Intro and key findings

As the United States continues to wrestle with the implications of COVID-19 and create a new normal for getting things done, small businesses are eager to reach prepandemic business levels. Although we have seen significant improvement since the 2021 report, many small businesses still struggle financially. At least 50 percent of firms in the Sixth District reported poor or fair financial conditions. We still see disproportionate financial barriers in small businesses and businesses owned by people of color.

In February, the 2022 Small Business Credit Survey's (SBCS) Report on Employer Firms presented findings on small firms that were still in business when the survey was fielded in fall 2021, one year and six months into the pandemic. This article examines state-level data from the SBCS on five states in the Federal Reserve Bank of Atlanta's District—Alabama, Florida, Georgia, Louisiana, and Tennessee—on a selection of questions in the national report. The results show notable differences between these southeastern states and the nation in terms of small business performance and pandemic recovery and expectations. We anticipate releasing subsequent updates that focus on owner demographics, industries, further regional breakdowns, and other emerging topics.

Some key takeaways include:

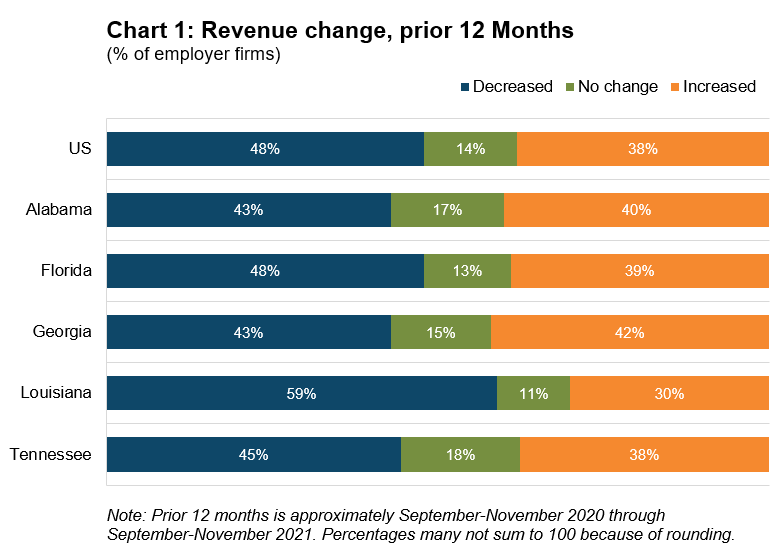

- Georgia firms reported doing better than small businesses across the United States in 2021. Only 43 percent reported a revenue decline in the prior 12 months, while 48 percent did so nationally. Firms in Alabama and Tennessee were less likely to report poor financial conditions; 15 and 14 percent of firms, respectively, reported they were in poor financial condition versus 21 percent nationally.

