We might not become a nation of renters. But we clearly are destined to see more apartments in our cities and suburbs.

Certain metropolitan areas in the Southeast are experiencing a burst of multifamily development. Nashville, for example, will see nearly double the number of apartment units open in 2016 versus 2015 and almost triple the number from two years ago, according to Axiometrics, a real estate analytics firm based in Dallas. Apartment builders are also particularly busy in Atlanta and Miami. (See chart 1.)

Apartment building is brisk nationwide. During 2015, 500,000 units were under construction, the largest number since 1973, Sam Chandan, an economist and associate dean at New York University's Schack Institute of Real Estate, said during a February conference at the Atlanta Fed. Not all those units will be completed this year. But the number coming on the market in 2016, 342,233, is up 28 percent from last year's total, which was up 17 percent from 2014, according to Axiometrics. (See chart 2.)

Why the surge in apartment building? And is there a danger of a glut of rental property, especially higher-end buildings? Largely because of rising development and land costs, most new units are at the pricier end of the market, which is one reason that the number of affordable rental units in several Southeast cities is plummeting. The Atlanta Fed's Community and Economic Development unit recently published research on that topic. This article focuses on the dynamics of the current multifamily development cycle.

Multifamily development brisk postrecession

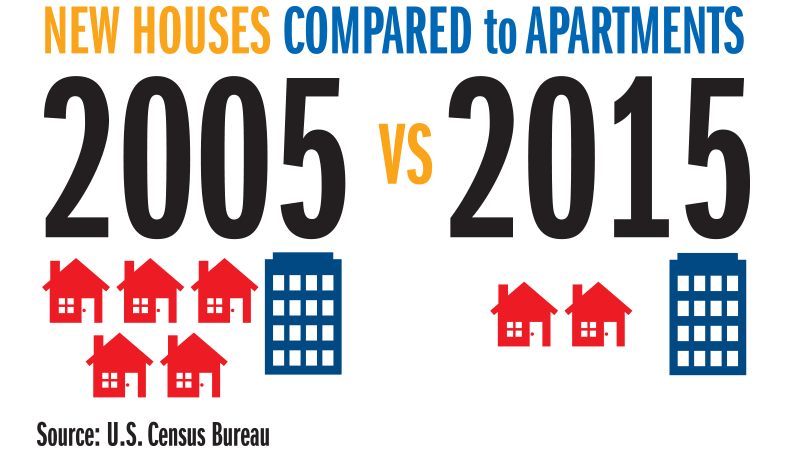

Residential development has emphatically swung toward multifamily and away from the largely single-family home construction that preceded the Great Recession. In several of the Southeast's largest metro areas, the proportion of residential building permits issued in 2015 for multifamily projects more than doubled from 2005 levels. (See the infographic)

Data on the number of residential housing starts by individual metro area are not available from the U.S. Census Bureau. But national numbers show construction shifting toward multifamily buildings, though there are still more houses than apartments being built overall. Over the past three years, about two single-family homes have been started for each apartment, according to the U.S. Census Bureau. In 2005, that ratio of houses-to-apartments started was roughly 5-to-1, as single-family starts reached a record 1.72 million, according to Census figures dating to 1959.

Recession's sting, tighter lending, demographics fuel apartment demand

Part of the rise in apartment building stems from the Great Recession's toll on homeownership. Before the downturn, many high-profile leaders, including then-President George W. Bush, spoke of home ownership as a linchpin of prosperity. At the same time, mortgage lending standards were loosening. That loosening was accompanied by an increase in the homeownership rate to 69 percent in 2004, the highest level since at least the mid-1960s, according to Census data.

But during and after the Great Recession, millions of homes were foreclosed on, and many of those homeowners became renters. Household creditworthiness and wealth took a major hit.

