By broad measures such as the unemployment rate and payroll job growth, American labor markets are robust. Yet deeper currents threaten the financial stability of millions of U.S. households.

In general, those challenges are most acutely felt by those born in low-income communities, minorities, and people with less education. So that is where workforce development efforts by the Atlanta Fed and the Federal Reserve System are focused.

Even in our broadly healthy labor market, there is evidence of persistent disparities. For example, the threat of automation eliminating jobs is far more ominous for those with less education. Two-thirds of jobs that require less than a high school diploma and half of jobs requiring a high school diploma can be automated, according to a study Susan Lund of the McKinsey Global Institute presented at an August conference hosted by the Atlanta Fed’s Center for Workforce and Economic Opportunity. By comparison, only one-fifth of jobs requiring a bachelor's degree or higher are "automatable."

That reality has clear consequences for the U.S. workforce: 41 percent have a high school diploma or less, and only 46 percent of students in the United States who start college earn a degree, according to the U.S. Census Bureau.

Other labor market disparities are linked to race. For decades, the unemployment rate of African Americans has been nearly double the national unemployment rate, with little indication that the relative difference is narrowing or that it can be fully explained by differences in education or sectoral mix of jobs, according to research by Federal Reserve economists.

"The persistently higher unemployment rates in lower-income and minority communities show why workforce development is so essential," former Fed chair Janet Yellen said in a March 2017 speech.

She pointed out that unemployment rates averaged 13 percent in low- and moderate-income communities from 2011 through 2015, compared with 7.3 percent in higher-income communities.

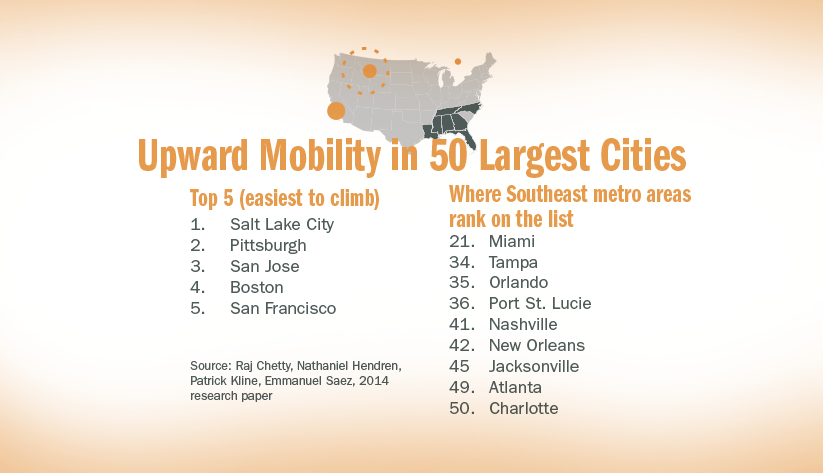

Even booming Southeast metropolitan areas offer dramatically uneven economic opportunity. Some of the region's most vibrant economic hubs, such as the metro areas of Atlanta and Nashville, are also among the most difficult places in the country for people born in poverty to move up the socioeconomic scale, according to research by economist Raj Chetty and others.

Labor market trends are likely exacerbating the disparities in economic mobility. As Atlanta Fed president Raphael Bostic noted in an October speech, evidence from the latest Federal Reserve Board of Governors' Survey of Household Economics and Decision making suggests that increasingly unpredictable and intermittent incomes can lead to financial stresses. In the survey, 40 percent of American households headed by someone with a high school diploma or less education reported they are struggling financially.

The Atlanta Fed's Center for Workforce and Economic Opportunity and the workforce development community broadly are focused on improving the job readiness and opportunities—and therefore the financial stability and resilience—of people who have been left behind in a generally strong labor market, explained Stuart Andreason, the center's director.