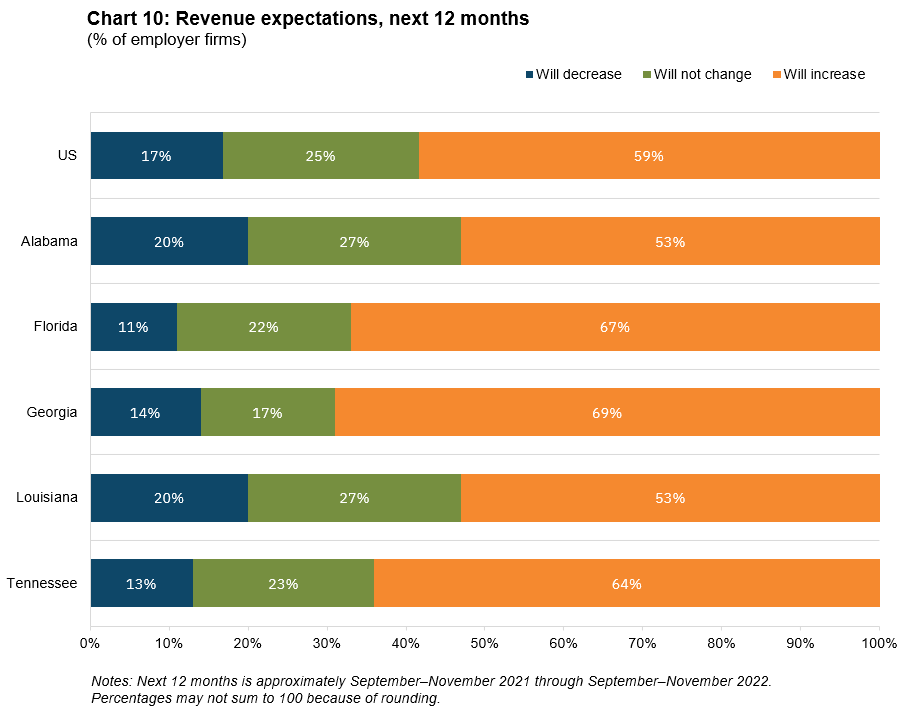

- A greater share of firms in Florida and Georgia expect higher revenue growth than peers across the country. Georgia (69 percent) and Florida (67 percent) firms reported a greater degree of optimism. Alternatively, small businesses based in Louisiana consistently reported poorer outcomes (e.g., highest decline in revenue change).

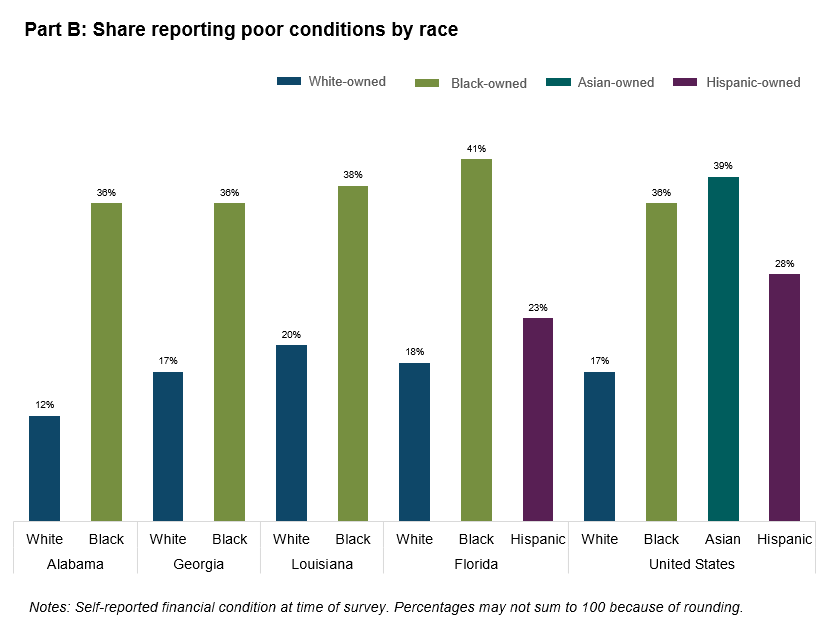

- Firms of color consistently reported more financial challenges. These firms were at least twice as likely to be in poor or fair financial condition.

Leaning on data from the 2021 report, small businesses are still trying to maintain stability as they explore alternative avenues to protect and increase their profitability, especially in this fiercely competitive labor market. This brief is designed to offer updates on the state of small businesses in the Southeast and examines key areas—performance, financial conditions, financing, and other operational challenges—to understand their current conditions.

Small business performance and challenges in the Southeast

Almost half of firms in the United States and the Southeast experienced decreased revenues in 2021, while 38 percent of US firms reported increased revenues, a 30 percent increase from the 2020 survey (see chart 1). Small businesses in southeastern states largely followed the national patterns, with a few notable exceptions. Firms in Georgia and Alabama appear to have fared comparatively better than peers across the United States in 2021; 43 percent reported a revenue decline in the prior 12 months. Meanwhile, firms in Louisiana fared worse than peers across the United States in 2021; 59 percent reported a revenue decline compared with 48 percent of businesses nationally.

