Raphael Bostic

President and Chief Executive Officer

Federal Reserve Bank of Atlanta

Rotary Club of Atlanta

Loudermilk Center

Atlanta, Georgia

January 8, 2018

- Atlanta Fed president and CEO Raphael Bostic offers his economic outlook in a speech to the Rotary Club of Atlanta on January 8, 2018. He also addresses the income mobility of residents in the Southeast.

- Bostic foresees a positive but modest boost to GDP growth in 2018, with some upside risk associated with recent changes to fiscal policy.

- Bostic says despite a tightening labor market, there has been a puzzling lack of wage and price pressure. He expects inflation to converge to the Fed's 2 percent target by the end of 2018.

- Bostic is comfortable continuing with a slow removal of monetary policy accommodation if recent data unfold in a manner similar to his outlook.

- Bostic is becoming increasingly concerned about the welfare of lower-income households. Research suggests that income mobility in the region and in metro Atlanta is particularly challenged.

- Workforce development can help more citizens share in prosperity by connecting people to work opportunities, says Bostic.

Good afternoon. As the new president of the Atlanta Fed, I am pleased to follow a longstanding and fine tradition: providing my first official remarks of the year to the Atlanta Rotary Club.

I now have about seven months under my belt in my new role. It's been a terrific experience so far, and I look forward to getting to know all of you better in the months ahead.

Today I will observe tradition and offer my views on the economic outlook for 2018. I'll then talk a bit about how tax reform might affect the outlook, and I will add my thoughts on the path of employment and inflation. Finally, I will offer some commentary on a concern I have for our region—the income mobility of our citizens.

But before I dive in, I thought you should know that I've spent a lot of my time traveling around the District, which spans six states in the Southeast. I've met with hundreds of business and community leaders, educators, students, and members of our Bank's boards of directors and advisory councils. All of their voices add a lot of texture and depth to our understanding of the economy and have shaped the views I will discuss today.

And speaking of that, please note that I'll present only my personal reflections and views today. I'm not speaking for anyone else in the Federal Reserve or the Federal Open Market Committee, or FOMC.

Economic outlook

At this early date, the signs point to a strong year for gross domestic product, or GDP, growth in 2018.

Our in-house tracking model—GDPNow—estimates that growth in the fourth quarter of 2017 rose by roughly 2.7 percent. If that estimate holds, growth over the past three quarters would have averaged 3 percent. It would also mean that real GDP growth for 2017 was stronger than I was expecting even six months ago.

Last year was another solid year for consumption growth. The latest data, combined with favorable fundamentals, suggest this strength will carry over into this year.

Perhaps the most welcome trend in 2017 was the recovery in capital spending. Real business fixed investment, which was tepid in 2015 and 2016, grew at a pace much more consistent with a normal expansion last year. This is especially true for equipment spending, which is on track to post back-to-back double-digit gains in the third and fourth quarters.

The recent evidence also points to a pickup in residential investment. The pace of new home sales has accelerated in recent months. And, while multifamily construction seems to have leveled off, single-family housing starts continue on a steady northward climb.

Despite all the apparent momentum heading into the new year, I am not projecting that 2018 will be a breakout year for growth. I see the economy expanding only modestly above its average over this expansion.

At the last FOMC meeting, my colleagues and I submitted our individual projections for GDP growth, inflation, and the unemployment rate for 2018 and beyond. This information was released to the public as the December "Summary of Economic Projections," or SEP. The GDP growth projections in the SEP suggest growth in 2018 will be between about 2.2 percent and just over 2.5 percent. That range feels about right to me.

Why? Three reasons.

First, we've been here before. For the past seven years, we have seen a predictable pattern. First-quarter GDP growth has averaged just above 1 percent, while growth over the rest of the year has averaged nearly 2 ½ percent. This pattern has tended to inflate growth figures later in the year at the expense of the first-quarter data. So, I'm looking through a bit of the strength we've seen over the second half of last year. And I'll also be taking any weak estimates we get on first-quarter growth with a sizable grain of salt.

