Can Lessons from the Great Recession Guide Policy Responses to the Pandemic-Driven Economic Crisis?

Jane Oates and Carl Van Horn

June 16, 2020

2020-05

10.29338/wc2020-05

Download the full text of this paper (1,025 KB) ![]()

Note: This article is part of a series titled Leading Workforce Resurgence that will be posted in Workforce Currents. The series is a joint effort of the Atlanta Fed’s Center for Workforce and Economic Opportunity, the John. J. Heldrich Center for Workforce Development at Rutgers University, and WorkingNation. The series is coedited by Stuart Andreason and Carl Van Horn.

In a 1948 speech to the British House of Commons, Winston Churchill warned, "Those who fail to learn from history are condemned to repeat it." As the U.S. economy struggles to reopen safely and recover, what are the lessons from the Great Recession that might help guide how policymakers respond to the pandemic-driven economic crisis?1 What should we expect over the coming months and years as the nation struggles to restore its economy, which before the pandemic had finally achieved historically low unemployment levels? In June 2020, there is much that we do not know or would even attempt to predict. However, it is not too early to consider how our nation could respond to the crisis and how to avoid repeating the shortcomings of policy responses during and after the Great Recession.

The Great Recession and the COVID-19 economic crisis

Of course, the origins of the Great Recession and COVID-19 economic crises were altogether different. The Great Recession was caused by a worldwide financial crisis brought about by risky financial decisions made by investors, bankers, and insurance companies. Capital markets seized up and capsized investments and loans for businesses and individuals alike. Addressing the crisis required stabilizing financial institutions, creating confidence in the markets, and assisting the millions of people who lost jobs, health care insurance, investments, and homes after the financial meltdown. Responses to the challenges of the Great Recession, while significant and widespread, were more readily targeted to reforms in specific sectors.

The COVID-19 pandemic spread a sudden, horrific, and invisible wave of illness, death, and fear. As of June 2020, over 1 million Americans were infected with the virus and more than 100,000 had died—a disaster on a scale unprecedented in the modern era. Federal, state, and local governments swiftly took actions to slow the spread of the disease, save lives, and stabilize the nation's health care system so it could treat those suffering with the virus. Mandatory stay-at-home orders by the governors of 45 states and closures of all but essential businesses, such as grocery stores, brought much of the U.S. economy to a standstill.

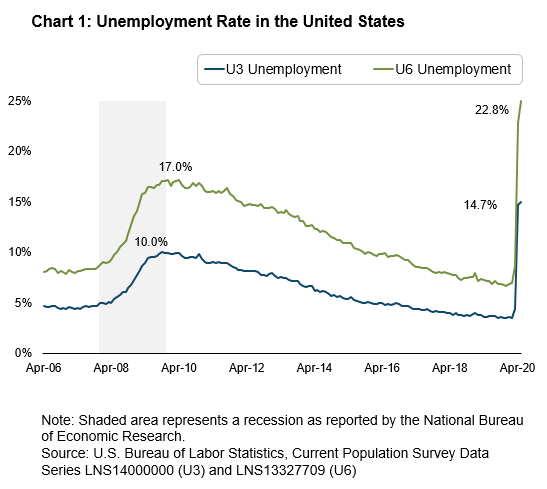

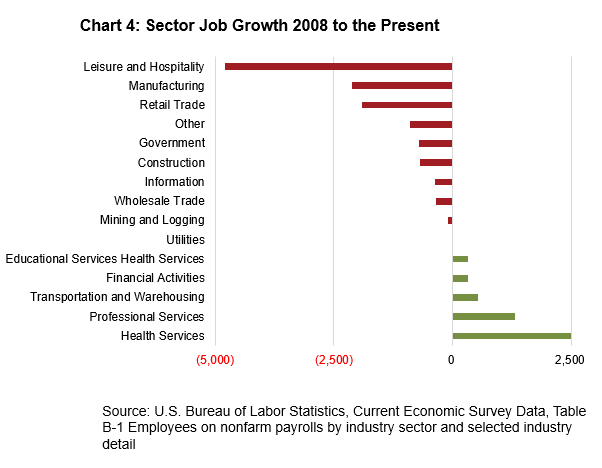

In just four months, the top-line unemployment rate jumped from 3.5 percent in February to 14.7 percent in May, exceeding the 10 percent level reached in 2009 during the Great Recession. By late May 2020, the U.S. labor market had shed approximately 40 million jobs—far greater than all of the jobs gained in the last decade. McKinsey's Global Institute estimated that nearly 60 million jobs were vulnerable to layoffs, furloughs, or reduced hours and compensations. A Federal Reserve System survey of 4,000 businesses, nonprofits, and financial institutions conducted in April reported that nearly 7 out of 10 respondents (69 percent) indicated that COVID-19 was a significant disruption to the economic conditions of the communities they serve.

