As concerns about widening gaps in income and wealth permeate economic policy discussion, the Federal Reserve Bank of Atlanta assembled some of the field's leading thinkers to explore the roots of inequality from various perspectives. When considering a topic as complex as inequality, economists and policymakers advance numerous questions such as the role of education and school quality in the intergenerational transmission of income, the economic importance of a person's physical location, and the role that higher education financing occupies in economic potential.

Indeed, Harvard University economist Raj Chetty recently grabbed headlines with his trailblazing Opportunity Atlas, a look at how one's physical location can affect social mobility. Chetty recently visited the Atlanta Fed to discuss his work as part of the Bank's ninth annual employment conference, "The Changing Nature of Inequality across Firms, Geography, and Generations." Melinda Pitts, research economist and director of the Atlanta Fed's Center for Human Capital Studies, organized the conference along with Richard Rogerson of Princeton University and Robert Shimer of the University of Chicago.

Atlanta Fed research conferences showcase new analytical work on important economic questions. In this case, inequality intrigued Pitts and her team because the divergence of income, wealth, and opportunity is a pressing concern in research and policy circles. Perhaps as a result, some of the most interesting labor market research today explores these matters, she said.

The Atlanta Fed's Melinda Pitts, one of the conference organizers. Photo by Keith Gray

"We like to bring in a diversity of research methods—micro, macro, theoretical, and applied—so that the focus is big-picture and policy oriented," Pitts explained.

While focused broadly on inequality, the conference convened economists who are exploring the subject from different angles, ranging from the implications of hyper-productive "superstar firms" to economic mobility in underserved neighborhoods. The conference's keynote presenter was Raj Chetty, the Harvard economist whose work on economic mobility by individual census tract has garnered widespread acclaim.

Additional conference papers examined the stagnation of median lifetime incomes over the past half century, states' financing of higher education, and the degree to which a few large employers dominate local labor markets, among other topics.

Below are summaries of some of the papers presented at the conference. Please visit the conference web page for links to the complete papers.

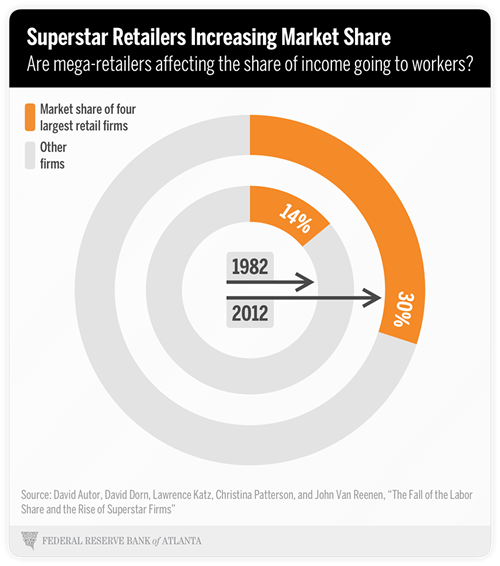

Superstar firms pay well but contribute to lower labor share of GDP

A widely cited 2017 paper presented at the conference, "The Fall of the Labor Share and the Rise of Superstar Firms," examines the rise of "superstar firms" that are so productive they have amassed huge profits and increasingly large market shares in various industries. These companies do not appear to skimp on salaries, said David Dorn, a coauthor who presented the paper.

Rather, they contribute in a different way to the declining share of overall income that flows to labor, what economists call "the labor share." These companies are so profitable, with fewer employees relative to traditional large firms, that more of their income flows to capital as opposed to labor, thus exacerbating an ongoing trend throughout the economy.

David Dorn at the Atlanta Fed conference. Photo by Keith Gray

In retail trade, the combined market share of the four biggest firms has more than doubled since the early 1980s, rising to 30 percent, Dorn and his coauthors found. Meanwhile, the share of those sales flowing to payroll has dipped by about 7 percent.

Dorn and his fellow authors find that industries where sales have concentrated most show the sharpest declines in the share of income funneling to workers.

It's not entirely clear what is causing this concentration of market share. However, the researchers point to technology as a probable reason. The rise in concentration of sales, according to the paper, is "disproportionately apparent in industries experiencing faster technical change … suggesting that technological dynamism, rather than simply anticompetitive forces, is an important driver of this trend."

