While discussions of the Obama administration's tax plan focus on the expected impact on consumer spending and the federal deficit, not much attention has been given to the incentives of the plan for work effort. Different tax rates, deductions, and rebates provide varying degrees of incentives to work less or work more, and those incentives differ across income groups. Here I want to focus on just one of the proposed changes: the reinstatement of the 39.6 percent marginal tax rate for the wealthy.

Supply side economists tout low tax rates across the board as a way to provide incentives for people to work harder and thus for the economy to grow faster; with this thinking, people work harder because they get to keep more of the money they're working for.

Results in a recent working paper, with coauthor Robert Moore, confirm these predictions by finding that work effort increased across all income levels when tax rates were cut (among other things) in the 2001 Bush administration tax reform. But work effort increased much less among the more educated (higher income) families.

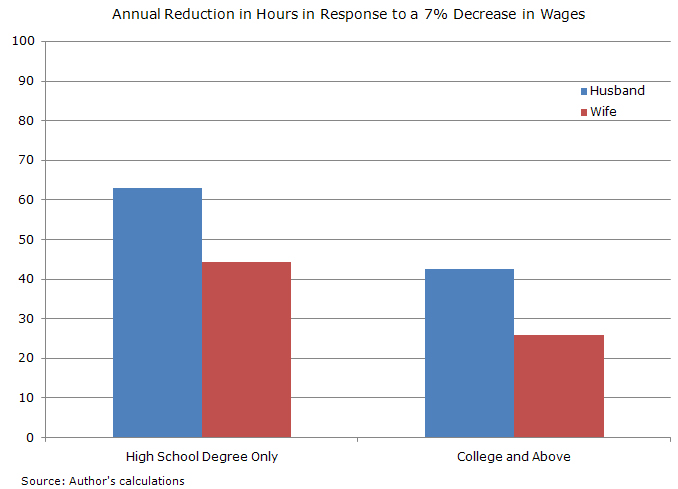

The administration's current budget plan includes a reversion of the marginal tax rate among the wealthiest to the pre-Bush tax rates—an increase from 35 to 39.6 percent. This tax rate increase is equivalent to reducing a worker's wage by 7 percent. The chart shows what the impact on work effort would be across education/income groups if wages were decreased for both groups by 7 percent; education and income are very highly correlated. The analysis found that husbands with a high school degree only would reduce their hours worked by about 63 hours per year (about 2.9 percent), whereas husbands with a college degree or more would reduce their work hours by only 42 hours per year (about 1.8 percent). Working wives in these families would also reduce their hours of work.

So, based on my research, if a need to raise some revenue means tax rates have to be increased for someone, raising them on the wealthiest will result in a smaller reduction in work effort than raising tax rates on the middle class.

The calculations here use results obtained from estimating a joint labor supply model for dual-earner families with different levels of education for the year 2000. A complete analysis of the work effort implications from the administration's tax plan would require accounting for all the changes to marginal tax rates, phase-outs of deductions, and tax credits simultaneously, as well as considering the impact on decisions of family members to enter or exit the labor market in response to the tax changes.

An additional relevant question remains: What is the implication of changing work effort for GDP growth? The relationship between work effort and value of output is not necessarily the same across income levels. In other words, one hour of high-income (higher education) labor is expected to yield a higher value of output in the economy than one hour of labor from a middle-income (lower education) worker. A complete analysis of the aggregate impact of the administration's tax plan would have to also take this into account.

By Julie Hotchkiss, research economist and policy adviser at the Atlanta Fed