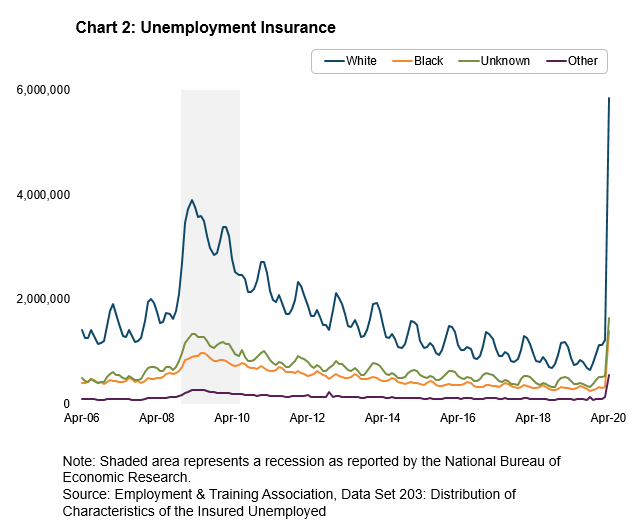

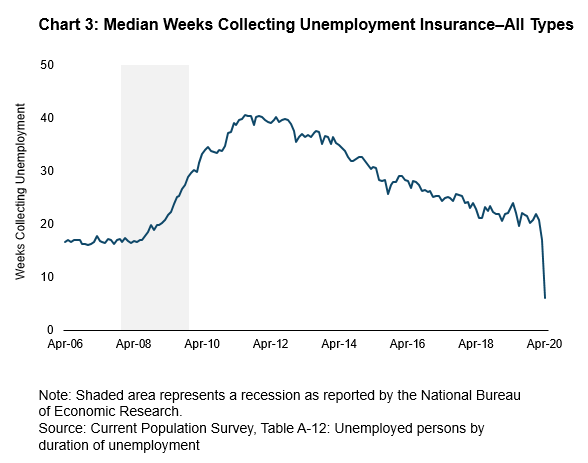

It is clear that the initial depth of the economic and workforce damage from COVID-19 is far greater than during the Great Recession. Comparisons of the pandemic economic crisis with the Great Recession are summarized in charts 1 to 4, which display unemployment rates, unemployment insurance claimants' demographics, median weeks of unemployment, and job loss by sector. See also the Atlanta Fed's Unemployment Claims Monitor, which charts weekly updates and reports on unemployment claims by state and county.

In parallel with the Great Recession, the groups of workers suffering the greatest economic harm in the current crisis are minorities, low-wage earners, and individuals with lower education levels. The Center on Budget and Policy Priorities estimates that "more than half of all jobs losses come from the low-paid group of industries" in the service sector.

The recovery from the Great Recession took nearly a decade. It is far too early to predict how swiftly the U.S. economy might return to full production and lower unemployment levels. The Federal Reserve estimates that the economy and labor market could recover by the end of 2021.

Federal government actions during the Great Recession and COVID-19

The federal government's response to the Great Recession began during the last few months of the 2008 presidential election campaign. The Federal Reserve took quick action, assisting financial institutions and insurance companies and lowering interest rates. Congress and the president also acted swiftly. With broad bipartisan support in October 2008, a $700 billion Emergency Economic Stabilization Act (EESA) to buy back troubled loans from banks and support large manufacturers—with loans equity investments in the auto industry and others—was enacted.

Within weeks of president Obama's inauguration, in February 2009, Congress passed the $840 billon American Recovery and Reinvestment Act (ARRA). The law included wage tax cuts increases in unemployment benefits and infrastructure investments. Funding was also included to support the "green economy" such as electric car manufacturing at Tesla and training programs for "green jobs."

