The United States embraces its reputation as a melting pot. No U.S. ethnic group is growing faster than Hispanics, and their impact in the Southeast—as well as nationally—is being felt in diverse areas of society and the economy.

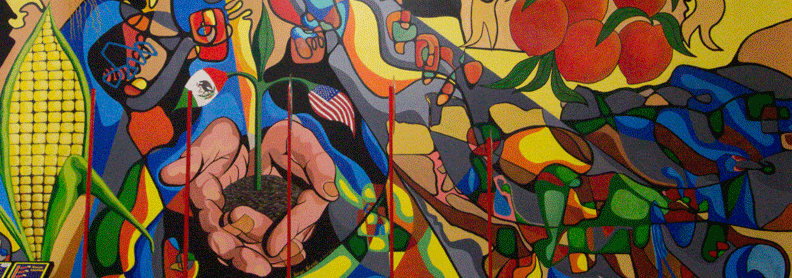

Inside Plaza Fiesta, a Hispanic-oriented shopping mall in metro Atlanta. (All photographs in this feature are by Lela Somoza.)

Inside Plaza Fiesta, a Hispanic-oriented shopping mall in metro Atlanta. (All photographs in this feature are by Lela Somoza.)Editor's note: This article is also available in Spanish and Portuguese.

The common description of the United States as a melting pot holds truer than ever. By 2044, the country will be majority-minority, meaning more than half of the population will be part of a minority race or ethnic group. That tipping point will come even sooner for young people. By 2020, more than half of the nation's children will be minorities, according to U.S. Census Bureau projections.

As the nation's largest minority, Hispanics are driving much of the shift to a more multicultural society. (In this article and the associated audio interviews, Hispanic and Latino are used interchangeably.) Indeed, when the 2010 Census uncovered the rapid growth in the country's Hispanic population, even demographers were taken by surprise. Hispanics totaled 50.5 million and accounted for more than half of the nation's population growth from 2000 to 2010, the census found (see the chart).

That trend has only continued, if not accelerated. More recent estimates show the Hispanic population surpassed 50 million in July 2014, making up roughly 17 percent of the U.S. population. What's more, that share is projected to grow to more than a quarter of the population—or 119 million people—by 2060, according to the U.S. Census.

The factors boosting Hispanics' role in U.S. population growth and, subsequently, the labor market are twofold. For one, Hispanics tend to be younger and have higher fertility than the overall population. At 28, the median age for Hispanics is well below the median age of 38 for the total population. At the same time, the nation's white population—77 percent of the U.S. population, according to census data—is rapidly aging and growing much more slowly.

That's one reason William Frey, a demographer and senior fellow at the Brookings Institution, believes the nation's so-called "diversity explosion" is happening just in time. In a book of the same name, he notes that "a growing diverse, globally connected minority population will be absolutely necessary to infuse the aging American labor force with vitality and to sustain populations in many parts of the country that are facing population declines."

Indeed, this infusion of young workers is helping the United States avoid some of the looming challenges faced by other graying nations. For one, slower labor force growth limits potential economic growth, economists say. A young and growing population benefits the broader economy by boosting demand for houses and other goods and by infusing the labor force with a new generation of innovators and entrepreneurs.

Yet challenges associated with these shifting demographic trends loom. Hispanics tend to lag the overall population, especially whites, on some socioeconomic measures such as educational attainment and household income. Moreover, Hispanic workers are concentrated in a handful of industries and, according to data from the U.S. Bureau of Labor Statistics (BLS), are roughly half as likely as whites to work as managers or professionals.

It may surprise some to learn that most of the growth in the Hispanic population comes from natural increase—that is, births minus deaths. Indeed, the flow of Hispanic immigrants has stalled in recent years, largely the result of the Great Recession and tighter border controls. As a result, U.S. births accounted for more than half of Hispanic population growth from 2000 to 2010. (That natural growth stands in stark contrast to the period from 1980 to 2000, when immigration was a much larger driver of Hispanic population growth.) That trend has only strengthened since the last census. From 2012 to 2013, for example, births accounted for more than three-quarters of Hispanic population growth, according to analysis by the Pew Hispanic Center.

