Special Report on the Affordable Housing Crisis

"The instability that arises when we have a lack of affordable housing—it's a hit to our economic potential in a very direct way."

Raphael Bostic, president and CEO, Federal Reserve Bank of Atlanta

A home is not just a place to lay your head at night. For many, it's a sanctuary, an anchor, a sign of permanency and strength. A way to build wealth for owners.

Across the Southeast, many individuals are struggling to find and afford a place they can call home. A 2018 discussion paper from the Federal Reserve Bank of Atlanta and the Shimberg Center for Housing Studies at the University of Florida reports that about three million renter households in the Atlanta Fed's district, or 47 percent, are housing-cost-burdened, based on U.S. Census Bureau data. (Households that are cost-burdened devote more than 30 percent of their income to housing.) The paper includes both rural renter households and those in urban areas.

Among low-income renter households, the figure is much more significant. More than two-thirds, or 69 percent, are cost burdened, the paper indicates. It cites a shortage of more than 1.2 million units of affordable housing for people who earn 50 percent or less of the median income in the Atlanta Fed's district, which includes the states of Alabama, Georgia, and Florida, and parts of Louisiana, Mississippi, and Tennessee. (See the chart to learn the percentages of cost-burdened households in the four most and four least-cost-burdened areas in each state in the district.)

Having stable housing is important not only because shelter is a basic need, but also because it affects other aspects of one's life. "Housing is fundamental to everything," said Marguerite Oestreicher, executive director at the New Orleans area Habitat for Humanity. Those other aspects include the ability to access a job, educational opportunities, and physical and mental health. If any of these is out of kilter, people's ability to improve their financial standing and operate at their potential is impaired.

"The lack of affordable housing is a constraint on people's ability to get more economic mobility, when we think about mobility as moving from a certain level of economic comfort to a higher one," said Atlanta Fed president Raphael Bostic.

Affordability issue has many faces

Throughout the six states that make up the Sixth Federal Reserve District, housing is becoming more difficult to afford, for renters and buyers alike. No area—big city or small town, urban or rural—seems to be immune to the affordable housing crisis.

"I did not know when I went to Knoxville, Tennessee, that I was going to hear complaints about affordable housing," Bostic said. The affordability issue can look different depending on location, but it's a consistent theme around the Southeast, he added.

In New Orleans, redevelopment is driving up property values, forcing many longtime residents to leave. In rural areas, the condition of housing can be a problem.

In Orlando, Florida, the problem is the "missing middle" of housing, said Mitchell Glasser, manager of Housing and Community Development for Orange County. The single-family homes and expensive apartments springing up in the county are beyond the reach of working class people who are primarily employed in the city's dominant lower-wage tourism jobs, he said.

"We need to diversify our housing stock and build more inclusive housing that has different sizes and different price points," Glasser said. "People are stressed with how expensive the rental market has become."

Partnerships with promise part 1: Hope in the Deep South

Hope Enterprise Corporation/Hope Credit Union (HOPE), a community development financial institution, has helped make the American Dream a reality for lower-income residents in a five-state region that includes Louisiana, Mississippi, Alabama, Tennessee, and Arkansas. Eighteen years ago, it launched a mortgage program and within a few years began offering affordable mortgages with no down payments and flexible underwriting terms to residents who typically do not pass traditional automated underwriting screening systems.

The company, which expanded its lending approach to deepen its impact in low-income communities, decided to underwrite its own mortgage product to serve customers whom it deemed as good risks but might have some small dings on their credit reports.

"There were a lot of what we thought were good loans that couldn't get through the underwriting process," said Phil Eide, HOPE senior vice president of community and economic development. "But what we knew from looking at the file was that applicants paid their rent on time each month for years and their mortgage payment would be the same or lower."

Most of HOPE's mortgage borrowers are people of color and first-time home buyers, and the loans tend to be small, lower than $100,000 on average, the company said. But they are profitable, with losses on that mortgage portfolio less than one-half of one percent, Eide said.

The company has found financial inclusion to be a recipe for success. HOPE works with consumers over time to help them improve their credit profiles so they can purchase homes. Since the recession, the company has markedly increased its lending to black consumers, comprising four out of five mortgage loans closed in 2018, while its median loan size has grown and charge-off rates have fallen, said Ed Sivak, executive vice president and chief policy and communications officer. "There is strong demand for that product," he added.

Recession's shadow lingers

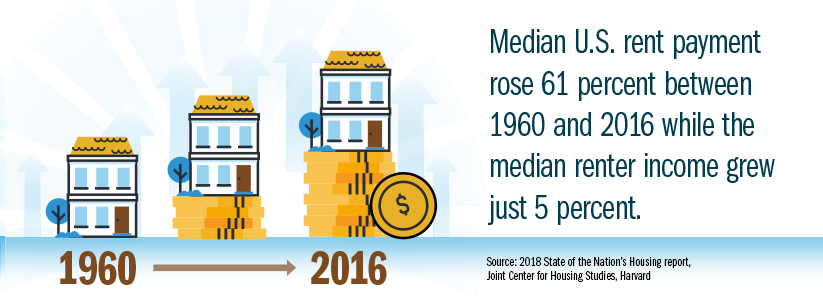

Effects of recession and modest wage growth limit the housing options for many people. As the economy has recovered, rents have skyrocketed and home prices have risen (see the chart), but pay increases aren't keeping pace. Adjusting for inflation, the median U.S. rent payment rose 61 percent between 1960 and 2016, while the median renter income grew just 5 percent, according to the State of the Nation's Housing 2018 report from Harvard University's Joint Center for Housing Studies. The pattern for homeowners is similar during that time frame, with the U.S. median home value climbing 112 percent and median owner income rising only 50 percent, the report shows.