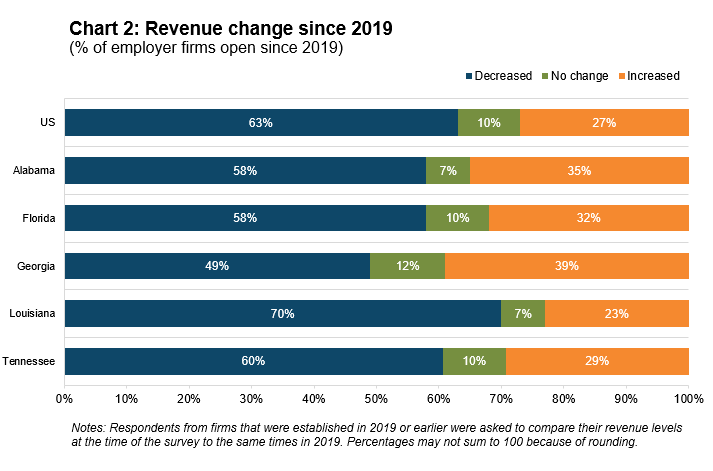

Many small businesses struggled financially throughout 2020 and 2021. Roughly 63 percent of small businesses experienced decreased revenues across the United States while only 27 percent of US firms reported increased revenues. Small businesses in southeastern states largely followed the national patterns, with notable exceptions in Georgia and Louisiana. Georgia firms appear to have fared comparatively better than peers across the United States; only 49 percent of Georgia small businesses reported that their revenues decreased since 2019. Louisiana small businesses fared comparatively worse; 70 percent reported experiencing decreased revenues since 2019 (see chart 2).

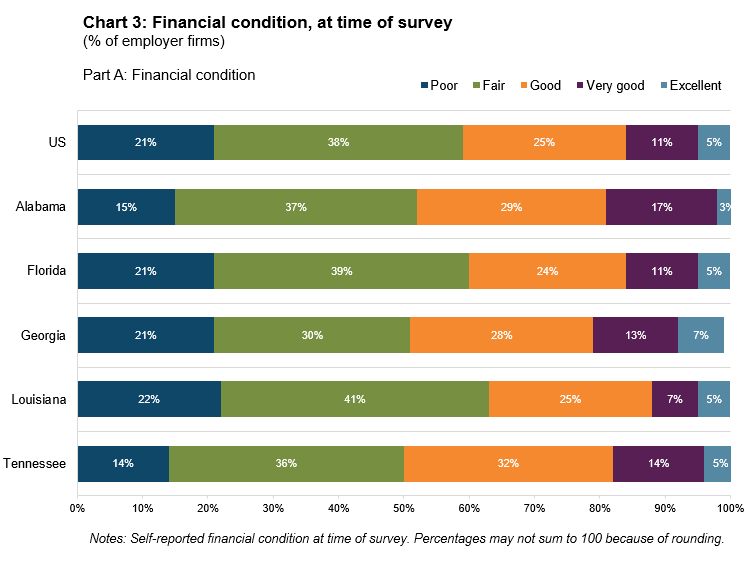

Many small businesses reported struggling financially in 2021. Among US small businesses, 21 percent classified themselves in poor financial condition, and a further 38 percent classified themselves in fair condition (see chart 3, part A). Firms in Florida and Louisiana experienced similar financial conditions compared with the national average when considering the combined share of firms in poor and fair conditions. Firms in Alabama, Georgia, and Tennessee fared somewhat better, with 52, 51, and 50 percent reporting they were in poor or fair financial condition, respectively. It is important to note that Louisiana accounted for the largest number of firms in poor or fair financial conditions at 63 percent of all small businesses. However, firms’ financial condition has seen an overall improvement from 2020, with a 2 percent decrease in firms in poor condition and an increase in the share of firms in fair condition, marking the start of a slow recovery.

