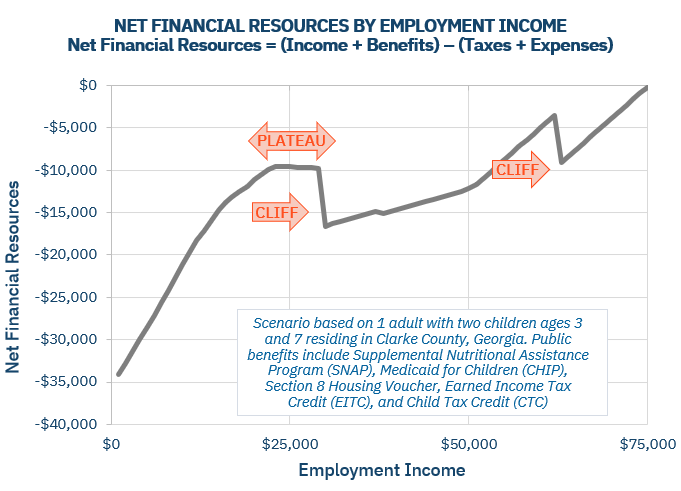

Working families experience a variety of financial barriers that limit economic mobility. One significant barrier occurs when career advancement puts a family above the income-eligibility threshold for public assistance programs. Due to the gradual or sudden loss of these programs, career advancement may result in a family being financially worse off (a benefits cliff) or no better off (a benefits plateau) than before the wage increase.

Source: Atlanta Fed’s Policy Rules Database Dashboard

The chart above demonstrates an example of benefits cliffs for a hypothetical single mother with two children who lives in Clarke County, Georgia. As employment income increases (left to right on the horizontal axis), benefits phase out before disappearing completely at various income eligibility thresholds. While some phaseouts are gradual, others are rather sudden and can result in a large drop in net resources (income plus benefits minus taxes and expenses).

You can explore potential benefits cliffs in other communities in the United States with the PRD Dashboard. To learn more about the calculations behind this chart, please visit the Policy Rules Database page.

Benefits Cliffs and Career Advancement

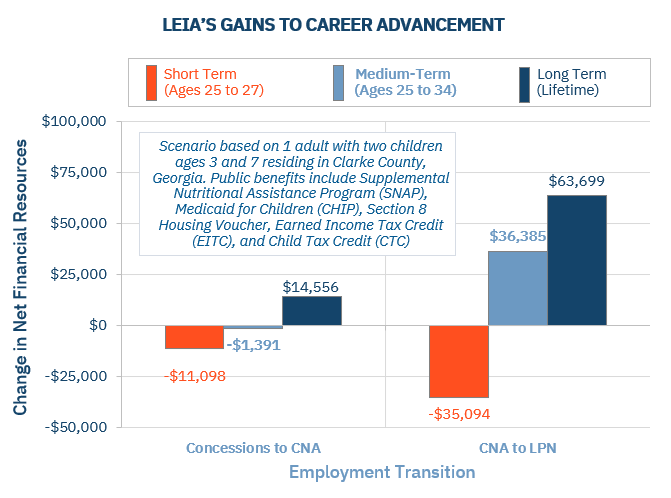

A key part of the Advancing Careers initiative is to understand how benefits cliffs interact with workforce development career pathways. Will the income gains associated with a higher-paying career outweigh the loss of public assistance in the short term, medium term, and long term? Or will benefits cliffs create financial barriers that inhibit economic mobility?

The following story helps illustrate the answer to these questions for a Leia, a hypothetical mother of two children living in Clarke County, Georgia. She works a near-minimum-wage job as a concessions worker at a theater. Leia receives a variety of public assistance because her employment income alone is not enough to meet basic family expenses such as food, housing, childcare, and health insurance. Leia, however, is interested in becoming a nurse. She knows she would thrive in the role and a nursing career might allow her to earn more money to support her family without having to rely on public assistance. When she begins researching careers in health care, she asks herself, “Will this higher-paying job actually make me and my family better off financially?”

Watch the video below to learn more about Leia's story and benefits cliffs.

Leia is considering a health care career path in which she would start as a certified nursing assistant (CNA) before progressing to a licensed practical nurse (LPN), and then becoming a registered nurse. For the concession worker to CNA and CNA to LPN transitions, the chart below shows the short-term, medium-term, and long-term incremental gains in annual net resources (Net resources is the value of income and benefits less taxes and expenses).

In both transitions, benefits cliffs create significant barriers to long-term economic self-sufficiency. During the initial three years after transitioning from a concessions worker to a CNA, for example, Leia’s cumulatively experiences a decline of more than $11,000. The negative short-term financial implications of the CNA-to-LPN transition are even starker—Leia would suffer a loss of net financial resources exceeding $35,000 during the first three years of the transition. These declines are the results of reduced work hours while in school and the prevalence of benefits cliffs. When resources are calculated over a lifetime, however, both scenarios would deliver a positive return to Leia. By providing a line of sight into the financial implications of pursuing specific career pathways, the CLIFF suite of tools can help inform mitigation strategies that allow Leia to realize her career goals while simultaneously reducing government dependence.

Source: Atlanta Fed’s Policy Rules Database Dashboard