"Over the past 30 years, wage growth has been stagnant overall, and housing costs, education costs, automotive costs have all increased at a faster rate than incomes," said Domonic Purviance, a senior financial specialist in the Supervision, Regulation, and Credit Division at the Atlanta Fed.

The Great Recession left the housing industry on unstable footing in a number of ways. It dealt a blow to the home construction industry and forced many smaller companies out of business. Home building came back, but production has not kept up with demand and builders have become more selective in what they build. (See the chart for an illustration of how the recession affected home building.) Now, increased labor costs and other fees, regulatory hurdles, and difficulty in securing land all have made constructing homes more expensive. "Very few (big) markets in our district are able to deliver new-home product below $300,000," Purviance said.

At the same time, millions of Americans who lost their homes in the foreclosure crisis spilled over into the rental market, which drove rents up. In Louisiana and Tennessee, for instance, the median rent including utilities for an apartment was $840 and $830 a month, respectively, in 2017, up 10 percent in both states since 2001, according to the Center on Budget and Policy Priorities. Cities such as Nashville and Atlanta are losing more than a thousand units each year that rent for $750 a month or less, according to a 2016 Atlanta Fed paper.

Partnerships with promise part 2: The shared home

Housing developer Atticus LeBlanc is looking to meet the demand for housing among working people in Atlanta. Two years ago, he launched PadSplit, a rooming house model set up as a public benefit corporation. The company works with owners of single-family homes, dividing the houses into rooms with a shared bath and common area that are rented out.

"The demand is unquestionably there," LeBlanc said. About 31,000 people have signed up for the service, which to date includes about 385 rooms, he said.

LeBlanc said the PadSplit model works for price-sensitive customers, people for whom a change in price of even $100 makes a difference. The majority of PadSplit members earn below $35,000 a year in income, he said. The furnished houses are located near transit and rent for $500 a month and up, collected in weekly payments that include costs for water and utilities.

"To the extent that you can combine lifestyle costs into a simple payment that happens with greater frequency, you can take a very high credit risk population and remove a fair amount of that risk," LeBlanc said.

Most vulnerable hurt most

Low- and moderate-income residents, some of whom depend on public subsidies for shelter, are bearing the brunt of the affordable housing crunch. For example, the state of Florida has just 22 affordable and available housing units for every 100 extremely low-income tenants (those who earn at or below 30 percent of the area median income), the Atlanta Fed study found.

Funding cuts are hampering many of the programs that have historically provided resources to build or preserve affordable housing, a 2018 report on rural affordable housing from the Federal Reserve Board explained.

"There is tremendous demand for housing that far exceeds our ability to deliver," said Oestreicher, the Habitat for Humanity executive director in New Orleans. The waiting list for Section 8 vouchers, she said, exceeds 20,000. About 50 percent of all renter households in the New Orleans metropolitan area are cost burdened, according to the Atlanta Fed report. "You have a lot of people who are literally one paycheck away from being on the streets," Oestreicher added.

What's more, there are signs that affordable lodging is set to dwindle even more as U.S. tax credits expire. The National Low Income Housing Coalition stated in an October 2018 report that nearly 500,000 housing units with income and rent limits will approach expiration between 2020 and 2029. Data from the National Housing Preservation Database indicate that more than 59,000 rental units in the Southeast that were built with subsidies are at risk of converting to market rates over the next five years if no additional investments are made to preserve their affordability mandates.

Under federal law, housing units financed by the Low Income Housing Tax Credit (LIHTC) are required to commit to affordability for a minimum of 30 years. That includes a 15-year compliance term and a 15-year extended-use period. Created under the Tax Reform Act of 1986, the LIHTC is the primary means to develop affordable housing in the United States. Many property owners have been increasingly using a process that can allow properties to convert to market rates after the initial 15 years, said Meaghan Shannon-Vlkovic, vice president and Southeast region market leader for Enterprise Community Partners, a nonprofit that works with partners to build, finance, and advocate for affordable housing. "In Georgia, we've seen significant loss of units," she said.

Addressing the affordable housing problem is not easy, but efforts are taking shape. Government agencies, private sector developers, and nonprofit organizations are realizing that their efforts are stronger when they work together. Though there is currently no magic formula that will provide affordable lodging for every household that needs it, these partners are offering solutions. (See the sidebars for information about some of these programs.)

Safe and affordable housing is important for the world for a number of reasons. It makes it possible for working families to be a part of communities. It promotes better work lives, improved health outcomes, and economic stability. Ultimately, it helps put people in a position to achieve success and contribute to society and the economy at large.

Partnerships with promise part 3: Revitalizing blighted neighborhoods

In Augusta, Georgia, government investment is helping to bring new life to areas that became blighted. In 2008, the city decided to revive Laney Walker and Bethlehem, two historic African American neighborhoods encompassing 1,100 acres, and the local Housing and Community Development Department has bought land, tore down dilapidated structures, and teamed with private developers to construct new homes in the area. In the development, located in the eastern part of the city, new market-rate homes stand alongside properties built with federal monies for low- and moderate-income buyers, who can receive up to $25,000 in down payment assistance that doesn't have to be paid back as long as they reside in the house for five years. Since the area was designated as an enterprise zone, property taxes are suspended for up to 10 years.

"Nobody can tell by looking at a house whether it's affordable or market-rate because the exterior aesthetics are the same," said Hawthorne Welcher Jr., director of the Augusta Housing and Community Development Department. The redeveloped neighborhood began with single-family homes, but now townhomes are being built and there are plans to add a small-house product that is 500 to 800 square feet, Welcher said.

In 2018, Laney Walker was approved as an opportunity zone, which offers a tax credit to new businesses that come to the area and create at least two jobs. Welcher says that will facilitate the arrival of establishments such as grocery stores and restaurants.