Federal Pandemic Unemployment Compensation and Wage Replacement Rates

Sarah Miller and Katherine Townsend

July 17, 2020

2020-08

https://doi.org/10.29338/wc2020-08

Download the full text of this paper (616 KB) ![]()

When coronavirus swept through the country in early March, the United States saw a public health crisis like no other in living memory. Shelter-in-place orders that were implemented to keep communities safe from coronavirus had another impact, a halt in most economic activity. Consumer spending dropped 6.9 percent in March year-over-year, falling to a 13.6 percent year-over-year decline in April. Personal income was down 2.2 percent in March, but, due to government programs such as increased unemployment insurance and the stimulus checks, up 10.5 percent in April, despite a record number of job losses. The CARES Act (signed into law on March 27, 2020) provided immediate relief to consumers and businesses to curb the economic impact of coronavirus shelter-in-place orders. The CARES Act was unique, providing quick financial relief and full-wage replacement for a significant portion of the dislocated workforce in the short term and stimulus checks to most Americans. As the July 31 expiration of many CARES Act policies approaches, it is imperative to know why the expanded unemployment provision policy was chosen and how its termination will affect workers.

Full-wage replacement from Federal Pandemic Unemployment Compensation (FPUC) provided immediate relief for families who were not able to find new jobs due to the public health crisis. FPUC is the portion of the CARES Act that provides an additional $600 weekly benefit to workers claiming unemployment through July 31. When Congress drafted FPUC, it intentionally decided an amount of extra unemployment compensation that would bring most workers to full-wage replacement.

Traditionally, unemployment compensation is used as a short-term aid to those who have lost their jobs. In the United States, unemployment compensation is not meant to provide full-wage replacement because it is assumed people will quickly return to work. During the COVID-19 crisis, the $600 per week enabled workers and their families pay bills, buy groceries, and keep money flowing in the economy. Unlike traditional unemployment insurance that provides an unsustainable wage, FPUC provided much needed relief to families and workers, as finding new jobs during the pandemic provided a different set of challenges due to broad stay-at-home orders and business closures.

The boost in unemployment relief was necessary for two reasons. The magnitude of job losses likely led to more than one income earner in a household losing their job, in which case the financial burden without FPUC would have been insurmountable.

The second reason was on the community level: by providing these families and workers the means to pay bills and buy food, other negative outcomes were avoided. As mentioned above, consumer spending fell in March and April, but personal income did not because of the CARES Act. Spending (and jobs) were affected by shelter-in-place orders, but unemployed workers were still able to contribute some amount to their local economy.1 Prior research has found only a 5 percent to 6 percent drop in spending at the onset of unemployment, specifically due to unemployment insurance benefits.2 Research by JP Morgan Chase found that without unemployment benefits, a household would see a 19 percent drop in spending. The research also found that high-benefit states saw even smaller declines in spending than in states with lower benefits. The combined impact of job losses, shelter-in-place orders, and unintended wait times for unemployment compensation would have created an even steeper decline in spending for March and April.

What is wage replacement?

The rate of wage replacement measures the proportion of previously earned income to the level of insurance benefits, including disability insurance and, in this case, unemployment insurance. Full-wage replacement occurs when 100 percent of a person's wages is covered by unemployment insurance compensation.

Historically, significantly expanded unemployment insurance compensation levels have been seen as a disincentive for workers to seek new employment. For instance, if workers are receiving full-wage replacement through unemployment compensation, they might be more selective about what positions they choose to pursue or have a smaller incentive to find a new job quickly. From the perspective of state budgeting, full-wage replacement can be expensive to maintain, especially since states have balanced budget requirements (that is, debt use by states is limited).

If full-wage replacement were completely detrimental to workers and their communities, why is it ever considered? There are a number of reasons that, even with full-wage replacement, a worker would rather find a new job than stay on unemployment. Unemployment has a time limit, does not offer health insurance, and can potentially cause negative mental health if unemployment endures for weeks. Full-wage replacement allows job seekers to be more selective. In these cases, job seekers can wait for jobs that are a better match for their skill sets. It also allows job seekers and their families to secure jobs with better benefits or higher wages.3 When families have this option, they spend a longer time in their new jobs than when they are required to take the first available position. High-wage replacement in a crisis provides a different benefit: relief.

