The Cyclical Recovery

The Cyclical RecoveryIn the complex U.S. economy, trends do not often fit cleanly into categories such as cyclical and secular. Broadly speaking, though, it is possible to classify certain developments as mainly cyclical and others as more persistent, or secular.

As the video explained, we have experienced a cyclical economic recovery. Let's delve deeper into cyclical elements of the economy that have, by and large, rebounded.

Macroeconomy

Annual GDP growth is a sort of speedometer for the nation's economy.

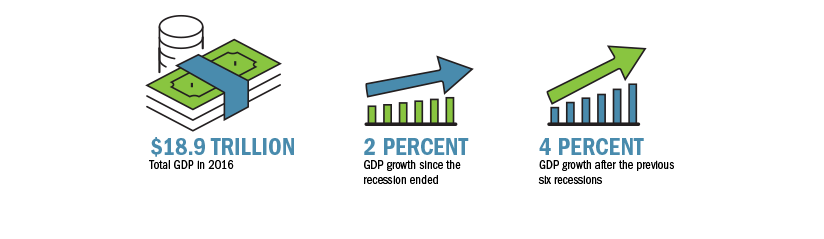

Start with the broadest gauge of the nation's entire economy. Gross domestic product, or GDP, is a monetary measure of the value of all final goods and services produced. In 2016, GDP in the United States totaled roughly $18.9 trillion, according to the U.S. Bureau of Economic Analysis. Another important macroeconomic indicator is inflation, which has been below the central bank's 2 percent target throughout the recovery.

Congress established the Federal Reserve's monetary policy objectives of maximum employment and stable prices in the Federal Reserve Act. These legislated objectives are often referred to as the "dual mandate."

Note that in charts, gray bars indicate recessions.

Labor Market

The labor market: More of us are working than ever.

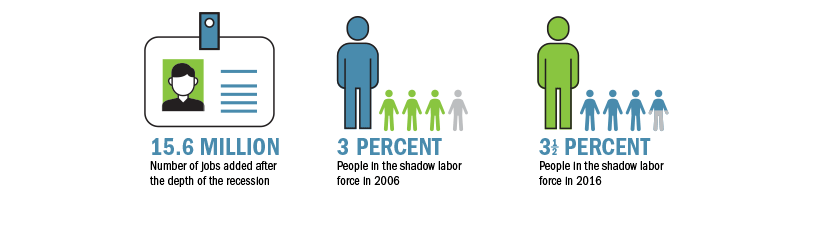

Businesses have been hiring at a solid pace despite tepid growth in output. Consequently, aggregate employment has staged a reasonably robust cyclical recovery from a bruising downturn.

Note that in charts, gray bars indicate recessions.

Consumer Finances

Consumers' finances are much healthier.

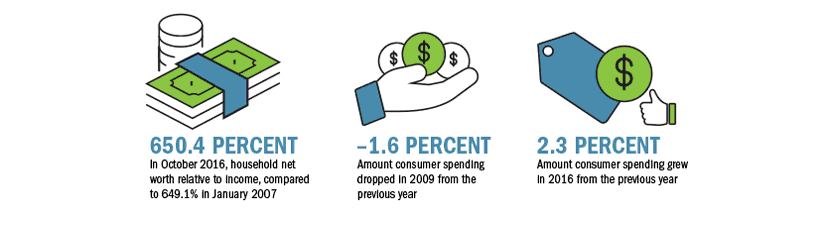

Consumer spending is the largest single component of GDP, so the health of the consumer sector is crucial to the health of the overall economy. Several broad measures of consumers' financial well-being and spending describe a cyclical recovery.

Note that in charts, gray bars indicate recessions.

Housing

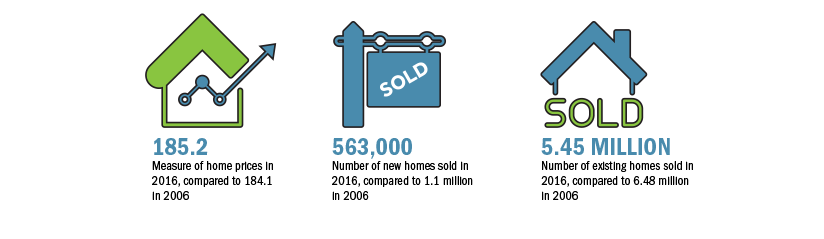

The residential real estate market is vital to the economy, even though new residential construction accounts for only about 3 percent of GDP. For homeowners, purchasing a home is usually their largest single financial transaction, and their homes may become their most valuable holding. In fact, residential real estate accounts for about 70 percent of the value of all household nonfinancial assets. The real estate sector also supports hundreds of thousands of construction jobs, as well as employment for those selling homes, making home loans, and producing and selling housing-related goods and services.

Note that in charts, gray bars indicate recessions.

Monetary Policy

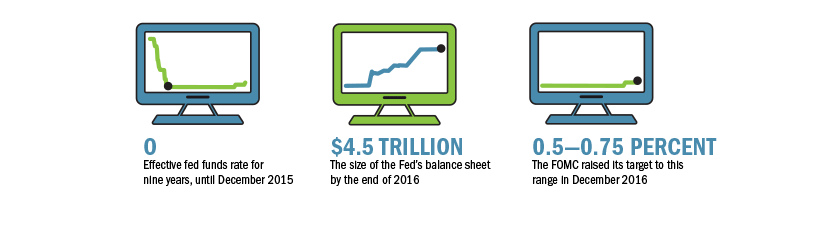

Monetary PolicyMonetary policy was the primary public policy tool deployed during much of the recovery, and it likely supported the cyclical rebound. Even though the economy has returned to a healthier state, by historical standards, monetary policy remains accommodative—interest rates are low. That's largely because of the secular factors restraining the recovery.

