Myth: The Fed Is Controlled by Powerful Financial Interests from Wall Street and Other Countries

Editor's note: This article is also available in Spanish and Portuguese.

Stop us if you've heard this one: the Fed is owned by a small, influential clique of global oligarchs whose aim is to serve powerful financial interests.

As Federal Reserve employees, we frequently encounter this misconception. And we are always eager to dispel it. The truth is, the Federal Reserve was established to serve the public interest and is not owned by anyone.

To fulfill our monetary policy goals (full employment and stable prices, often referred to as our "dual mandate"), the Fed operates as an independent entity within the government. Simply put, the Federal Reserve Board of Governors in Washington, D.C., is part of the federal government, but it's not funded by tax dollars appropriated by Congress. (The Fed draws its income from open market operations, plus other fees and financial holdings.) The 12 regional Federal Reserve Banks are not part of the federal government but are accountable to the Board of Governors. (We understand how having the word "federal" in our name can give the wrong impression.)

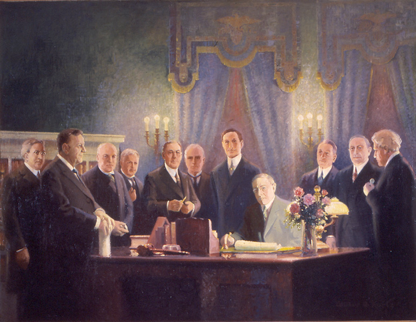

Signing of the Federal Reserve Act

Signing of the Federal Reserve ActCourtesy of Woodrow Wilson Presidential Library; Painting by Wilbur G. Kurtz

When Congress established the Fed in 1913, lawmakers did not want to concentrate all the central bank's operations and decision-making authority in the capital. So to put the institution closer to the people, they established the 12 regional Federal Reserve Banks as operating arms of the central banking system.

And as for ownership? Reserve Banks are organized similarly to private corporations. For example, the Reserve Banks issue shares of stock to member banks. In fact, the law requires member banks to invest 3 percent of their capital as stock in the Reserve Banks. These Fed member banks include all national banks (those chartered by the federal government) and state-chartered banks that wish to join and meet certain requirements. About 34 percent of the nation's 5,000-plus banks are members of the Fed system.

And about those global financial interests? By law, no foreign financial institution can own stock in a Reserve Bank.

So although Fed-member banks own stock in Reserve Banks, it's nothing like owning shares in a private, for-profit company. Member banks cannot sell or trade Reserve Bank stock.

Strong safeguards prevent big banks from exerting too much influence on Reserve Bank boards of directors. First, the majority of the bankers on the boards are from smaller institutions. These community bankers are plugged into their local economies like almost nobody else. They bring their unique insight to the Reserve Banks, which use that grassroots input to help inform monetary policy discussions.

To prevent conflicts of interest, Reserve Bank directors who are bankers receive no information on Reserve Banks' regulatory policy and work, and directors who represent private banks also have no say in choosing the Fed bank presidents. Finally, as a further way to avoid conflicts of interest—real or perceived—no directors are allowed to see confidential regulatory information.

These are the facts we regularly use to dispel the myths surrounding Fed ownership. We invite you to suggest topics for future installments.