Southeast a new destination for Hispanics

Although most U.S. Hispanics live in nine states (Arizona, California, Colorado, Florida, Illinois, New Jersey, New Mexico, New York, and Texas), the Southeast is home to some of the fastest-growing Hispanic destinations.

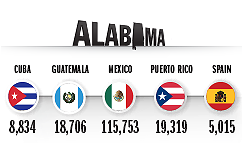

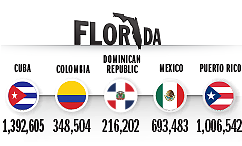

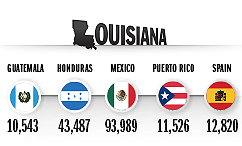

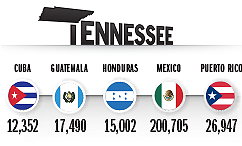

From 2000 to 2010, the region's Hispanic population grew by more than 2.3 million—a nearly 70 percent increase. The overall figure is impressive but masks even more dramatic increases at the state level (see the infographic). For instance, the Hispanic populations in Alabama, Mississippi, and Tennessee more than doubled, placing them among the fastest growing in the nation. (Despite robust growth, the Hispanic populations in those states remain small in absolute terms.) Meanwhile, the number of Hispanics in Georgia nearly doubled to more than 850,000, making it the tenth-largest state by Hispanic population.

The makeup of the "new" Hispanic destinations differs from other more traditional Hispanic communities in the eastern United States, said Pew Research Center director Mark Hugo Lopez. Whereas Cubans, Puerto Ricans, and South Americans make up much of the Hispanic population in Florida, Lopez noted that Mexicans—and, to a lesser extent, Central Americans—make up a large share of the Hispanic population in Georgia, Tennessee, and other fast-growing southeastern destinations. Hispanics in these states are also more likely to be foreign born.

Southeastern States' Top Countries of Origin for Hispanic Population in 2014

Source: U.S. Census Bureau

The Southeast's housing boom and rapid economic growth prior to the Great Recession drew many Hispanic immigrants. According to a Pew report, the robust conditions "acted as a magnet to young, male, foreign-born Latinos migrating in search of economic opportunities." The report went on to note that even though these trends were not unique to the region, they were occurring with "greater intensity and across a larger variety of communities—rural, small towns, suburbs, and big cities." Indeed, Hispanic workers poured into big cities and rural towns alike, filling demand for labor in the construction, agriculture, and manufacturing industries especially.

The demographic changes taking place across the Southeast have not been entirely free of friction. For instance, Alabama and Georgia in 2011 passed tough laws to limit illegal immigration. Although a federal appeals court struck down some of the harsher measures, the laws raised concerns among farmers, contractors, and other employers about the potentially chilling effect on the region's economy. According to estimates from Pew Research, unauthorized immigrants totaled just over 5 percent of the U.S. labor force in 2012. Undocumented workers in the Southeast tend to be concentrated in construction and agriculture, Pew calculations show. Although the laws may have caused some Hispanics to flee Georgia and Alabama, the data indicate that "these are still, relatively speaking, fast-growing states," Lopez said.

As the nation's demographics continue to shift, Hispanics will exert a growing influence politically as well as economically, experts say. But what will that growing influence look like for the Southeast and the nation overall, especially when it comes to the economy?

U.S.-born Hispanics driving growth

To begin, Hispanics—both U.S.-born and immigrants—will play a growing role in the labor force. Hispanics accounted for nearly 17 percent of the U.S. workforce at the beginning of 2015, BLS data show. Further, the agency's projections suggest that over the next several years Hispanics will account for more than a quarter of new entrants into the labor market, topping 31.2 million by 2022.

Mirroring the U.S. Hispanic population overall, the Hispanic portion of the labor pool is also becoming more native-born. By 2013, immigrants were no longer a majority of Hispanic workers, according to Pew's analysis of U.S. Census Bureau data. "The Latino labor force has gone from being just a few years ago majority foreign-born to now being…majority native-born and that's a major change from what we had seen for 20, almost 30 years," explained Pew's Lopez. That shift means many new Hispanic entrants into the labor force will have experiences—cultural and otherwise—similar to other U.S. workers. Indeed, a growing share of native-borns—that is, young Hispanics who grew up in the United States—are already entering the labor market, explained Lopez. "These are people who are U.S.-born. They may have immigrant parents or they may not, but they represent the majority of the U.S. labor force that is Latino," he said.