The second reason I am not carrying forward the full amount of the recent increase in GDP growth is that some of the strength in the recent indicators likely reflects transitory effects of rebuilding from last fall's hurricanes.

And third, my staff has collected survey and anecdotal evidence suggesting that, on balance, businesses are optimistic but are not expecting significant increases in growth.

Tax reform considerations

Much like everyone else, my staff and I have been trying to parse the details of the recently enacted tax changes to get a deeper understanding of what they may imply for the outlook.

In November, as the House and Senate were formulating their respective versions of the tax package, the Atlanta Fed had two surveys in the field—our Business Inflation Expectations survey of businesses in the Sixth Federal Reserve District, and a joint national survey conducted by the Atlanta Fed, Stanford University, and the University of Chicago. In both of these surveys, we asked firms how tax reform would affect their capital expenditure plans for 2018. In the Business Inflation Expectations survey, we also asked how tax reform would affect hiring plans.

On business investment, roughly two-thirds of respondents to our national survey, which was in the field after the original House bill had been passed, indicated that the reform wouldn't affect their capital expenditures at all. Just 15 percent said they would increase their capital spending by 10 percent or more, and those responses came mostly from smaller firms.

Similarly, in their responses to the hiring question in our regional survey, the majority of firms indicated that tax reform would not change their plans. Here, too, positive responses were skewed in the direction of smaller firms. For those businesses with more than 100 employees, almost 70 percent indicated there would be no change in their hiring plans as a result of tax reform being passed.

We also held in-person interviews with a diverse set of business leaders across the District. They generally indicated that the proposed tax changes would serve only to accelerate, not expand, their current plans.

Of course, the details of the final bill have changed somewhat from what was known at the time our surveys were taken. But the final bill that was signed into law just before Christmas is similar enough to the early drafts to give me some confidence that the responses to our questions would not be much changed if we asked today.

As a result of this input, I'm marking in a positive, but modest, boost to my near-term GDP growth profile for the coming year. For now, I am treating a more substantial breakout of tax-reform-related growth as an upside risk to my outlook.

Labor markets

Alongside solid economic growth, labor markets have continued to tighten. Looking back on 2017, the economy added, on net, a little more than 2 million jobs, an average monthly increase of roughly 170,000 jobs. That was enough to bring the unemployment rate down to its lowest level in 17 years.

Broader measures of labor market health have also improved. The so-called "U-6" unemployment rate, which includes those working part-time for economic reasons and those marginally attached to the labor force, has dipped to its lowest level since March 2007. Unemployment has also returned to prerecession levels in metro Atlanta.

Yet, despite what appears to be a tightening labor market, there has been a puzzling lack of wage and price pressure. Most measures of wage growth have stalled out since late 2015 and remain well below their pre-crisis levels.

Inflation

It is not just wage growth that has been low. Since the start of the recovery, back in the second half of 2009, headline inflation as measured by the personal consumption expenditures, or PCE, index has increased at an annualized rate of just 1.5 percent.

And, over the past year, inflation has still been running a bit below 2 percent. That 2 percent number is important. In January 2012, the FOMC established an explicit numerical inflation target—aiming to achieve a 2 percent inflation rate as measured by the PCE index.

I have always thought of the inflation target as an objective designed to deliver a price level reasonably close to a 2 percent growth path over the medium term. Clearly, that hasn't been the case during this expansion, and I worry about the implications of deviating on the low side of our target for six years now.

My main concern is that inflation expectations risk becoming anchored below 2 percent. If this happened, it would be increasingly difficult for the Fed to hit our 2 percent target.

One way to guard against inflation expectations becoming anchored to the downside is to emphasize that the FOMC's inflation target is symmetric. Symmetry here means that the central bank is equally concerned when inflation is running below or above its target.

Survey evidence—as well as estimates about the expectations gleaned from financial market prices—indicates that individuals may not be completely convinced about the symmetry of the FOMC's inflation objective. This possibility is one factor that might argue for being somewhat more patient in raising rates, even as the inflation rate moves toward the 2 percent objective.