Almost immediately, EESA and ARRA attracted critics from all corners of the partisan and political spectrum. Liberals charged that the federal government should not have bailed out the same financial institutions and big businesses that created the crisis. They also complained that the scope and content of federal policies were insufficient to meet the needs of workers. Conservatives complained that the government's actions were too expensive and excessively expanded the role of the federal government.

By 2010, the policy actions at the onset of the Great Recession created even sharper partisan divisions. Addressing the loss of employer-provided health care insurance during the Great Recession, a divided Congress narrowly passed the Affordable Care Act in March 2010. With the economy still struggling and unemployment remaining high, partisan divisions over the scope of federal government interventions deepened. These divisions contributed to the birth of both the Tea Party and Occupy Wall Street movements. While these groups arrived at different policy suggestions, both movements were also reactions to widening economic inequality in the country.2

Riding a wave of public dissatisfaction with the economy and federal government action, Republicans regained control of Congress in the 2010 midterm elections. Thereafter, decisions about government spending that had been bipartisanship disappeared as Republicans and Democrats argued over the size of federal debts and deficits. Spending cuts were enacted and federally funded extensions of unemployment insurance were eliminated.

Other positive, but less celebrated, federal policy outputs after initial responses to the Great Recession included the revised Workforce Innovation and Opportunity Act of 2014. Passed by Congress without dissent, it increased the focus on public-private partnerships; stressed business engagement in education programs; and sectoral training programs, career pathways, and skills-based instruction. The Obama administration, with support from Congress, also put additional resources in community colleges and expanded their role in providing training programs that led to industry-recognized credentials. States also received federal support through a Workforce Data Quality Initiative and the State Longitudinal Data Systems to create linked data systems that enabled them to allocate resources based on program performances and to better inform the public about program outcomes.

During the early months of the COVID-19 pandemic, the federal government's fiscal and monetary policy were enormous and bipartisan. In less than three months, Congress passed and the president signed four bills allocating over $3 trillion with all but a few dissenting votes. As shown in the tables below, the initial policy actions by Congress and the Federal Reserve to the crises also were similar in many respects. During the COVID-19 outbreak, the Federal Reserve added the Main Street Lending Program and a Term Asset-Backed Securities Loan Facility. Congress also provided enhanced unemployment insurance, funds for "gig workers" who previously were not eligible for assistance, and direct payments to most families with earnings less than $100,000. In contrast to the Great Recession, Congress did not provide funding for purchasing troubled assets and shoring up financial institutions, but did provide loans and direct assistance to several industries, including the airline industry.

Table 1: Federal Reserve Crisis Responses

| Great Recession | COVID-19 Crisis | |

|---|---|---|

| Cut federal funds rate | Yes | Yes |

| Securities purchasing (quantitative easing) | Yes | Yes |

| Primary Dealer Credit Facility | Yes | Yes |

| Money Market Mutual Fund Liquidity Facility | Yes | Yes |

| Secondary Market Corporate Credit Facility | No | Yes |

| Main Street Lending Program | No | Yes |

| Term Asset-Backed Securities Loan Facility | Yes | Yes |

| Term Auction Facility | Yes | No |

| Term Securities Lending Facility | Yes | No |

| Commercial Paper Funding Facility | Yes | No |

Table 2: Congressional Crisis Responses

| Great Recession | COVID-19 Crisis | |

|---|---|---|

| Individual tax rebates (stimulus checks) | Yes $600 | Yes $1,200 |

| Extended unemployment | Yes | Yes |

| Additional federal unemployment | Yes $25/week | Yes $600/week |

| Gig worker unemployment | No | Yes |

| Medicaid assistance | Yes | Yes |

| Expanded food assistance (such as SNAP) | Yes | Yes |

| Federally Purchased Troubled Assets | Yes | No |

Note: Policies for COVID-19 represent Federal Reserve and congressional actions through May 2020.

Source: Summary of Federal Reserve and federal legislative actions prepared for analysis by Katherine Townsend, Federal Reserve Bank of Atlanta; see appendix for full discussion

The economic stoppages put public health and safety at the forefront of policymaking in 2020 but created further challenges for recovery. Traditional post-crisis economic strategies—investments, extended unemployment insurance, tax credits and tax cuts, and regulatory reforms—deployed during the Great Recession and in previous recessions may not be sufficient to turn the economy around. Large numbers of Americans have shown that they are reluctant to return to previously common activities, such as going to restaurants, traveling by air and rail, staying in hotels, and going to events.3 Many businesses that thrived before the pandemic will not recover their customers in time to avoid bankruptcy. Timing accurate and responsive policies to support workers and the firms affected is incredibly difficult until there are proven health remedies that treat and prevent the virus.

