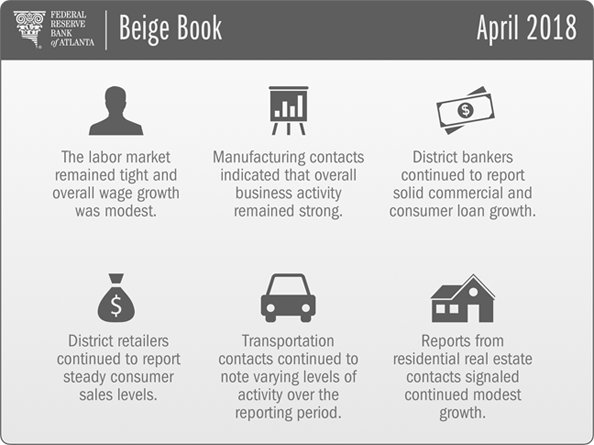

Steady but modest improvement continues to characterize the economy in the Southeast, according to the new Beige Book report from the Federal Reserve Bank of Atlanta.

But those general sentiments from the Atlanta Fed's business contacts, which are largely consistent with other recent reports, combine with at least a couple of more complicated developments. Those nuances involve wage growth and the threat of tariffs.

Start with wages. Overall, reports of pay increases were mixed as contacts continued to report widespread difficulties landing sought-after skilled workers. Particular fields reporting labor shortages included information technology, long-haul transportation, construction, and medical fields, according to the April Beige Book![]() .

.

Many Atlanta Fed contacts reported they are increasing wages steadily but still modestly. However, firms in certain geographic areas and high-growth industries say they are finding it necessary to offer "large wage increases in order to attract and retain workers."

Most notably, according to the Beige Book, "the transportation sector reported that they were compelled to provide drivers with sizeable bonuses and wage increases in an attempt to thwart turnover." More broadly across economic sectors, employers continued to note they were increasing the proportion of workers' compensation that is temporary and can be withdrawn if need be, such as bonuses and incentives.

Fostering maximum employment and stable prices is the Federal Reserve's dual mandate from Congress. On the price front, Sixth District businesses told the Atlanta Fed pressures remain mostly muted. At the same time, some contacts noted that the prices they pay for steel have risen amid heightened rhetoric concerning tariffs.

The Fed's inflation goal is 2 percent, as measured by the Personal Consumption Expenditures Index. The Atlanta Fed's latest Business Inflation Expectations survey of regional firms showed that their unit costs were up 1.9 percent in March compared to a year ago. Respondents indicated they expect costs to climb 2.1 percent over the next year.

Here's a snapshot of other findings from the April Beige Book:

Consumer spending and tourism: Retailers continued to report steady sales. Home improvement stores cited increased sales early in the year, while auto dealers reported lower demand. Meanwhile, travel and tourism contacts said domestic travel was strong and were optimistic as they headed into spring.

Construction and real estate: Contacts reported continued modest growth generally. Looking ahead, home sellers and builders expect activity to hold steady or increase over the next three months. In commercial real estate, contacts noted continued improvement overall. But the pace of improvement varied by property type, metropolitan area, and even pockets within metro areas, according to the Beige Book.

Manufacturing: Business remained strong in general, and most contacts indicated they are optimistic about the coming months.

Banking and finance: Bankers continued to report solid commercial and consumer loan growth.

Energy: Out of Louisiana, reports noted that increasing demand for liquefied natural gas is fueling rising exports. Meanwhile, freezing conditions along the Gulf Coast in recent weeks temporarily disrupted petrochemical operations, leading to backlogs and tight supplies.

Agriculture: Conditions across the District were mixed. Over the years, prices secured by farmers in February were up for rice, beef, broilers, and eggs but down for corn, cotton, and soybeans.