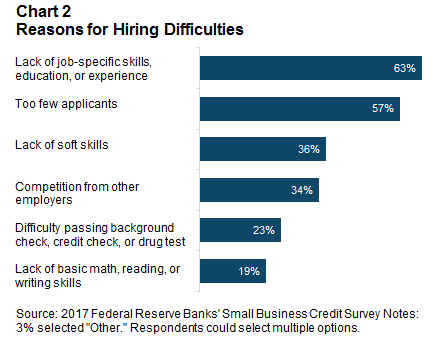

The reasons behind hiring difficulties can be roughly divided into two groups: a mismatch in the skills candidates have and firms want, and a relatively small pool of applicants for open positions. In terms of skill alignment, 63 percent of firms that experience difficulties cite a lack of job-specific skills, education, or experience as a reason (see chart 2). Thirty-six percent of firms say candidates lack the necessary soft skills, and 19 percent say candidates lack basic math, reading, or writing skills.

The second most frequently cited reason for hiring difficulties is the small size of the applicant pool; 57 percent of firms that experience hiring difficulties say it is a problem. Just over one-third say competition from other employers for workers is a problem, and 23 percent of firms cite candidates failing background and credit checks or drug tests as an issue.

How firms respond to hiring difficulties varies based on the nature of the challenges these firms face. The most common response is to increase compensation, both in the form of starting pay and benefits or non-wage compensation. About half of all firms increased compensation: 44 percent of firms raised starting pay, 20 percent increased benefits, and 14 percent did both. Firms that cite skills-related challenges, such as applicants with a lack of job-specific skills or soft skills, are more likely to respond by restructuring the responsibilities of their current employees, loosening the requirements for certain positions, or offering more training. In contrast, firms that experience too small applicant pools or competition from other employers are more likely to raise starting pay or increase benefits.

Rural struggles

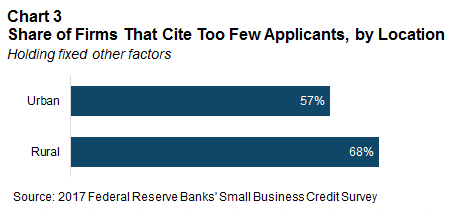

Interestingly, there is significant variation in the prevalence of the reasons behind hiring difficulty across industries and geographic location. Rural firms appear to face more difficulties hiring in this tight labor market. Firms in rural areas are 7 percent more likely to face hiring difficulties when hiring for non-college-educated positions, and about 9 percent more likely to experience difficulties when hiring for bachelor's degree or postgraduate positions than are firms located in urban areas, after controlling for a variety of other firm-specific factors.1 Firms in rural areas are about 10 percent more likely to cite "too few applicants" as a reason for their hiring difficulties than are similar urban firms (see chart 3). However, rural firms are no more or less likely to cite a lack of job-specific skills among applicants than urban firms are. In fact, rural firms that experience hiring difficulties are slightly less likely to have applicants that lack math, reading, or writing skills compared to urban firms.

Previous research indicates this rural-urban differential may be related to lower labor force participation rates in rural areas. In mid-2017, for instance, the labor force participation rates among prime-age workers in rural areas was 3 percentage points lower than that of similar workers in metro areas, and this divergence, particularly between larger metros and rural areas, has widened over the past decade. This is in part driven by increasing health and disability issues in rural areas. Somewhat relatedly, recent research suggests the opioid epidemic could be an important driver of declining labor force participation rates. Addressing these public health challenges might offer a lever to boost the size of the labor force in rural areas, which in turn may have a beneficial impact on the difficulties rural firms face in hiring workers.

Industry differences

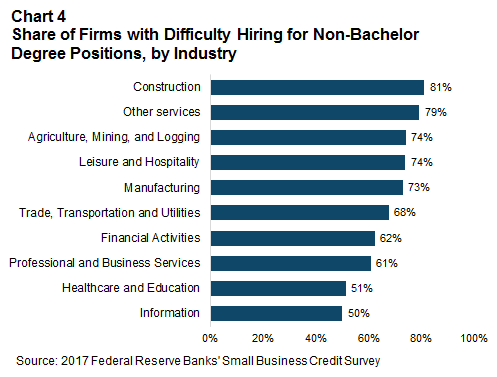

Across industries, firms experience significant differences in the level of difficulty they have attracting and hiring applicants that do not have college degrees. The construction and other services2 industries have the highest shares of employers who state they experience trouble hiring such workers, at 81 and 79 percent of firms, respectively, followed by 74 percent of firms in extractive industries, and in leisure and hospitality (see chart 4). Even after controlling for various firm-specific factors, these four industries remain the most challenged in terms of hiring such workers. Construction and leisure and hospitality firms tend to employ high shares of non-college degree graduates. Additionally, because these two industries tend to have higher turnover rates, they must hire non-college graduates more often and are thus more likely to run into hiring difficulties.