National snapshot of unemployment benefits

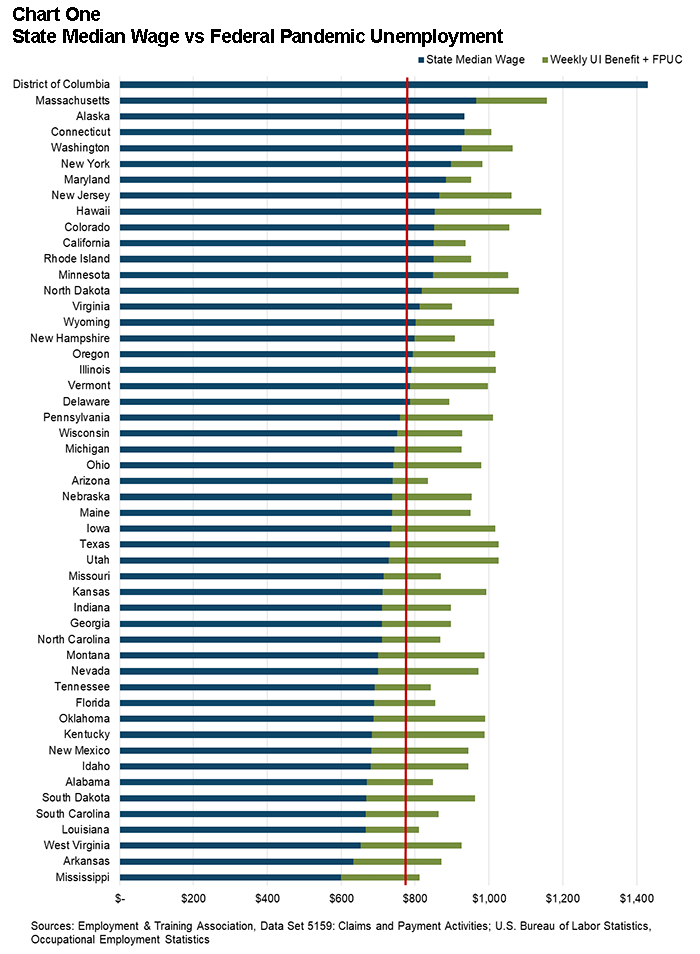

The weekly median benefit amount in March 2020 (without FPUC) replaced 46 percent of weekly wages (when compared with the state median weekly wage). On the low end of the spectrum was Washington, DC, and Alaska, which both have higher state median wages. Other states with low replacement rates were Louisiana, Arizona, and Tennessee; the median wage in these states is relatively low compared with the national average ($774 per week). Hawaii has the highest replacement wage under regular unemployment policy, with the median unemployment benefit accounting for 58.5 percent of the state's median wage.

After the $600 from FPUC is considered, nearly every state has a wage higher than the median (see chart 1). Despite the additional $600 infusion, Alaska (93.5 percent wage replaced) and Washington, DC (67.6 percent replacement), still fall short. Other states that had a low wage replacement rate before FPUC achieved wage replacement rates from 113 percent to 122 percent.

