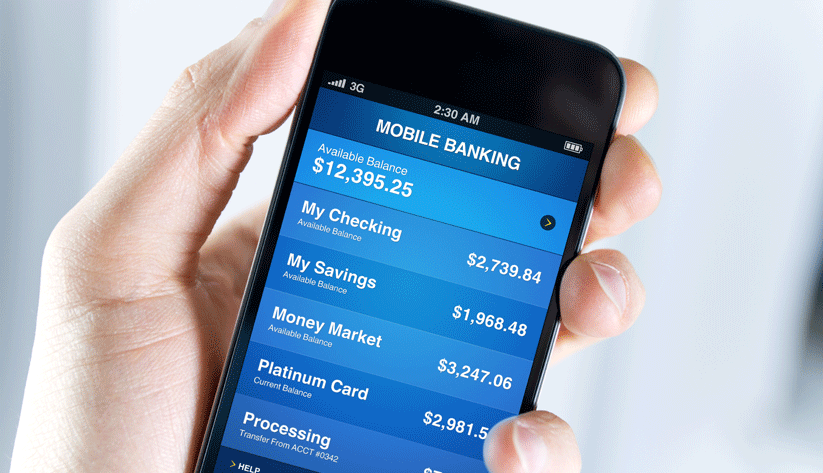

Consumers are increasingly using their mobile phones to conduct their banking, whether checking an account balance, transferring funds, depositing a check, or making a payment.

To assess the state of mobile banking, banks in the Federal Reserve System periodically survey financial institutions in their districts about their service offerings and customer adoption. Last year, eight reserve banks—including the Atlanta Fed—collaborated on the third Mobile Financial Services Survey, which follows previous ones in 2014 and 2016.

The latest survey found that mobile banking services are nearing ubiquity, with 91 percent of respondents currently offering them and an additional 5 percent planning to do so over the next two years. In total, 504 institutions, including 167 credit unions, took the survey. The banks and credit unions that responded mainly had less than $500 million in assets.

Dave Lott, payments risk expert in the Atlanta Fed's Retail Payments Risk Forum, led the survey effort for the Sixth District. "While the drivers of new banking products and services are the larger institutions, I think it is extremely valuable to understand how the midsize and small financial institutions are reacting to this competitive pressure," he said. "The survey validates previous studies that mobile banking has essentially become a utility product, although financial institutions are differentiating their product with additional features such as remote deposit capture and customer alert notifications. On the other hand, making payments with a mobile device has been slower to gain traction for a variety of reasons, so it was interesting to see the increases in enrollment and usage by these financial institutions from the 2016 survey."

The 2019 study yielded national results that were broken down by Federal Reserve district. The data below show how banks and credit unions in the Atlanta Fed's coverage area—which includes Georgia, Alabama, Florida, and parts of Mississippi, Louisiana, and Tennessee—responded to certain questions. Roughly 85 institutions from the Atlanta Fed's district participated.