Long-standing problems experienced during the Great Recession still plague the U.S. economy and millions of workers

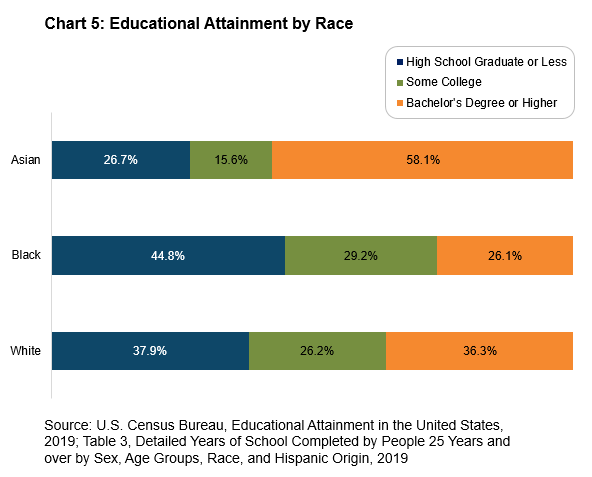

The recovery from the Great Recession was gradual and uneven. Millions of people never recovered their jobs or lost earnings. The top-line unemployment rate reached 10 percent in 2008 and did not fall to 4 percent—a common benchmark for full employment—until 2018. During the entire period, the unemployment rates for Blacks and Latinos was nearly twice the rates for White Americans. This persistent pattern is already prevailing during the COVID-19 pandemic. Low-income people, less educated individuals, minorities, women, and older workers have been hit harder than others, often because lack of skills and postsecondary education and discrimination4; see chart 5.

As documented by the Federal Reserve 2019 Survey of Household Economic Decisionmaking, 37 percent of Americans have no more than $400 in savings, making it impossible to manage essential car repairs or medical bills, let alone unemployment, especially if it lasts beyond the period of federal and state financial support.

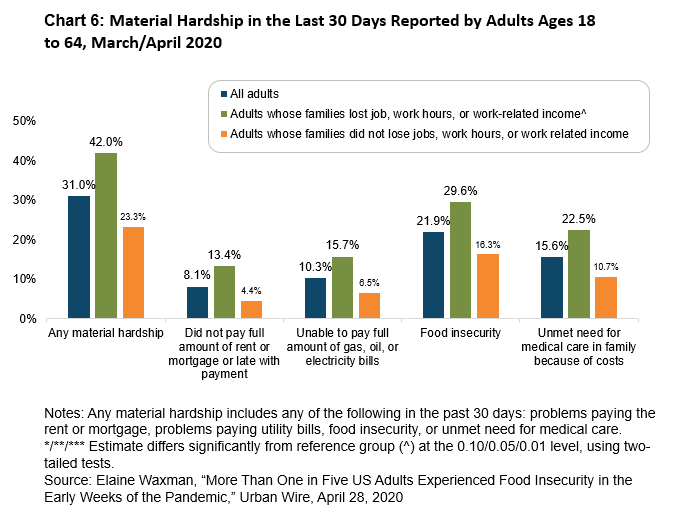

The U.S. safety net for our most vulnerable citizens is stretched thin even in prosperous economic periods. These weaknesses were revealed in the early phases of the pandemic crisis. Researchers at the Urban Institute documented that one in five Americans are struggling to purchase food. Millions more are not able to fully pay rent or mortgages and are skipping visits to their doctors or dentists; see chart 6.