The rise of superstar firms and decline in the labor share of income also may be related to the proliferation of outsourcing, according to Dorn. Large employers, he explains, increasingly use contracting firms, temporary help agencies, and independent contractors for a wider range of work that traditionally was done in-house.

Incomes stagnating across generations

Another paper discussed at the conference analyzes the trajectory of workers' career-long incomes. In a nutshell, the news is not good.

The researchers' findings are significant. Such a sweeping examination of lifetime income distribution is unusual, as most research looks at incomes at a particular point in time—say, comparing what people in different generations earn at age 40—because the mass of data needed to explore ongoing incomes of millions of people across decades has typically been unavailable.

In fact, the presenter, Fatih Guvenen of the University of Minnesota and the Federal Reserve Bank of Minneapolis, and his coauthors write that they believe their paper—titled "Lifetime Incomes in the United States"—is the first analysis of lifetime income distributions for a large number of age groups in the United States. The researchers examined a 57-year-long set of data, from 1957 to 2013. The oldest group they analyzed turned 25 years old in 1957, and the youngest turned 55 in 2013.

Guvenen and his coauthors found that for a vast swath of the workforce, median lifetime incomes adjusted for inflation declined. For example, the group that began their careers in 1983 have a lifetime median income that is 10 to 19 percent lower than that of the group that entered the labor market in 1967. In particular, lifetime income showed little to no increase for those in the bottom 75 percent of male lifetime income distribution. More generous employer-provided health and pension benefits somewhat offset those results, but that "does not alter the substantive conclusions," wrote Guvenen and his coauthors.

Median lifetime income for women increased sharply, by 22 to 33 percent, during the same span. However, those gains came off very low incomes for the earliest age group, the researchers point out. Median incomes stagnated mainly because of substantial changes in income early in careers, especially for men.

The economists conclude that to determine why the distribution of U.S. income has tilted dramatically toward the top of the spectrum over the past 50 years, we must better understand what is happening early in the careers of more recent generations of workers and how their experiences differ from those of previous generations.

Findings from other papers include:

- States that invest more public money in higher education have larger proportions of college-educated workers in their labor force than states that invest less. The author, John Kennan of the University of Wisconsin-Madison, also estimates that a uniformly inexpensive national tuition rate would significantly boost the share of college graduates in the country. The resulting increase in income taxes paid by more high-earning workers would almost completely offset the loss in tuition revenue, his model suggests.

- School quality is probably not a huge factor in differences in economic mobility among children in different neighborhoods. That is not to say that school quality is unimportant, emphasized the author, Jesse Rothstein of the University of California-Berkeley. But strictly in terms of the variation among locales in intergenerational income transmission—basically, kids earning more than their parents—evidence indicates that factors other than school quality may matter more. Those include cultural tendencies toward early marriage and the presence of "labor market networks," which essentially means knowing neighbors and friends who are employed and may be able to help you find a job.

- A paper presented by Esteban Rossi-Hansberg of Princeton University explores why people stay in less-promising locations rather than moving to places that offer better prospects for them and their families. Rossi-Hansberg and his coauthor argue that we can understand location decisions as an investment in a "location asset." Their work suggests that "savers" choose to spend more today by living in a more expensive area that offers better future returns. On the other hand, "borrowers" go to cheap locations to avoid bigger expenses today, in some cases—such as a blue-collar worker with little wealth who has lost a job—because that is all they can reasonably afford.

- Interactions among inventors and researchers are crucial to productivity and economic growth. The authors of this paper used a new set of data on millions of European inventors to bring hard statistics to a body of research that had been largely theoretical, allowing researchers to better quantify typically ambiguous concepts such as interactions, productivity or knowledge, and the value of research teams. According to presenter Stefanie Stantcheva of Harvard University and her coauthors, their model could be used to study policy questions such as how immigration policies affect the inflow of inventors and ideas.

- In the average U.S. labor market—for example, a metropolitan area—workers have limited choices of employers. This labor market concentration is associated with significantly lower wages advertised in job listings, according to an analysis based on the most frequent occupations posted on the employment website CareerBuilder.com.

Jesse Rothstein discusses his research. Photo by Keith Gray