The survey found stark disparities in the share of firms in poor financial condition by the race or ethnicity of business owners. In the United States, larger shares of firms owned by people of color reported experiencing poor financial conditions compared with White-owned firms; 39 percent of Asian-owned, 36 percent of Black-owned, and 28 percent of Hispanic-owned businesses did so, compared with 17 percent of White-owned firms. In the Southeast, similar trends played out, with notable differences. Like the United States as a whole, Black-owned firms in Florida and Louisiana more frequently characterized their financial condition as poor compared with White-owned firms in those states (see chart 3, part B). Interestingly, Hispanic-owned firms in Florida reported a smaller share in poor financial shape (23 percent) compared to Hispanic-owned firms across the United States (28 percent).

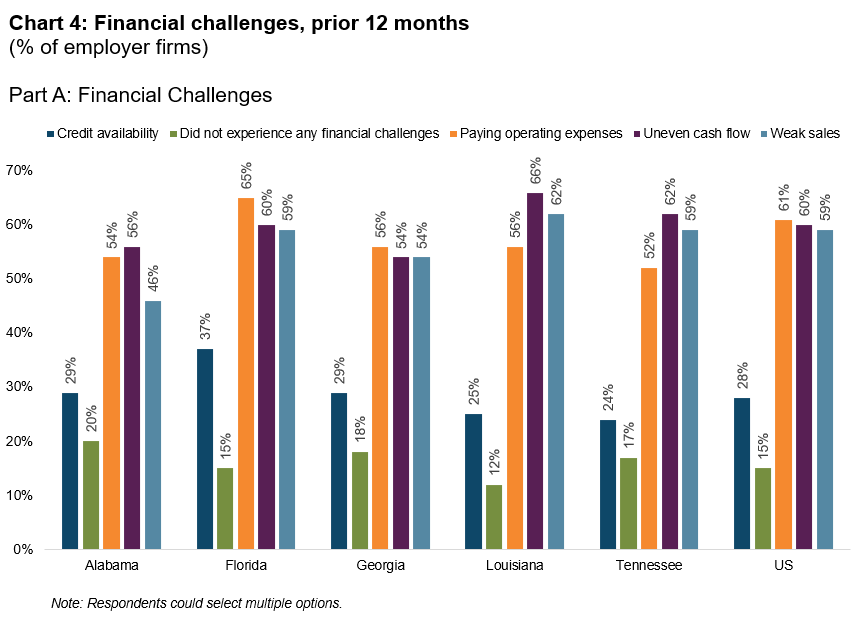

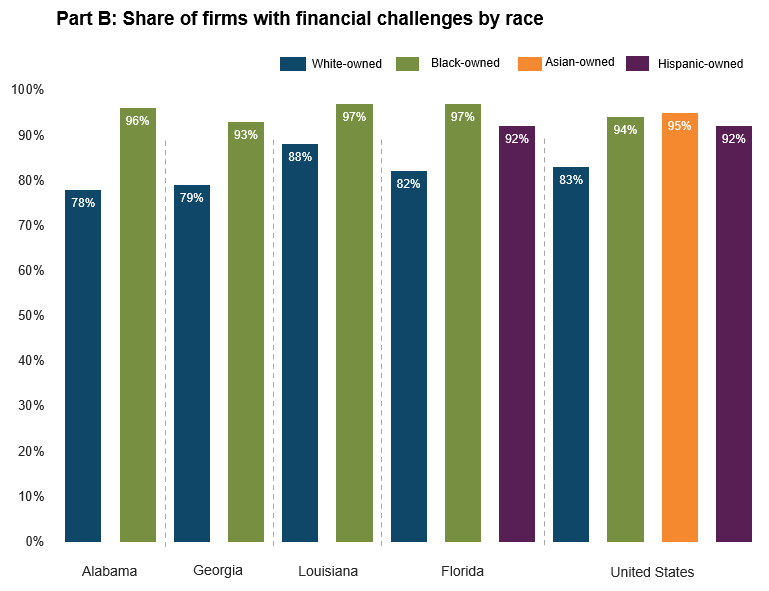

While firms in southeastern states overall fared similarly to firms nationally (see chart 4, part A), the share of small businesses that reported having had financial challenges in the past year varied by the business owners' race and ethnicity (see chart 4, part B). Nationally, Asian-owned and Black-owned firms faced the most financial challenges. Black-owned firms in Alabama, Florida, and Louisiana experienced more financial challenges compared to White-owned firms in those states.