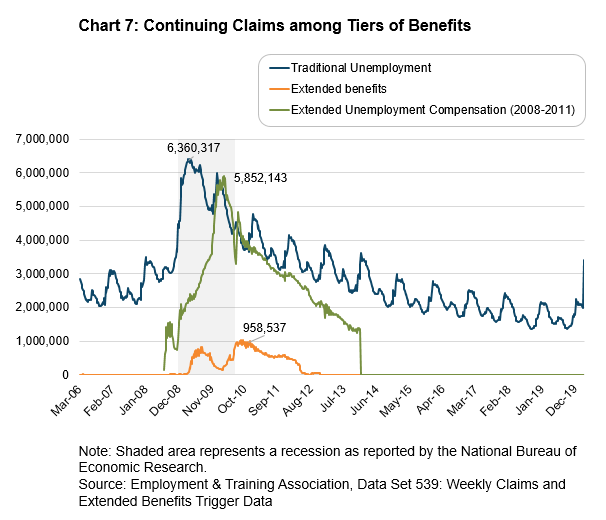

During and after the Great Recession, federally funded unemployment insurance benefits were extended up to 99 weeks. Eventually, this policy became controversial and was curtailed. During the COVID-19 outbreak, Congress enacted direct cash payments and extensions of eligibility for unemployment insurance (UI). During the Great Recession, the additional extra payment was $25 a week, compared to $600 a week in 2020. Federally funded extensions of unemployment insurance—beyond the traditional 13 weeks—were added by Congress in March 2020, but it is by no means certain that there will be any further extensions.

In March and April, many states extended weeks of UI coverage and short-time compensation laws. However, as states lift business closures restrictions, some of them indicated that the changes to UI were temporary. In Georgia, for example, where UI was extended to 26 weeks, the governor and legislature indicated they may return to only 13 or 14 weeks of coverage. In other states, governors made it clear that individuals who refused to return to work when called back by their employers would lose UI benefits, even if the furloughed workers expressed concerns about workplace safety; see chart 7.

While unemployment insurance is a bedrock safety net for millions of workers, it varies widely in coverage from state to state in duration and amount of benefits. Simply put, unemployment insurance does not cover everyone nor provide sufficient support for millions of individuals who will need financial relief during the COVID-19 economic crisis. Permanent changes to UI also are needed to better serve part-time and contract workers.

The surge in unemployment claims that overwhelmed state labor departments revealed decades of underinvestment in the system's frontline workers and technology. As a result, there has been an increase in fraud schemes engineered by criminals exploiting the weaknesses in technology and security in some states. These deficiencies should bring about the long-delayed modernization of the UI system that is routinely recommended by practitioners and scholars.

Meeting several urgent policy and programmatic concerns will be critical to achieving a robust and equitable COVID-19 economic recovery. Among the most important are the following (these topics will be covered in depth in future Workforce Currents Leading Workforce Resurgence articles):

- Strengthening education and training programs5

Improving the quality of training for unemployed workers and those seeking to improve their wages is always important. During the recovery, it is even more imperative, given the need for many workers to change careers or upgrade their skills for a transformed economy. Utilizing labor market information to inform the creation, retention, and revision of education/training programs for in-demand jobs and skills will be especially important. - Creating public service jobs6

As the labor market slowly recovers, Congress should consider efforts to create public service jobs for long-term unemployed workers. There will be many short-term needs, including contact tracing and related public health-care services. - Meeting mental health needs

Another persistent problem revealed during the Great Recession that has emerged during the pandemic is the need for more robust mental health care services to help people cope with the devastating job losses that may lead to stress, depression, drug and alcohol abuse, domestic violence, and suicide. - Expanding broadband access

The lack of broadband access in many rural and low-income communities created remote work deserts that further disadvantages people in the emerging stay-at-home model and is another important priority for bringing about recovery across the widening digital divide. - Assisting older workers and the long-term unemployed

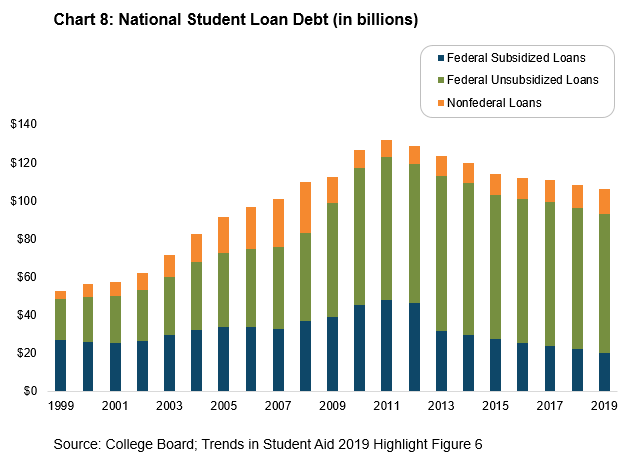

Savings for millions of older workers will be decimated, forcing them to remain in the workforce longer, which has implications for millennials. Older workers may also be discriminated against because of their age. Thousands of older individuals who own small businesses will also be unable to sell their business in order to finance their retirement. Evidence from the Great Recession also demonstrates that older workers struggled to return to work and often experienced age discrimination.7 - Helping recent high school and college graduates