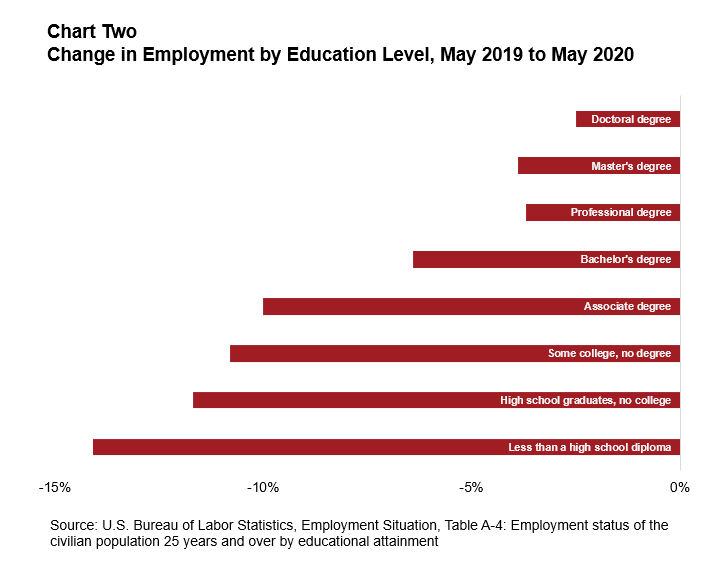

Workers who have earned less than a bachelor's degree are more vulnerable to shocks in the economy that lead to unemployment. Historically, unemployment rates are higher for those without a bachelor's degree (at least 12.4 percent in May 2020, compared with 8.4 percent or lower for those with a bachelor's degree or higher). Further, jobs lost have disproportionately affected less educated and moderately educated workers. Chart 2 shows the difference between May 2019's unemployment rate and May 2020's rate by education attainment. Compared to last year, the unemployment rate for workers with no degree has increased over 10 percent.

Opportunities for growth: Center for Workforce and Economic Opportunity data tools

In addition to workers being more vulnerable to unemployment, the jobs available to those without a bachelor's degree often pay less than an area's median wage. The Atlanta Fed's Center for Workforce and Economic Opportunity's Opportunity Occupations Monitor shows careers that require less than a bachelor's degree and provide a wage above the national median wage (state adjusted). These career paths are important steps that lead to family-sustaining wages, job stability, and increased wealth.

There are 443 occupations that do not require a bachelor's degree and provide wages above $39,810 (the national median wage). The median wage is adjusted by state; for instance, in California the adjusted median wage is $45,941. In Kentucky, the adjusted wage is $34,953. The difference represents cost of living in each state and ensures the comparisons between states are fair. For the purposes of this analysis, we looked at an even higher income. Using the median unemployment benefit per week in April plus the $600 provided by FPUC, we determined how many of the occupations still earned higher wages.

There are many jobs that earn higher wages regardless of their location. In health care, jobs such as dental hygienists, MRI or radiology technicians, and respiratory therapists earn above-average wages in more than 45 states. Many mechanics (industrial machinery, aircraft, electrical, and electronic) can find careers with sustainable wages. In construction, telecommunications and power line installations are fields with high wages. According to the U.S. Bureau of Labor Statistics' growth projections, many of these careers are also positioned for growth in the next decade (see the table).

These opportunity occupations offer a reasonable and short pathway to reemployment at wages that pay at comparable rates to the expanded unemployment insurance payments. The occupations require less than a bachelor's degree and, in many cases, require only short-term industry-recognized training that could be pursued while someone is still claiming unemployment.

Growth Rate of National Opportunity Occupations

| Occupation | BLS Growth Projection |

| Respiratory therapist | 20.8% |

| Magnetic resonance imaging technologist | 10.9% |

| Dental hygienist | 10.8% |

| Radiologist technologist and technician | 9.0% |

| Electrical power line installer and repairer | 8.0% |

| Industrial machinery mechanic | 5.1% |

| Aircraft mechanic and service technician | 3.1% |

| Telecomm equipment installer and repairer | -5.6% |

Source: U.S. Bureau of Labor Statistics (BLS) Current Employment Statistics; Table 2.1 Employment by Major Industry Sector

Policy recommendations

As July 31 approaches, an extension of the benefits would help to close the spending gap and keep businesses operating and families housed. Without continued support from Congress, the 17 million unemployed workers would fall far short of full-wage replacement. With many provisions in the CARES Act set to expire simultaneously, families and workers would lose full-wage replacement while also seeing the moratorium on rent and mortgage payments end. While these programs have thus far propped up the economy, without them, other social safety net services such as the Supplemental Nutrition Assistance Program (SNAP) and Temporary Assistance for Needy Families (TANF) would come under stress with increased utilization.

