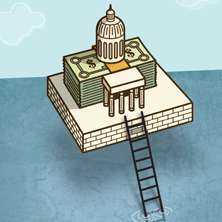

After several years of battered budgets, many states find themselves at a crossroads of sorts. As their finances begin to recover, some governments are beginning to reverse the cuts they made during the recession. Others are pursuing an alternate route—cutting taxes—in an effort to boost growth.

After several years of battered budgets, many states find themselves at a crossroads of sorts. As their finances begin to recover, some governments are beginning to reverse the cuts they made during the recession. Others are pursuing an alternate route—cutting taxes—in an effort to boost growth.

Whichever path states choose, those decisions will have a significant impact on the economy and the services people rely on daily, writes Lela Somoza in "Climbing Out of the Trough." The article, featured in the second-quarter issue of EconSouth, examines the challenges facing state and local governments as they recover from the downturn.

State governments were the first to feel the impact when sales and income taxes plummeted. At their lowest point, in the second quarter of 2009, state revenues were 17 percent below year-earlier levels. Local government finances were hit, too, but with a lag. "Property taxes, which account for about 30 percent of local government revenues, did not immediately respond to declining property values," writes Somoza. But by 2011 they had begun to decline, a trend that is expected to continue through 2013 in some markets. Perhaps the most visible result of these challenges has been the dramatic reduction in public sector employment. After peaking in 2008, state and local government employment shrank steadily. Nearly five years later, the sector continues to bleed jobs.

The good news is that state and local government finances are starting to improve, albeit slowly. State revenues in 2012 finally surpassed their prerecession peak and, by the end of the year, had increased for 12 consecutive quarters. Still, several near- and longer-term challenges loom, which will keep state and local leaders occupied for some time. To read more about the challenges facing state and local governments, see the full story in the second quarter of EconSouth.