The Federal Reserve Bank of Atlanta’s new Beige Book report details the coronavirus pandemic’s far-reaching economic toll across the Southeast. Contacts in the Sixth Federal Reserve District said economic activity continued to decline from April to early May.

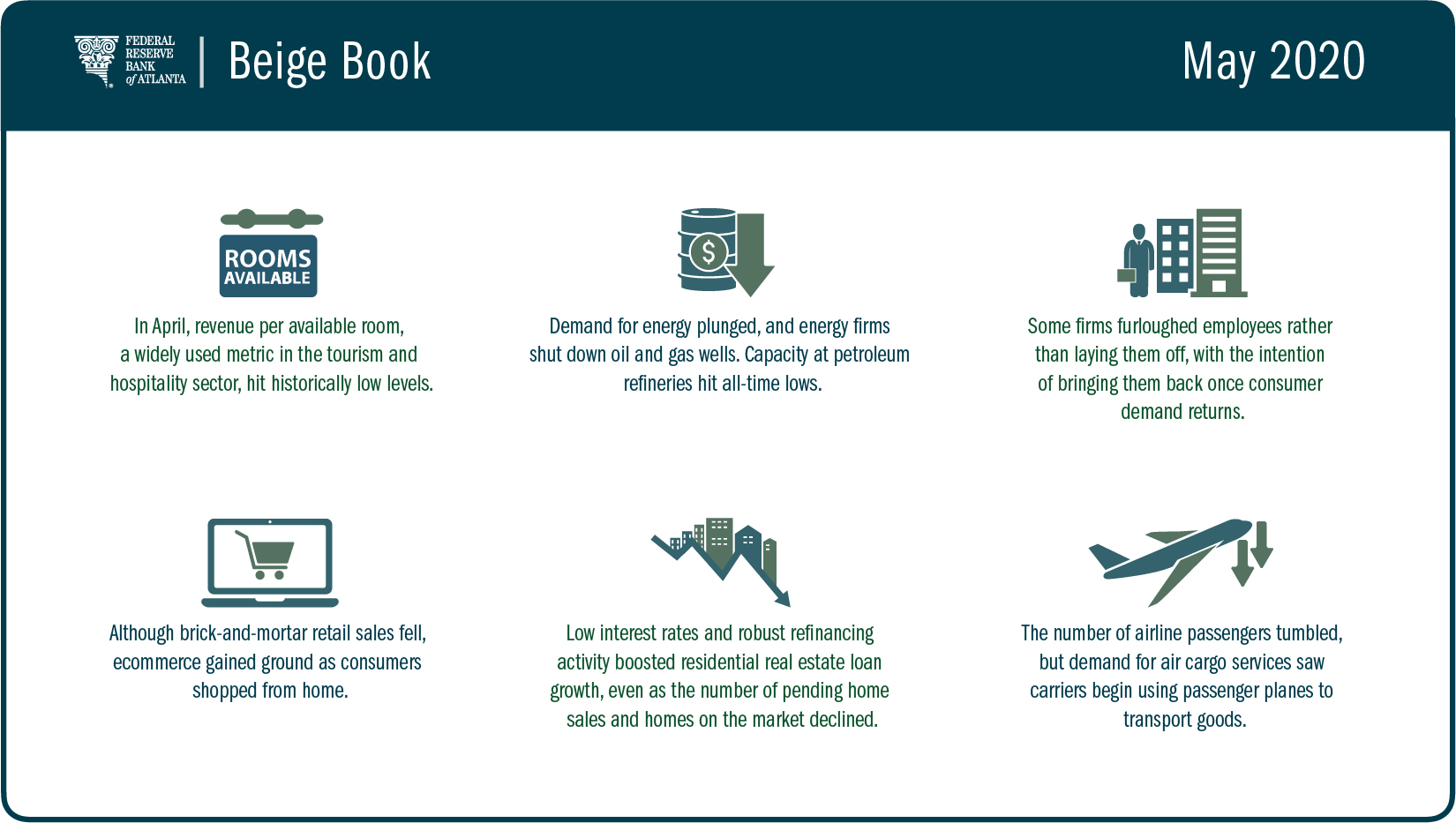

Almost no sector was spared. Pay cuts and reduced hours were widespread. Tourism and hospitality contacts reported revenue per available room, a lodging industry metric, at historic lows in April. Most passenger flights were suspended, energy firms reported shutting oil and gas wells, and refineries used all-time low levels of capacity. Manufacturers cut production amid declining new orders.

However, amid the gloom was nuance and, maybe, even a glimmer of positive news. For example, many small business contacts said they secured loans through the federal Paycheck Protection Program, which allowed some firms to avoid layoffs. And most contacts were furloughing staff with medical benefits, as opposing to laying them off, in hopes of rehiring workers when demand picks up.

Although banks reported lower earnings as they boosted reserves to cushion potential loan losses, lenders also said loan growth accelerated for the commercial and industrial segment. The growth stemmed from a combination of customer drawdowns of existing lines of credit and approvals of new loans under the Paycheck Protection Program. Retail sales reportedly grew in grocery and household products, office equipment, and home improvement goods. Ecommerce continued to accelerate while sales at brick-and-mortar retailers fell.

Hospitality contacts are crafting marketing plans to showcase reopenings and devising social distancing measures and extra sanitation programs. In general, lodging and travel contacts said they expect a “moderately slow” recovery.

Elsewhere:

- Some temporary increases in hourly wages and bonuses continued to be reported among high-demand and essential workers, yet there was no evidence these inducements were increasing substantially or spreading to other sectors.

- Residential real estate loan growth increased because of lower interest rates and a high level of refinancing.

- Most firms have not raised prices, either because they lack pricing power or as a goodwill gesture to troubled consumers.

- Contacts indicated a sharp decline in pending home sales and fewer homes on the market. Nevertheless, sellers generally stuck to their asking prices.

- Commercial real estate sources reported that more tenants sought rent relief.

- Demand remained strong for air cargo services, so carriers used passenger planes to haul goods.

- Utilities contacts reported decreased demand for power, largely from the commercial segment.

The Federal Reserve issues the Beige Book report of economic conditions before each meeting of the Federal Open Market Committee. The next FOMC meeting is scheduled for June 9 and 10.