When the CARES Act, including FPUC, was passed, there was hope that coronavirus would cause only a short-term public health emergency. Since March 21, nearly 45 million new people have filed for unemployment insurance (through June 27, 2020). While the economy saw jobs added in May, the recent spike in COVID-19 cases in many states may reverse some of that economic rebound. Recently, Chair Jerome Powell spoke to Congress to reiterate the need for further legislative action to curb the economic impact of lost jobs in travel, accommodation, and other industries that will not return to normal soon.

However, since the full $600 weekly payment is costly and will not necessarily provide long-term wage increases, different structures could extend the time benefits of the program by beginning to taper off benefits to relieve funding pressures while still ensuring that families' needs are met. For instance, $400 per week would provide 99 percent wage replacement on average; excluding Alaska and the District of Columbia, each state would have at least 85 percent wage replacement. Alternative models of FPUC would have trade-offs between government costs and benefits to workers and the economy, just as the current construction of the FPUC does.

The Congressional Budget Office (CBO) performed a cost-benefit analysis on the extension of FPUC. The CBO's projection was that there would be increased consumption and demand for goods in the second half of 2020, while still predicting lower employment through the end of the year. However, the CBO also reports that the extension of FPUC at $600 would decrease consumption in 2021, as workers would likely stay unemployed for longer. Research from Nekoei and Weber is consistent with the CBO findings, suggesting that extending unemployment does, in fact, lead to longer spells of unemployment.3 However, the authors also determine that when job seekers have the option for extended unemployment, they secure jobs with higher wages and maintain those positions.

The following modifications could be considered as a way to build a bridge from unemployment to reemployment.

Phasing out unemployment benefits

Any further provision or expansion of traditional unemployment should consider how the benefits expire. Rather than an abrupt end to the benefits, a gradual decline would aid in personal financial planning, incentivize finding a position quickly, and continue to provide consumption smoothing benefits. The CARES Act is not the only program that should consider the benefits cliff. Considering the effect of sudden expiration for all social benefits would magnify the impact of existing programs.

Increase income-disregard maximums

In many states, the amount of wages a claimant can receive and still be eligible for unemployment insurance (the income that is disregarded as a part of the weekly benefit calculation per person) varies greatly, and in many cases, is no more than $50 per week. Georgia recently passed SB 408, which extended the number of eligible weeks for unemployment insurance and increased workers' income-disregard levels to $300 per week, allowing them to find part-time work to supplement up to 50 percent of the income they will be set to lose when the FPUC expires at the end of July.

Support skill development while workers claim unemployment insurance

As dislocated workers are receiving their unemployment insurance payments, the workforce system and other intermediaries could advocate for skill development in occupations that pay a wage above the FPUC threshold. See the opportunity occupations detail for each U.S. state and metropolitan statistical area on the Opportunity Occupations Monitor. See also recent research by the Philadelphia and Cleveland Feds on skills-based mobility within these occupations. Consider how skills developed in previous roles can connect to new opportunities, and use recent research by Burning Glass Technologies about "lifeboat" jobs as a way to put workers on a longer career pathway.

With the extended compensation set to expire at the end of July, many Americans will be left with limited ability to meet their basic financial needs. Without federal intervention, states and regions can work to modify their current policies and build bridges that lead to higher skills and higher-quality career pathways. Use the Unemployment Claims Monitor to track your state's unemployment claims. The tool shows what sectors or demographic groups have claims continuing or tracking to reemployment. Using this information can show possible career pathways that workforce agencies can use as guidance to provide targeted skill development for those who will need unemployment insurance beyond the FPUC expiration.

Sarah Miller is a senior adviser and Katherine Townsend is a research analyst I, both at the Center for Workforce and Economic Opportunity.

_______________________________________

1 Gruber, Jonathan. (1997). "The Consumption Smoothing Benefits of Unemployment Insurance." American Economic Review 87(1): 192–205.

2 Ganong, Peter and Pascal Noel. (2019). "Consumer Spending during Unemployment: Positive and Normative Implications." American Economic Review 109(7): 2383–2424.

3 Nekoei, Arash and Andrea Weber. (2017). "Does Extending Unemployment Benefits Improve Job Quality?" American Economic Review 107(2): 527–561.