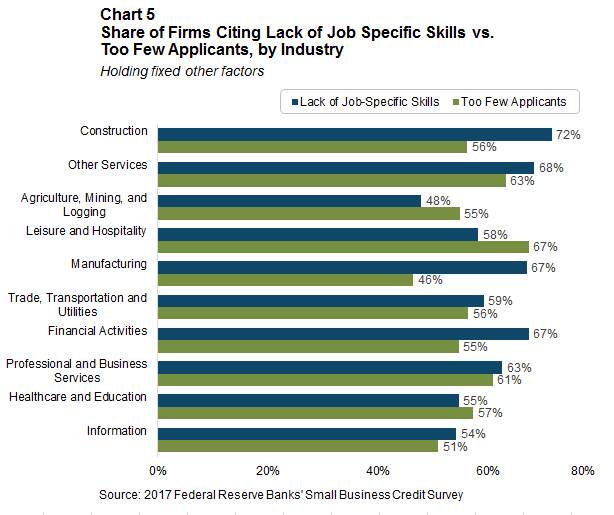

Notably, a larger share of firms in the construction and manufacturing industries indicate a skills deficit among their applicants than say they have an applicant pool that is too small, after controlling for other factors (see chart 5). Seventy-two percent of construction firms that experience difficulties cite a lack of job-specific skills among their applicants, while 56 percent cite the size of their applicant pool. Among manufacturing firms that experience difficulty hiring, 67 percent cite job-specific skills challenges, while 46 percent cite the size of their applicant pool as the reason. In fact, manufacturers are significantly less likely than other industries to say they have "too few applicants." The construction and manufacturing industries appear instead to face relatively pressing problems in their pipeline of skilled workers.

Another issue that appears to particularly affect the construction industry is job candidates failing background and credit checks or drug tests, with the latter being the most common factor. After controlling for other firm-specific factors, one-third of construction firms cite these as reasons for their hiring difficulties. Construction firms are significantly more likely to cite this as an issue than firms in other industries, with the second highest share among leisure and hospitality firms at 23 percent. Recent research from the Atlanta Fed's Center for Real Estate Analytics suggests the tight labor market facing construction firms is one of several important challenges affecting the current housing market, and could be indirectly increasing the cost of housing. Addressing some of the most prevalent reasons for hiring difficulties among construction firms—a lack of skilled applicants and a larger share of candidates failing background or drug tests—could thus have wide-ranging economic benefits.

Policy implications

The data collected by the 2017 Small Business Credit Survey present reasons for firms' hiring difficulties by industry and geography, which could inform some targeted approaches by policymakers looking to address labor or skills shortages. For instance, interventions that focus on skills training and education to bolster the pipeline into the construction and manufacturing industries could be particularly beneficial to non-college-educated workers and employers in those industries. Further research can help identify the precise nature of the skills that firms in these industries believe are lacking and are driving their hiring challenges. Finally, efforts to grow the size of the labor pool in rural areas—by addressing persistent public health challenges, for instance—may pay large dividends for rural employers that face dwindling applicant pools.

Mels de Zeeuw is a research analyst II in the Community and Economic Development group. The views expressed here are the author's and not necessarily those of the Federal Reserve Bank of Atlanta or the Federal Reserve System.

_______________________________________

1 These controls include the size and age of firms, whether they were profitable in the previous year, the educational level of the majority of their workforce, and whether they are planning to expand their workforce in the next 12 months. Finally, it includes various types of unemployment rates, depending on their appropriateness for the model. For more detail on these controls, and on the firm-specific factors in the models that concern the reasons for and responses to hiring difficulties, please refer to the paper.

2 The other services industry includes repair and maintenance firms such as automotive service companies as well as personal care and laundry service businesses.