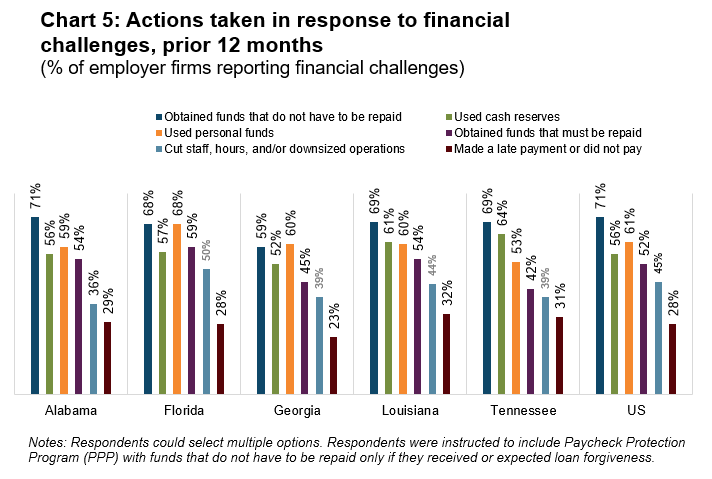

Across the country, 98 percent of firms acted in response to financial challenges in 2021 (see chart 5). Small businesses in southeastern states largely followed national patterns. The most common action taken, by 71 percent of firms, was to obtain funds that do not have to be repaid. The next most common actions by US firms in response to financial challenges, by 61 percent and 56 percent, respectively, were using personal funds and cash reserves.

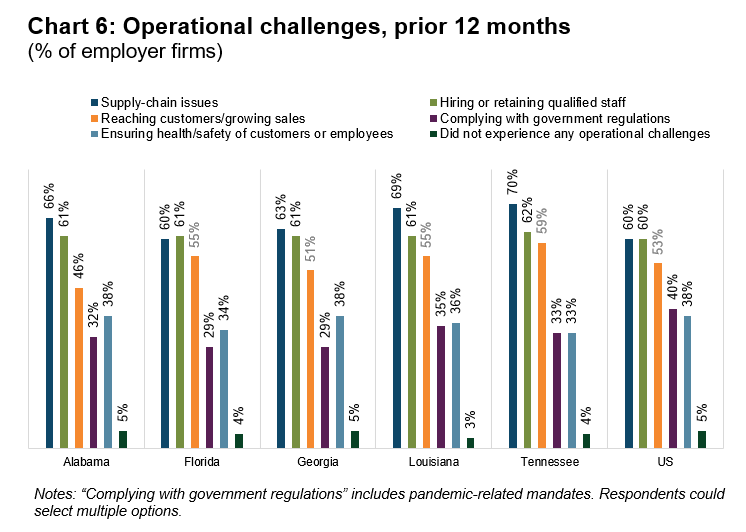

Across the country, 95 percent of US firms experienced operational challenges in 2021 as they faced COVID-19 recovery (see chart 6). The most common operational challenges, supply-chain issues and hiring or retaining qualified staff, were experienced by 60 percent of US firms. In the Southeast, supply-chain issues were experienced the most in Tennessee, reaching 70 percent of firms. The next most common operational challenge was reaching customers/growing sales; 53 percent of firms in the United States experienced this issue. States in the Southeast followed similar trends. However, Tennessee firms faced the highest at 59 percent.

