Construction and Real Estate Survey Results

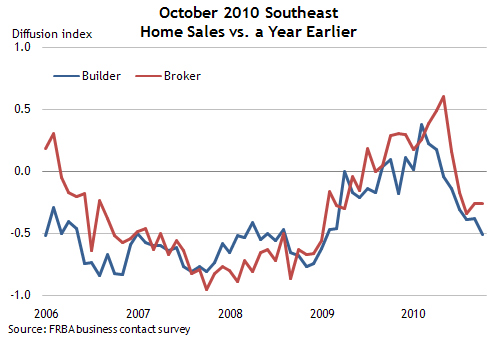

Reports from Southeastern brokers and builders indicated that home sales remained weak in October on a year-over-year basis.

- Just over half of Southeastern brokers continued to report declining home sales on a year-over-year basis. Additionally, half of respondents reported that sales declined from September to October.

- Reports from Florida brokers indicated that home sales were even with a year earlier; however, Florida contacts once again noted that the foreclosure moratorium had stalled sales.

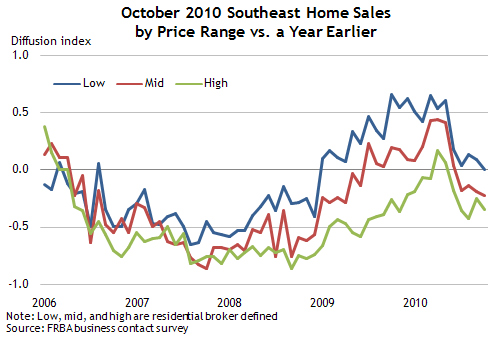

Brokers in the Southeast indicated that home sales weakened across all prices ranges in October.

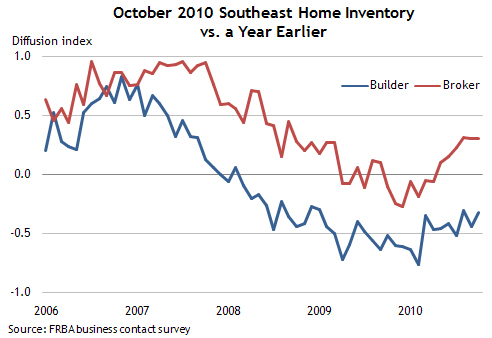

Southeastern brokers said that existing home inventories remained above the year-earlier level and steady while builders reported that new home inventories remained below the year-earlier level.

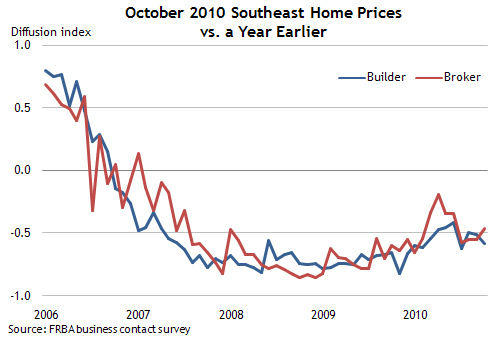

Southeastern brokers and builders indicated that home price growth trends were mixed in October.

- On a month-to-month basis, most brokers reported that home prices were flat to slightly down, similar to the September reading.

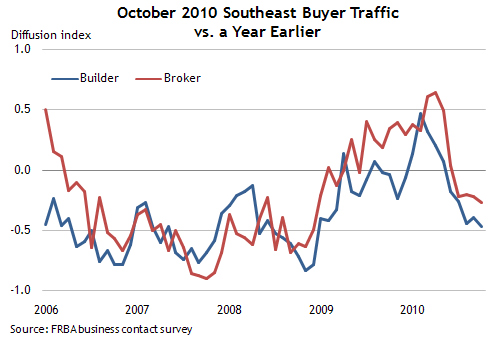

Southeast buyer traffic continued to weaken when compared with stronger traffic levels last year associated with the initial federal housing stimulus program.

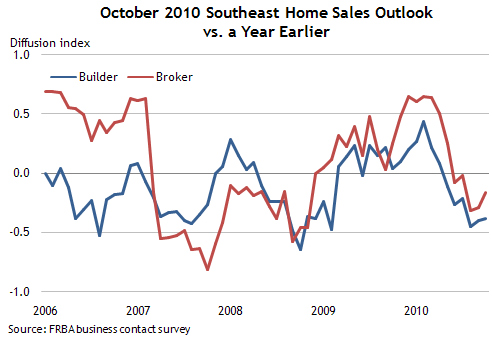

Despite weak buyer traffic, the outlook among Southeastern residential builders and brokers improved modestly but remained below the year-earlier level.

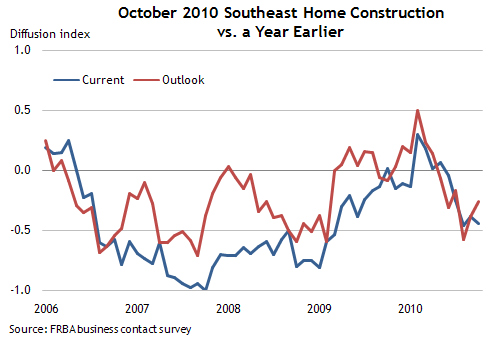

Southeastern builders reported that home construction activity weakened again in October on a year-over-year basis while the outlook improved slightly, but declines are expected to persist.

Note: October survey results are based on responses from 113 residential brokers and 54 builders and were collected Nov. 1–10.

The housing survey's diffusion indexes are calculated as the percentage of total respondents reporting increases minus the percentage reporting declines. Positive values in the index indicate increased activity while negative values indicate decreased activity.

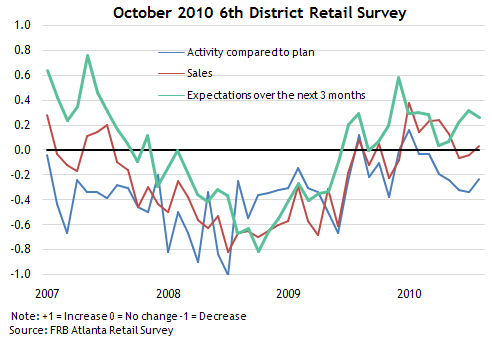

The District Retail Survey showed some improvement in the retail sector for October, and the outlook continued to be optimistic.

- Most respondents reported that sales and traffic in October was unchanged or slightly up from October 2009.

- Most survey respondents were positive about the outlook for the third consecutive month, with 47 percent expecting sales to increase in the next three months.

- In addition, the majority of retailers expect holiday sales will increase slightly compared with last year.

Note: October survey results are based on responses from 30 retailers and were collected Nov.1–10.

The retail survey's diffusion index is calculated as the percentage of total respondents reporting increases minus the percentage reporting declines. Positive values in the index indicate increased activity while negative values indicate decreased activity.