The Policy Rules Database is a repository that allows for research on public assistance programs and tax policies and helps users model benefits cliffs that might arise on career pathways.

Public assistance programs and tax credits that support workforce participation in the United States are comprised of a patchwork of policies administered at the federal, state, and local levels, each with their own unique structures and terminology. The PRD simplifies the interpretation of public assistance programs by creating a common structure and a common terminology. It culls eligibility information into one simple-to-use database and boils the complex program design down to a common set of logical or numeric fields.

Public Assistance Programs Included in the Policy Rules Database

Child Care and Development Fund Subsidies (CCDF), Head Start, Health Insurance Marketplace Subsidies, Housing Choice Voucher Program (Section 8), Low Income Energy Assistance Program (LIHEAP), Medicaid/Children's Health Insurance Program (CHIP), National School Breakfast and Lunch Programs (NSBP & NSLP), Social Security Disability Insurance (SSDI), State-Funded Pre-Kindergarten, Supplemental Nutrition Assistance Program (SNAP), Supplemental Security Income (SSI), Temporary Assistance for Needy Families (TANF), Women, Infants and Children Nutrition Program (WIC)

Availability of program rules varies by state and year.

Taxes and Tax Credits Included in the Policy Rules Database

Federal personal income tax, state personal income tax, Federal Insurance Contribution Tax Act (FICA), federal Earned Income Tax Credit (EITC), state Earned Income Tax Credit (EITC), federal Child Tax Credit (CTC), state Child Tax Credit (CTC), federal Child and Dependent Care Tax Credit (CDCTC), state Child and Dependent Care Tax Credit

Download the Policy Rules Database Technical Manual ![]()

Access the Policy Rules Database on GitHub.

Benefits Cliffs across the United States

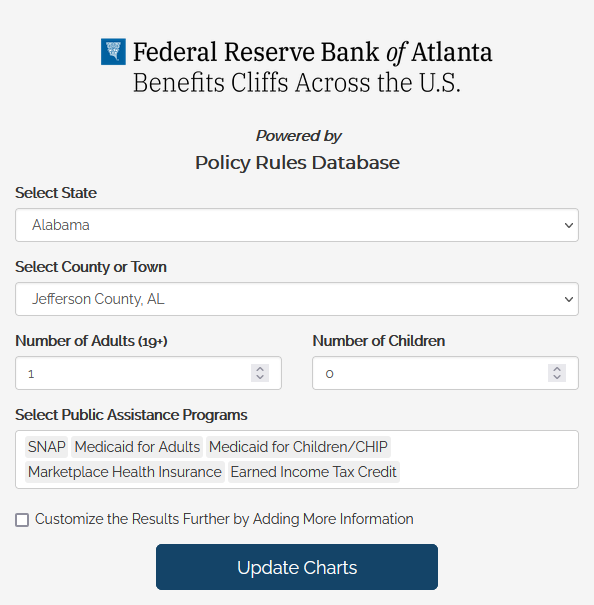

To simplify the task of visualizing and understanding the US social safety net, we have created the Policy Rules Database (PRD) Dashboard, a simple-to-use visualization tool that shows how existing public assistance programs and tax credits come together to support families in any location in the United States.

The PRD Dashboard demonstrates how the dollar value and composition of public assistance changes with increases in income. It can be used to identify when wage gains make a family worse off or no better off financially than before the wage increase. Using dropdown menus, users can select any public assistance program, location, and family type and visualize how benefits value changes with income.

See this article for an example of how to use the PRD Dashboard.

Partnerships

The Policy Rules Database is the result of a collaborative effort between the Federal Reserve Bank of Atlanta and the National Center for Children in Poverty. The minimum household budget used here reflects the lowest cost of household basics necessary to live and work in the modern economy and is based on our partnership with United for ALICE. ALICE® stands for asset limited, income constrained, employed and includes households that struggle to afford basic expenses despite having earnings that exceed the federal poverty level.