In the aftermath of the Great Recession, young workers struggled to find jobs and begin careers. Their subsequent unemployment and underemployment meant that they were often unable to achieve family-supporting wages and salaries. Those with student loans often were unable to make payments and defaulted; see chart 8. - Supporting postsecondary education

Obtaining postsecondary education remains an imperative for achieving economic opportunity—and for the nation's economic future. The expense of the COVID response and economic shutdowns hobbled state governments, shrank college endowments, and diminished the ability of individuals to afford tuition and fees. Additional support for college and university students and institutions will be essential in the coming years. See Pew research on how the pandemic could alter government higher education spending. There is also the question of how colleges might reopen in the fall.

The recovery will be a marathon, not a sprint

As of mid-June, much of the country is reopening businesses and some workers are returning to work. But it is clear that the economic recovery will be slow, and the country may experience setbacks as more people are infected with COVID-19 before vaccines and effective treatments are widely available. The long-term impacts on the workplace and work patterns could be transformative.

Bipartisan working majorities in the House and Senate powered the rapid and unprecedented responses to the Great Recession and COVID-19. Just as the consensus on responding to the Great Recession unraveled in 2009, the bipartisan approach to responding to the COVID-19 crisis is beginning to crumble. It will be further strained during the 2020 elections. After the election is over, elected leaders need to find a way to mitigate the economic depression brought about by an invisible enemy that will not disappear until we find the medical solutions to the disease and death it causes. If they fail to do so, the United States is condemned to repeat the policy shortcomings of the Great Recession. Only this time it could be far worse.

Jane Oates is president of WorkingNation. She was appointed by president Barack Obama and confirmed by the Senate as U.S. assistant secretary of labor from 2009 to 2013. As head of the U.S. Employment and Training Administration, she led the nation's federal/state unemployment and job training system.

Carl Van Horn is distinguished professor of public policy at Rutgers University and director of the Heldrich Center for Workforce Development at Rutgers. He is also a visiting scholar at the Federal Reserve Bank of Atlanta. He chaired the board of directors of the New Jersey Economic Development Authority from 2006 to 2010.

Appendix: Summary of Federal Responses to COVID-19 as of June 2020

_______________________________________

1 While second-quarter gross domestic product (GDP) numbers had not been released at the time of this writing, the U.S. Bureau of Economic Analysis estimated a 4.8 percent decline in GDP in the first quarter of 2020. The Atlanta Fed's GDPNow model estimated real GDP growth (seasonally adjusted annual rate) in the second quarter of 2020 as -48.5 percent on June 9, 2020.

2 Van Horn, Carl E. (2013). Working Scared or Not at All. Lanham, MD: Rowman & Littlefield Publishers.

3 NORC Center for Public Affairs Research (2020). "Economic Attitudes as the Country Starts to Reopen." May 14–18 Poll.

4 See, for example, Farrell, Diana, Fiona Greig, Chris Wheat, Max Liebeskind, Peter Ganong, Damon Jones, and Pascal Noel. (April 2020). "Racial Gaps in Financial Outcomes: Big Data Evidence." J.P. Morgan Chase & Co. Institute. Also see Parker, Kim, Juliana Menasce Horowitz, and Anna Brown. (April 21, 2020). "About Half of Lower-Income Americans Report Household Job or Wage Loss Due to COVID-19." Washington, DC: Pew Research Center.

5 See Holzer, Harry J. (April 2, 2020). "Planning Phase IV: What Do Workers Need Most?" The Hill.

6 See Van Horn, Carl. (April 27, 2020). "Put 1 Million Americans back to Work with Community Public Service Jobs." The Hill.

7 See Van Horn, Carl E. and Maria Heidkamp. (2019). "Difficult Adjustments: Older Workers and the Contemporary Labor Market," in Current and Emerging Trends in Aging and Work, edited by Sara J. Czaj. New York: Springer Publishing Company.