I am not quite ready to concede that inflation expectations have diverged from the FOMC's objectives. I think there is still some transitory noise attached to the year-over-year inflation rates. This is largely due to a few large idiosyncratic price declines early in 2017.

I have been somewhat encouraged that the last couple of inflation reports have come in a bit stronger than what we saw early last year. While I view the possibility that the public believes inflation will persistently fall short of the 2 percent objective as a risk, my baseline outlook still has inflation converging to the Fed's target by the end of 2018.

The policy path

Should the recent data unfold in a manner similar to my outlook, I am comfortable continuing with a slow removal of policy accommodation. However, I would caution that that doesn't necessarily mean as many as three or four moves per year.

Recent evidence suggests that the interest rate that would prevail when GDP and inflation are back on target could be close to 2 percent at the moment, and may rise only modestly over the medium term.

If this is right, then the current stance of monetary policy is still somewhat accommodative but is approaching a more neutral stance. Finally, it is important to remember that the Fed is also removing accommodation by shrinking its balance sheet.

To summarize, I see the economy continuing to expand at a modest pace in 2018, with some upside risk associated with recent changes to fiscal policy. Employment gains should remain substantial enough to keep the unemployment rate near its low level, and I expect inflation to track gradually to the Fed's 2 percent target.

Income mobility

The outlook I just shared focuses on macroeconomic measurements and is a broad view of how the overall economy is expected to perform.

While policymaking often focuses on these macroeconomic gauges, the Fed's statutory mandate of maximum employment and stable prices also has direct links to microeconomic considerations. In this regard, it is important to consider how economic outcomes are dispersed because they are material for determining what our maximum aggregate economic growth can be. For example, if a percentage of entrepreneurs don't have full access to capital, then overall economic potential may be constrained.

As a consequence, I am becoming increasingly concerned about the welfare of lower-income households because much of the economic growth we anticipate may not reach the full extent of our populations.

In the remainder of my comments, I'd like to focus on challenges faced in our nation's metropolitan areas—metro Atlanta and the Southeast in particular. Recent work by economist Raj Chetty and his colleagues suggests that income mobility in our region is challenged. They note that among the 50 largest metro areas in the nation, Atlanta has the smallest share of people born into poverty who grow out of it as adults. In this group, only Charlotte exhibited lower mobility than Atlanta. This concern is particularly relevant in the Sixth Federal Reserve District.

Beyond Atlanta, three of the Atlanta Fed's branch cities—Nashville, New Orleans, and Jacksonville—also exhibit some of the lowest mobility in the country. In short, far too many people do not benefit from the growth our region has experienced.

Drilling down more into the details of who is left out in metro Atlanta, north Atlanta and south Atlanta show very different economic conditions and, ultimately, opportunities for their residents.