Note that in charts, gray bars indicate recessions.

Secular Trends

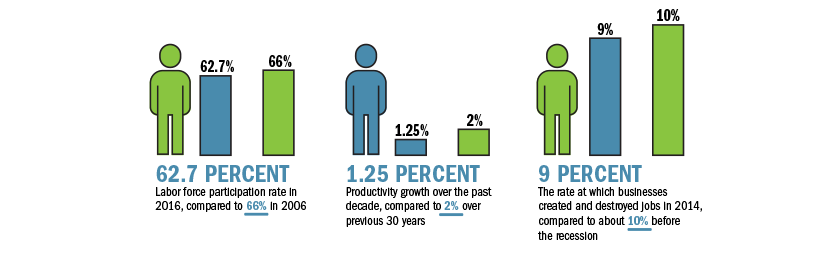

Secular TrendsBeneath the cyclical healing lie stubborn forces that have not been much influenced by monetary policy, and probably won't be. Addressing these issues is likely up to federal and state legislative bodies, along with the private sector.

Note that in charts, gray bars indicate recessions.

Headwinds

HeadwindsUnexpected headwinds keep interfering with steady growth.

Unpredictable events can sow uncertainty that can restrict hiring and capital spending. Events that generate policy uncertainty "foreshadow declines in investment, output, and employment," economists Scott R. Baker, Nicholas Bloom, and Steven J. Davis write in a March 2016 paper. That trio maintains an index measuring economic policy uncertainty.

Of course, unpredicted events didn't start in the past decade. But the index of policy uncertainty has drifted upward since the 1960s, Baker, Bloom, and Davis write. And since 2007, policymakers have faced seemingly unrelenting waves of uncertainty. Consequently, says Dennis Lockhart, Atlanta Fed president from early 2007 until the end of February 2017, "It's very difficult, in real time, to know exactly where the economy is."

Note that in charts, gray bars indicate recessions.

A windy decade

An extraordinary increase in house prices and mortgage debt partially set the stage for the financial crisis. From 1998 to 2006, average U.S. home prices more than doubled, while home mortgage debt rose from the equivalent of 61 percent of GDP to 97 percent of GDP.

Scroll through the decade-long timeline to view some of the unexpected events that likely influenced the economic recovery.

JULY 2007

Bear Stearns liquidates mortgage-backed securities hedge funds

AUGUST 2007

Interbank credit markets freeze

OCTOBER 2007

Citigroup writes down subprime mortgage losses

FEBRUARY 2008

Economic Stimulus Act signed

MARCH 2008

Bear Stearns collapses, bought by JPMorgan Chase

SEPTEMBER 2008

Fannie Mae, Freddie Mac go into government conservatorship

SEPTEMBER 2008

Lehman Brothers collapses; largest bankruptcy in U.S. history

SEPTEMBER 2008

AIG Group accepts $85 billion federal loan

DECEMBER 2008

FOMC cuts fed funds rate target to 0–0.25%

JANUARY 2009

FOMC says Fed will buy long-term Treasury securities

FEBRUARY 2009

President Obama signs $787 billion stimulus package

OCTOBER 2009

Unemployment peaks at 10%

LATE 2009

European debt crisis intensifies

MARCH 2010

Affordable Care Act becomes law

APRIL 2010

Greek debt crisis deepens

JULY 2010

Dodd-Frank Wall Street Reform and Consumer Protection Act was signed into federal law

DECEMBER 2010

Congress approves $860 billion tax cut, extended unemployment insurance

JANUARY 2011

Arab Spring protests spread

MARCH 2011

Massive earthquake, tsunami in Japan

JULY 2011

Debt ceiling crisis threatens U.S. government debt default

AUGUST 2011

Budget Control Act avoids default, brings big cuts

DECEMBER 2011

China's economic growth slowed through 2011

OCTOBER 2012

Superstorm Sandy strikes New Jersey, New York; second costliest U.S. hurricane ever

NOVEMBER 2012

Euro zone economy falls back into recession

DECEMBER 2012

U.S. government approaches "fiscal cliff"

MARCH 2013

Automatic spending cuts begin (sequestration)

JULY 2013

Detroit files nation's largest public sector bankruptcy

OCTOBER 2013

U.S. government shuts down for 16 days

OCTOBER 2013

Affordable Care Act goes live

DECEMBER 2013

Fed begins reducing asset purchases

JULY 2014

Crude oil prices fall sharply

AUGUST 2014

Police shootings, demonstrations roil U.S.

OCTOBER 2014

Fed announces end of quantitative easing

AUGUST 2015

Worries about Chinese economy send Dow down over 1,000 points in a day

NOVEMBER 2015

Terrorists carry out attack in Paris

DECEMBER 2015

FOMC raises rate target to 0.25–0.50%

JUNE 2016

United Kingdom votes to leave European Union

NOVEMBER 2016

Bitter U.S. presidential election