Emergency Funding and Looking Ahead

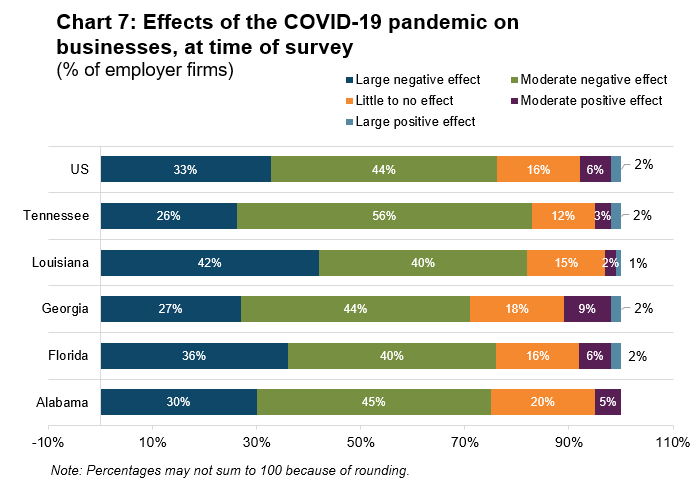

Overall, 77 percent of firms in the United States experienced a negative impact from the pandemic (see chart 7). Firms in Tennessee and Louisiana experienced the most negative impacts from the pandemic at 82 percent. Firms in Georgia fared somewhat better, with 71 percent of firms reporting a negative impact from the pandemic.

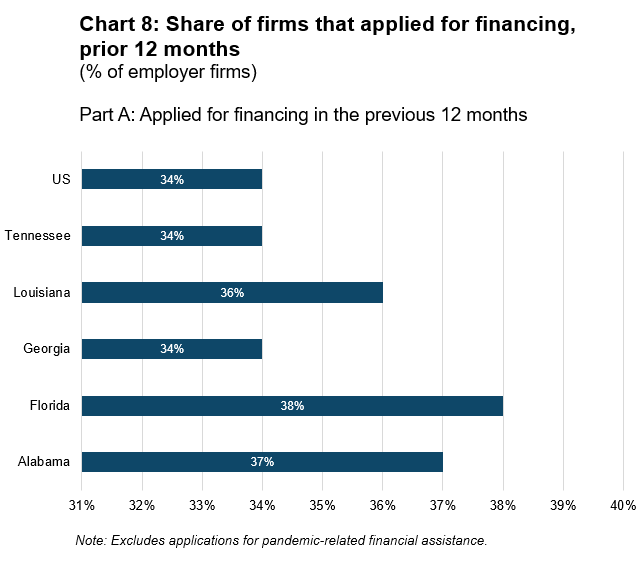

Thirty-six percent of firms across the country applied for financing in the past year (see chart 8). While small businesses in southeastern states largely followed the national patterns, firms in Florida applied for the most financing at 39 percent.