At the same time that many potential home buyers were strapped, mortgage lenders toughened their standards. Tighter borrowing constraints "have a substantial negative impact on the probability of becoming a homeowner in the aftermath of the Great Recession," write Federal Reserve Board economist Jesse Bricker, Philadelphia Fed economist Paul Calem, and two coauthors in a research paper published in January. They estimate that the homeownership rate from 2010 to 2013 was 5.2 percentage points lower than it would have been if borrowing constraints were the same as in 2004 to 2007. Meanwhile, home prices have risen, and most new houses are more expensive than typical "starter homes."

Then there are the millennials. There's a widespread notion—supported to a degree by data but perhaps overblown in the view of many experts—that young adults are simply uninterested in owning homes. Rather, they prefer renting amid urban entertainment and night life. The reality is perhaps more complex, according to research by Atlanta Fed analysts Jessica Dill and Elora Raymond. They find that millennials are not the main reason behind the decline in purchases by first-time home buyers.

Nevertheless, all these factors have curtailed homeownership, which of course can be good news for the apartment industry. Because of tighter lending standards, lingering financial damage from the recession, demographics, and other factors, the homeownership rate fell to 63.5 percent in the first quarter of 2016, from 69 percent a dozen years earlier. If sustained, that 2016 figure would be the lowest annual average in 40 years.

Apartment boom slowing?

Despite generally favorable multifamily fundamentals, caution may be prudent. That goes especially for lenders that finance construction and development, say Chandan and Brian Bailey, a senior financial policy analyst who tracks commercial real estate in the Atlanta Fed's supervision and regulation department. Nationally, the rate of apartments being completed has lately been about 10 percent above long-run averages. However, those completion rates vary from city to city, Bailey points out.

Chandan believes the fixation on multifamily development may prove shortsighted. Just as the marketplace and psychological pendulum swung dramatically toward home ownership before the Great Recession, it has since swung perhaps too far toward renting, he says.

"I can ask any one of my students, 'Do you want to graduate, buy a home in the suburbs, and own a minivan?' And they will all say no," Chandan says. "One day they will all own minivans in the suburbs." In thinking about housing supply, he notes, it is critical to consider whether today's new construction will serve communities' needs in 10 to 20 years.

Still, many vital signs of the multifamily market remain healthy. Vacancy rates generally are low, except for scattered markets in energy-dependent areas and a few places in the Northeast. And rents keep rising.

In most Southeast markets, occupancy rates are above long-term averages. In some of the region's metros with the most apartment construction, including Atlanta, Nashville, Orlando, and Tampa, effective rents are up more than 6 percent through April compared with the same period a year earlier, according to Axiometrics. For perspective, the national average increase in effective rent—excluding concessions and other incentives from landlords—since the late 1990s is 2.2 percent, says Nick Fitzpatrick, a real estate analyst with Axiometrics.

Steadily rising rent is less welcome for tenants than for landlords. Chandan notes that rents have been rising faster than incomes for the past four years in every major U.S. market. Pricier rents make it more difficult for younger people to save enough to make a down payment on a home, thus delaying a home purchase. While that could be good news for the multifamily industry in the short term, Chandan cautions that it could eventually become a larger economic and societal concern.

On the other hand, the multifamily construction boom could be slowing. Axiometrics projects that builders nationally will start far fewer units in 2017 than this year—about 200,000 compared to 340,000. Most prime parcels of land, especially in expensive urban cores, are taken, Fitzpatrick says. Plus, concerns about affordability stemming from rapidly rising rents could ultimately temper growth in multifamily development, he says.

A couple of things seem certain. One, it's extremely difficult to identify the peak of any real estate market cycle in real time, Chandan points out. Another truism: real estate cycles, even booms and busts, are nothing new. The highs and lows of property markets are as old as the nation itself. In a 2013 paper, "A Nation of Gamblers: Real Estate Speculation and American History," Harvard University economist Edward Glaeser writes, "The first and most obvious lesson of this history is that America has always been a nation of real estate speculators."