Hispanics concentrated in key sectors

According to Pew, about half of Hispanics work in one of four industries: construction; eating, drinking, and lodging services; wholesale and retail trade; and professional and other business services. Meanwhile, they tend to be underrepresented in the government, education, and health services sectors, according to the BLS. Hispanics also make up a smaller share of STEM (science, technology, engineering, and math) workers relative to the overall work force.

Despite being underrepresented in some growing fields, Hispanics have made an outsized mark as entrepreneurs. Prior to the recession, Hispanic-owned businesses were the fastest-growing small business sector, expanding at more than twice the national rate of 18 percent between 2002 and 2007. Although the growth in Hispanic-owned small businesses has positive implications for the economy and the Hispanic community, these firms also tend to lag white-owned establishments in terms of revenues and number of employees. About 11 percent of the 2.3 million Hispanic-owned firms in 2007 had paid employees, compared to about 20 percent for white-owned firms.

The Census Bureau surveys business owners every five years. The results of the 2012 survey, due for release later this year, will give researchers and others a better understanding of how Hispanic entrepreneurship held up during the Great Recession and the ensuing sluggish recovery.

Will they be ready? The importance of education

The growing role of Hispanics in the labor force raises new challenges and opportunities for other areas of society, too. As Lopez explained, "How young Latinos come of age and who they become is going to be very important in determining the success not only of the Latino Hispanic community but of the nation as a whole."

A lot of that boils down to education, an issue stressed by Lopez and the Brookings Institution's Frey. The Economist also weighed in on the issue in a March 2015 special report, noting that "if in 2050 America's Hispanic population were to look the same as today's, only doubled in size, a great demographic adventure might end badly," an observation made partly because educational attainment is relatively lower among Hispanics. They are more likely than whites to drop out of high school and less likely than other groups to attend a four-year college. Census data show that about 80 percent of Hispanics age 25 and older do not hold a bachelor's degree, compared with about 68 percent for Americans overall (though it should be noted that the Hispanic dropout rate is falling; see the chart).

The relatively lower levels of education among Hispanics limits their labor market success and hurts the economy by contributing to widening income inequality and dampening consumer spending.

What the future labor market will require

The gap in educational attainment is troubling because it can pose an obstacle to economic success and, in turn, U.S. economic competitiveness. According to BLS projections, 19 of the 40 fastest-growing occupations over the next several years will typically require some form of postsecondary education.

The good news is that young Hispanics are starting to close the education gap. "One of the interesting things over the last few years has been the surge in college enrollment among Latinos," Lopez noted. That's partly driven by an increase in the number of Hispanics prepared to attend college, simply because more of them are finishing high school, he explained. The high school dropout rate for Hispanic 18- to 24-year-olds has been steadily declining for years, falling to just 13.7 percent in 2013 from 28 percent a decade ago.

That same year, 43 percent of Hispanic high school graduates were enrolled in college. That's down slightly from the previous year, when 49 percent were enrolled. (2012 was also a milestone because Hispanic enrollment for the first time surpassed the rate for whites and blacks.) "You take a look at the decisions of recent high school graduates to enroll in college, and interestingly enough, Latinos are just as likely as whites and blacks to say that they are going to enroll in college the fall immediately following their high school graduation," Lopez noted. "This is a huge change in what we'd seen 10 years ago."

Even as Hispanics make strides in education, Frey and others voice concern about whether communities are making the needed investments to prepare future workers. "The fact that we have a youth population which is very different than even our most recent working-age population says a lot about what we have to do to [prepare] our labor force for the future," Frey noted.

If the saying "demography is destiny" holds true, then the U.S. labor market will in coming years undergo dramatic changes, the extent of which has yet to be fully understood. But as much of the western world grapples with a rapidly aging population and concerns about the supply of young workers, the United States finds itself in the midst of a demographic shift that, for the most part, will leave the country with a relatively young, multicultural labor force that is poised to meet the challenges of the 21st-century economy.