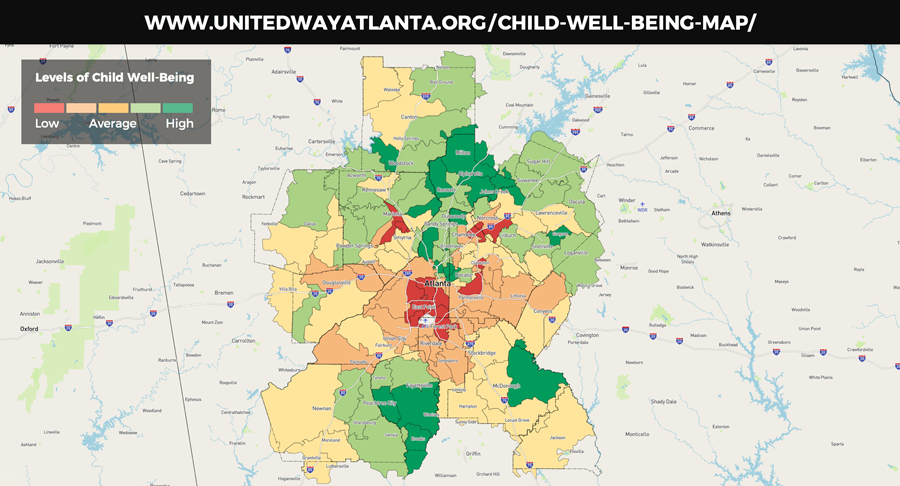

A look at the United Way of Metro Atlanta's Child Well-Being map shows that many communities south of I-20 face high levels of disadvantage in terms of housing cost burdens and low levels of financial stability. Outcomes for children in these areas include lower third-grade reading proficiency, lower eighth-grade math proficiency, and lower levels of high school graduation.

But importantly, this is not just a "south of I-20" problem. Pockets of lower levels of well-being exist in every county in that map except one. This is an "everywhere" issue that deserves the attention of everyone.

To be clear, the United Way is not the first or the only group worrying about this issue. The Annie E. Casey Foundation has identified many of the same well-being challenges in its recent Changing the Odds report on metro Atlanta. Also, this region's Learn4Life initiative on education has focused on this issue.

Paradoxically, several of the states in our District, including Georgia, rank as some of the top business climates in the country. That, in my view, is a source of opportunity and optimism.

I think that part of the solution to helping more people share in the prosperity that opportunity affords is to shore up the income and employment situations for families in the area. A big part of that effort is helping to prepare parents and young adults for available jobs through workforce development, which has been a major focus of our Bank's efforts recently.

Workforce development speaks to the maximum employment half of the Fed's dual mandate. In an increasingly competitive world, our nation leaves potential resources behind at our peril.

Late last year, the Atlanta Fed launched the Center for Workforce and Economic Opportunity to help identify ways to connect people to opportunities and work that will help them advance their economic situation and provide for their families. Our staff has focused on identifying policies and programs that support this goal and helps to monitor where the labor market is heading to best connect people to work.

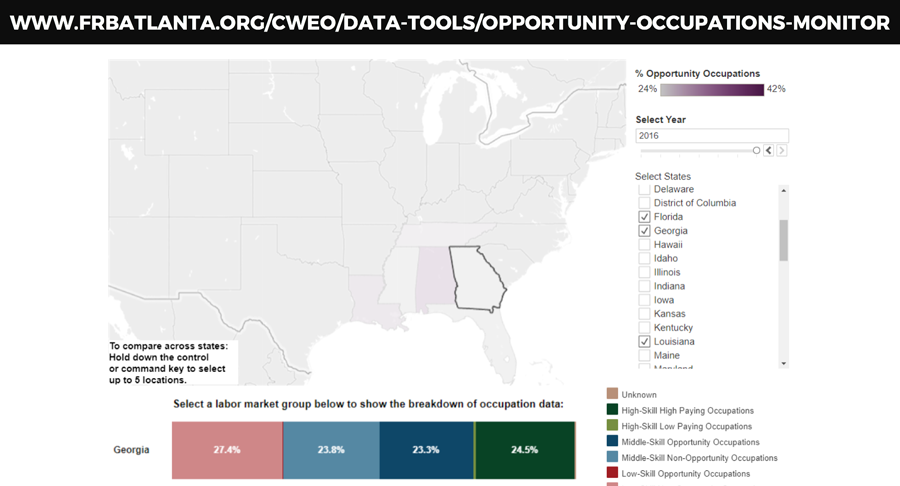

I would particularly encourage you to visit the center's website and to look at the Opportunity Occupations Monitor data tool, which highlights the availability of well-paying jobs that do not require a college degree by metro area across the country. It also shows what types of occupations provide these opportunities in each region.

Knowing about the challenges in opportunity is a first step. Finding ways to advance opportunities for families and children is the next. I encourage you to find an effort or people working to advance opportunities in the area and see what you can do to help make Atlanta a community that continues to grow—and grow inclusively.

If we do not work to solve these disparities, we will likely miss yet another generation of children—and that would be a tragedy.