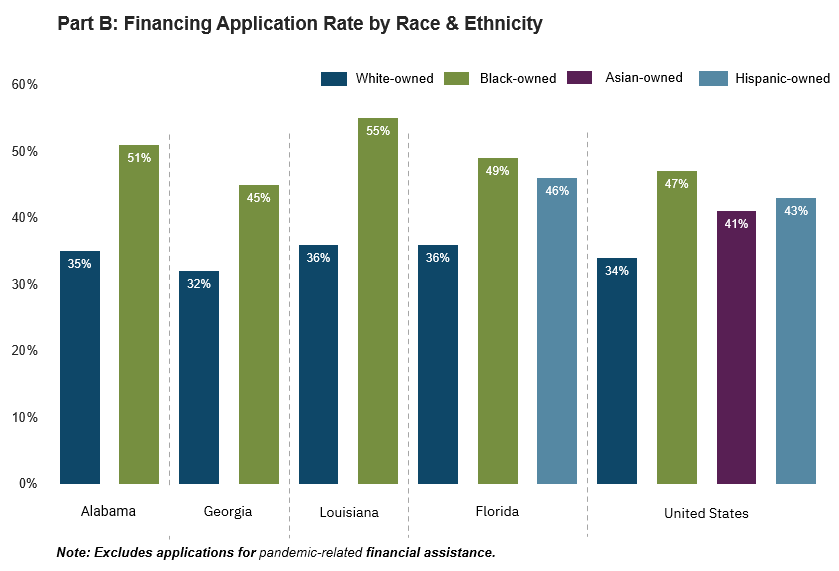

While firms in southeastern states overall fared similarly to firms nationally, the share of small businesses that applied for financing in the past year varied by the business owners' race and ethnicity. Nationally, Hispanic-owned and Black-owned firms had the highest application rates. Black-owned firms in Alabama, Florida, Georgia, and Louisiana had higher application rates compared to White-owned firms in those states.

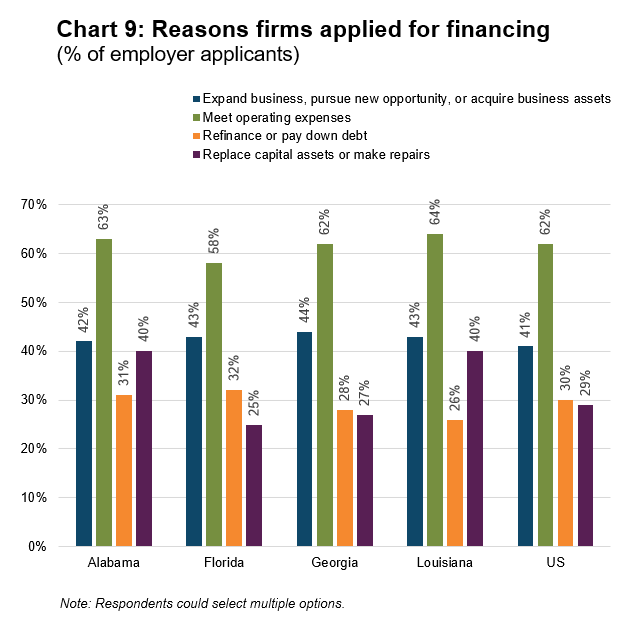

The most common reason US firms sought financing, at 63 percent, was to meet operating expenses (see chart 9). The next most common reason was to expand business, pursue new opportunities, and acquire business assets at 41 percent. Small businesses in southeastern states largely followed the national patterns. It is important to note that Louisiana (40 percent) and Alabama (39 percent) exceeded US averages (29 percent) to use funds to replace capital assets or make repairs.

Across the United States, 59 percent of firms expect their revenues to increase and 17 percent expect a decrease over the next 12 months (see chart 10). Interestingly, a larger share of firms in Georgia, Florida, and Tennessee expect higher revenue growth than peers across the country. Firms in Georgia (69 percent), Florida (67 percent), and Tennessee (64 percent) reported a greater degree of optimism while firms in Alabama and Louisiana anticipated their revenues to decrease at greater rates (20 percent) than national averages (17 percent).

Conclusion

Small businesses play a critical role in fostering a thriving and competitive economy. They are also responsible for providing necessary goods and services in local communities. While the overall financial performance of small businesses has considerably improved from 2020, these firms have yet to perform at prepandemic levels. This is especially true of small businesses of color. To achieve a thriving economy, it is important to strengthen small businesses, and the systems that support them, to bolster their participation.

By Mary Hirt, CED research analyst II, Janelle Williams, CED senior adviser, and Natalia Rosas, former CED intern. The views expressed here are the authors' and not necessarily those of the Federal Reserve Bank of Atlanta or the Federal Reserve System. Any remaining errors are the authors' responsibility.